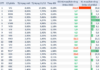

LPBS Q1 2024 Business Results

(Unit: Million VND)

Revenue from operations climbed primarily due to gains from HTM investments — accounting for the largest proportion (62%) — which surged by 43% year-over-year to nearly 2.4 billion VND. Income from custody services remained unchanged at over 1 billion VND compared to the same period last year.

In contrast, LPBS generated revenue of 400 million VND from financial advisory services in Q1, while none was recorded in the previous year. Conversely, the company suffered a loss on available-for-sale financial assets (AFS) which amounted to 61 million VND in the same period last year.

However, after deducting operating expenses (1.4 billion VND, down 19%) and administrative expenses (3.1 billion VND, up 43%), LPBank Securities incurred a loss of over 640 million VND before and after taxes. In the same period last year, the company reported a loss after tax of 1.1 billion VND.

As of the end of Q1, LPBS’s total assets stood at over 277.5 billion VND, a slight increase compared to the beginning of the year. Of which, the value of HTM investments (term deposits with maturity of over 3 months) amounted to 171 billion VND, unchanged from the start of the year.

| LPBank Securities’ Financial Structure |

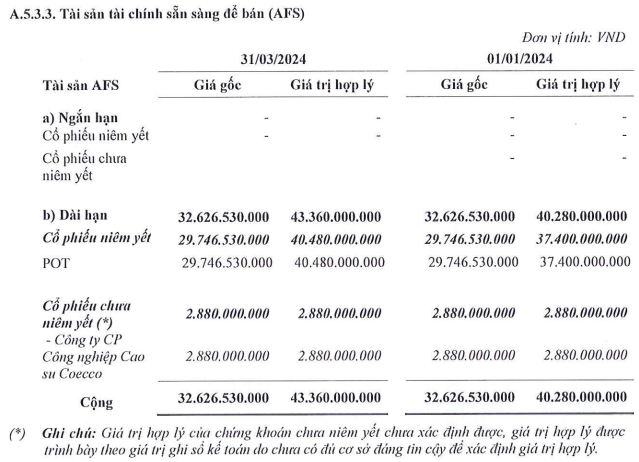

Moreover, long-term AFS assets at the end of Q1 were valued at 43.4 billion VND, indicating an increase of nearly 33% from the original cost and nearly 8% compared to the beginning of the year. LPBS primarily holds listed shares of Postal Equipment Corporation (HNX: POT), with a fair value of nearly 40.5 billion VND. The remaining AFS portfolio comprises unlisted shares of Coecco Rubber Industry Corporation.

Source: Company’s Financial Statements |

On the other side of the balance sheet, the company’s capital primarily consists of equity, recorded at 274.5 billion VND at the end of Q1, with liabilities exceeding 3 billion VND.

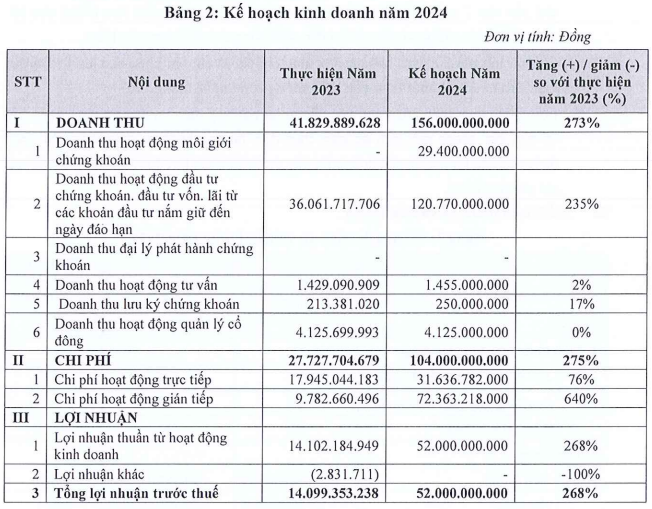

2024 Pre-tax Profit Target Multiplied Nearly Fourfold

According to the documents submitted to the 2024 annual shareholders’ meeting, the company set revenue and pre-tax profit targets of 156 billion VND and 52 billion VND, respectively, both approximately 3.7 times higher than the previous year’s performance. The pre-tax profit plan presented to the shareholders’ meeting is higher than the 40 billion VND projected in the 2023 annual report.

Source: LPBS |

Margin lending will contribute the most to revenue (64% of total revenue), with disbursements primarily starting in Q3; the margin and pre-sale advance balance at the end of the period is expected to be around 3,000 billion VND.

Revenue from brokerage activities (19%) is expected to emerge once the core securities business officially commences operations; revenue from savings interest (14%) is anticipated due to short-term deposit contracts for funds awaiting disbursement for margin lending and pre-sale advances; consulting and shareholder management activities are not expected to fluctuate significantly in 2024.

Regarding expenses, salary expenses are projected to be the largest, accounting for 60% of total expenses, an increase of nearly seven times compared to 2023, following LPBS’s hiring spree, primarily in the last two quarters of the year. Of this, salary expenses (including commissions) for the securities brokerage department are expected to constitute 49% of total projected salary expenses.

Thus, the 2024 actual profit will primarily stem from interest on margin lending services, prepayments, and interest on savings. The brokerage segment is not expected to generate profit yet due to insufficient transaction fee revenue during the initial development phase, most of which will be used to cover commission expenses.

The staffing target for the end of 2024 is 305 employees, to be recruited from the beginning of Q2. At the end of 2023, the company had a total of 28 employees.

Two other key objectives to be accomplished in 2024 are increasing the charter capital to a minimum of 3,888 billion VND and registering as a member of the Vietnam Stock Exchange (VNX) to develop brokerage services.

In fact, the offering of 363.8 million shares to existing shareholders at a price of 10,000 VND per share to increase charter capital ended on April 16, 2024. As a result, the company distributed all of the aforementioned shares, raising a net 3,638 billion VND. This increased the charter capital from 250 billion VND to 3,888 billion VND, nearly 16 times higher.

A Securities Company Aiming for a 16-Fold Capital Increase, Poised to Re-enter the Race

Earlier, on April 8, VNX approved LPBS as a listed securities trading member, registering VNX for trading. Subsequently, the Ho Chi Minh Stock Exchange (HOSE) and the Hanoi Stock Exchange (HNX) also issued documents approving online trading connectivity with LPBS.

|

LPBank Securities was formerly known as Viettraninmex Securities. The company changed its name to Lien Viet Securities (LVS) in 2010. In September 2023, the company rebranded as LPBank Securities. In the past, the company terminated its membership with HOSE and HNX in 2013. |