Q1 Business Results of LPB

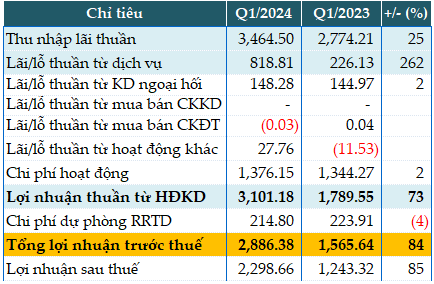

In Q1, due to improvements in the global and domestic economies, business activities of individuals and enterprises began to recover, requiring additional working capital for production and business operations. The bank disbursed loans to meet capital needs for the economy, resulting in a 25% increase in net interest income year-over-year, reaching nearly VND 3,465 billion.

Services contributed the most to LPBank’s revenue this quarter, reaching nearly VND 819 billion, 3.6 times higher than the same period last year. The bank attributed the increase in revenue to the launch of new products and increased domestic and international payment services.

Foreign exchange trading also generated a profit of over VND 148 billion, a slight 2% increase year-over-year, due to improved export orders from manufacturing businesses, leading to increased demand for foreign currency.

Additionally, in the first quarter, the bank reduced its credit risk provisioning expense by 4%, resulting in a provision of nearly VND 215 billion. This contributed to LPBank’s pre-tax profit of over VND 2,886 billion, an 84% increase year-over-year.

As a result, after the first quarter, LPBank has achieved 27% of its pre-tax profit target of VND 10,500 billion for the full year of 2024.

Q1 2024 business results of LPB. Unit: Billion VND

Source: VietstockFinance

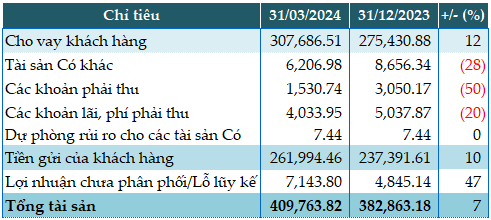

As of March 31, 2024, the bank’s total assets grew by 7% year-over-year to nearly VND 409,764 billion. Of which, deposits at the State Bank of Vietnam decreased by 23% (to VND 11,256 billion), deposits at other commercial banks increased by 20% (VND 42,176 billion), loans to customers increased by 12% (VND 307,686 billion) …

On the funding side, customer deposits increased by 10% (VND 261,994 billion), deposits and loans from the government increased 12-fold (VND 1,089 billion), deposits from other commercial banks increased by 14% (VND 53,823 billion) …

Some financial indicators of LPB as of March 31, 2024. Unit: Billion VND

Source: VietstockFinance

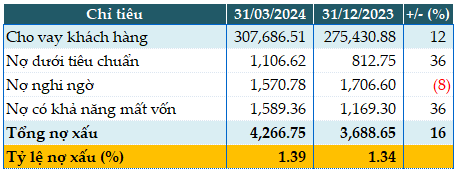

LPBank’s total bad debt as of the end of the first quarter increased by 16% year-over-year, recording VND 4,267 billion. The ratio of bad debt to outstanding loans increased slightly from 1.34% at the beginning of the year to 1.39%.

Loan quality of LPB as of March 31, 2024. Unit: Billion VND

Source: VietstockFinance

LPBank’s annual general meeting of shareholders in 2024, held on April 17, approved the name change to Loc Phat Vietnam Joint Stock Commercial Bank. The English name is Loc Phat Vietnam Joint Stock Commercial Bank. The English abbreviation LPBank remains unchanged.