Market Liquidity Rises; VN-Index Falls after Positive Open

Market liquidity improved compared to the previous trading session, with trading volume on the **VN-Index** exceeding 1 billion shares, equivalent to a value of over 22.5 trillion VND; the **HNX-Index** reached nearly 128 million shares, equivalent to a value of nearly 2.6 trillion VND.

The **VN-Index** opened the afternoon session positively as bargain-hunting emerged from the start, pushing the index steadily towards the reference level. However, selling pressure intensified towards the end of the session, causing the index to plunge and close near its intraday low. In terms of impact, **VIC**, **CTG**, **FPT**, and **BCM** were the stocks with the most negative impact, taking away over 5 points from the index. Conversely, **BID** and **MSB** had the most positive impact on the **VN-Index**, adding nearly 0.5 points.

| Top 10 Stocks Impacting the VN-Index on April 19, 2024 |

The **HNX-Index** also followed a similar trend, with the index negatively impacted by stocks such as **LAS** (-9.68%), **TAR** (-8.7%), **CEO** (-6.84%), **SHS** (-6.45%), and others.

|

Source: VietstockFinance

|

Red dominated nearly all industry groups. The financial services sector experienced the steepest decline in the market, with a loss of 4.85%, primarily due to **IPA** (-5.93%), **OGC** (-3.83%), and **TVC** (-3.57%). This was followed by the securities and real estate sectors, which declined by 3.97% and 3.23%, respectively. Conversely, the home appliance manufacturing sector was the only one that rebounded, with a gain of 0.42%, mainly driven by **TCM** (+6.89%) and **MSH** (+0.24%).

In terms of foreign trading, foreign investors returned to net buying over 649 billion VND on the **HOSE** exchange, focusing on **VNM** (93.49 billion), **DIG** (92.15 billion), **VND** (85.32 billion), and **HPG** (76.35 billion). On the **HNX** exchange, foreign investors sold a net of over 43 billion VND, concentrating on **IDC** (41.43 billion), **SHS** (12.81 billion), and **VGS** (6.32 billion).

VNM shares traded positively, recovering in the afternoon session and regaining the reference level when the dairy industry leader announced that net revenue from export activities reached over 5,000 billion VND, a 4.4% increase year-over-year, contributing to Vinamilk’s overall net revenue growth of 0.7% to 60,369 billion VND. Export net revenue surged by 19.3% in the fourth quarter of 2023 compared to the same period in 2022.

| Foreign Net Buying and Selling Activity |

Morning Session: VN-Index Plunges Sharply, Weighted Down by Large-Cap Stocks

Pressure from large-cap stocks caused the market to plunge during this morning’s session. The VN-Index extended its decline from the beginning of the session. By the end of the morning, the VN-Index had lost over 23 points, reaching 1,169.93 points. The VN30-Index dropped nearly 21 points, ending at 1,190 points.

At the end of the morning session, the **VN30** group was awash in red, with 29 stocks declining in value and only one advancing. **SHB** was the only stock in the **VN30** basket that remained in the green, but its impact on the index was minimal.

Stocks in the securities, construction, and real estate sectors continued to underperform. In the securities sector, 24 out of 26 stocks fell, while the remaining two in the group performed even worse, hitting the floor prices.

The real estate sector had 66 out of 82 stocks declining in value, while the banking sector, although not declining as sharply, also experienced a widely spread red hue, with 19 out of 21 stocks closing in the negative.

The rubber products sector was equally pessimistic, primarily due to stocks such as **DRC** (-4.09%) and **CSM** (-5.1%).

In the mining sector, a weak rally quickly faded, indicating a fierce battle between buyers and sellers, particularly in stocks such as **PVD**, **KSV**, **KSB**, **TMB**, **PVB**, **DHA**, **TVD**, and others. However, stocks like **PVS** and **PVC** managed to maintain their green color until the end of the morning session.

10:40 AM: Real Estate and Securities Sectors Continue to Weigh on the Market

Bearish sentiment continued to drive the major indices below the reference level. As of 10:40 AM, the VN-Index had declined by 11.96 points, trading around 1,181 points. The HNX-Index had lost 3.47 points, trading around 227 points.

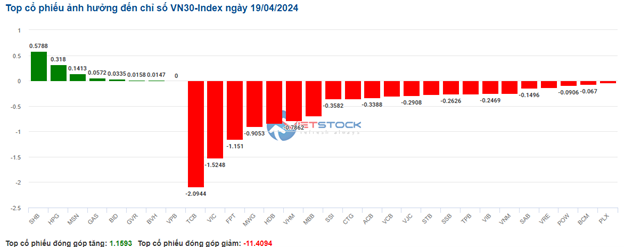

The **VN30-Index** basket remained in the red, with most stocks facing significant selling pressure, with a breadth of 22 declining stocks to 7 advancing stocks. Of these, **TCB**, **VIC**, **FPT**, and **MWG** shaved off 2.09 points, 1.52 points, 1.15 points, and 0.91 points from the overall index, respectively. On the other hand, only a handful of stocks managed to stay in the green, including **SHB**, **HPG**, **MSN**, **GAS**, and **BID**, but their gains were insignificant.

Source: VietstockFinance

|

The real estate sector faced further headwinds, with most stocks experiencing significant declines. Specifically, **VHM** fell 2.15%, **VIC** lost 3.11%, **BCM** declined 3.31%, and **KDH** dropped 3.38%, among others. Conversely, only a few stocks showed slight recoveries, such as **LDG** up 2.25%, **TIP** up 1.36%, and **TDC** up 0.87%.

Notably, **BCM** continued its long-term downtrend after breaking below key support levels in July 2022 and October 2023 (around the 55,300