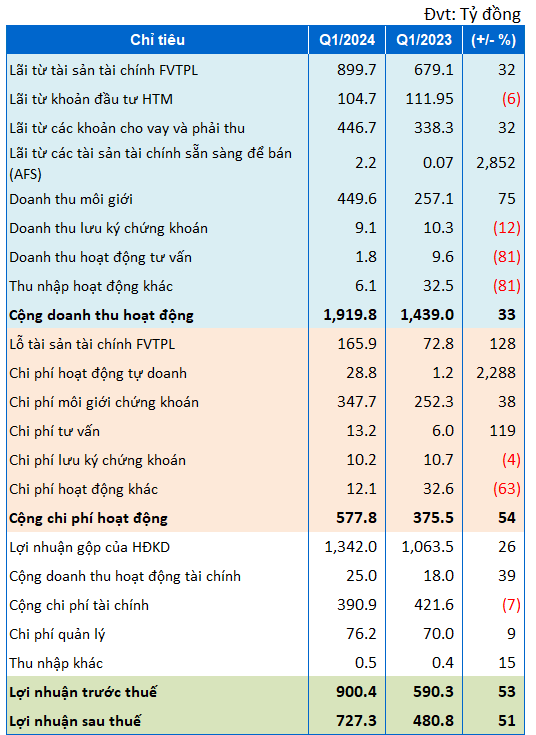

Pre-tax Profit Reaches VND 900 Billion

Q1/2024 Business Result of SSI

|

Q1/2024 Business Result of SSI

Source: VietstockFinance

|

SSI Securities Corporation (HOSE: SSI) has just released its Q1/2024 parent company financial report. In Q1, SSI Securities recorded a 33% increase in revenue compared to the same period, reaching nearly VND 1,920 billion. Revenue from financial assets recorded through gains/losses (FVTPL), brokerage, lending and receivables all increased. In particular, profit from FVTPL assets increased by 32% to nearly VND 900 billion. Interest income from loans and receivables also increased by 32%, reaching nearly VND 447 billion.

Brokerage activities had a positive quarter with revenue increasing by 75% to nearly VND 450 billion.

Margin lending balance reached VND 16,957 billion, up 16% compared to the end of 2023, thanks to positive market developments.

However, revenue from other business segments such as consulting and securities depository declined. Depository revenue this quarter decreased by 12% to over VND 9 billion, while consulting revenue fell by 80% to nearly VND 2 billion.

In addition, profit from held-to-maturity investments (HTM) decreased slightly by 6% to VND 105 billion.

Financial expenses in Q1 were VND 391 billion, down 7% compared to the same period. Management expenses increased by 9% to VND 76.2 billion.

Overall, SSI achieved pre-tax and after-tax profits of VND 900 billion and VND 727 billion, respectively, up by over 50% compared to the same period.

The company estimates consolidated revenue of VND 2,022 billion and pre-tax profit of VND 945 billion, completing 25% and 28% of the 2024 plan, respectively, which is expected to be submitted to the General Meeting of Shareholders for approval.

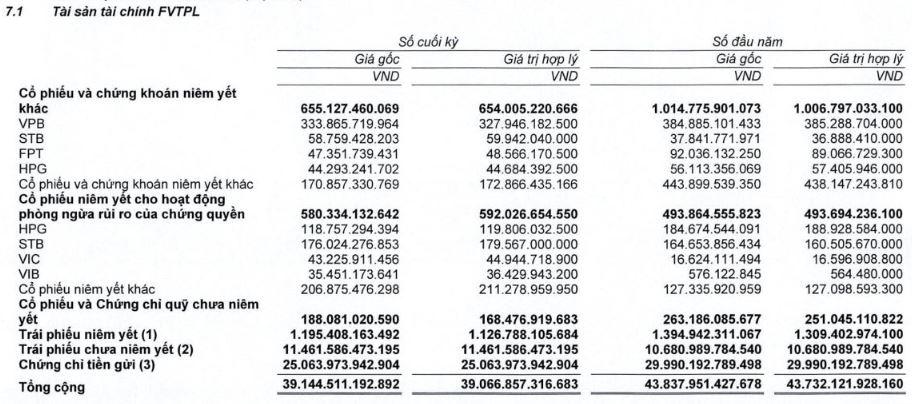

Proprietary Trading Profits High in Q1, VPB Occupies Half of Portfolio

SSI’s proprietary trading segment had a positive first quarter with a profit of VND 705 billion, thanks to a strong increase in FVTPL asset gains, offsetting losses on FVTPL assets, increasing by 128% to nearly VND 166 billion. Compared to the same period, SSI’s proprietary trading profit increased by 17%.

During the quarter, the Company earned a net profit (selling profit – selling loss) of over VND 80 billion from the sale of listed stocks and securities, VND 153 billion from the sale of bonds, unlisted securities, certificates of deposit, and nearly VND 40 billion from the sale of warrants issued by the Company.

|

SSI’s Gain/Loss on Sale of Financial Assets in Q1/2024

|

Source: SSI

|

The size of the Company’s FVTPL financial asset portfolio decreased slightly from the beginning of the period to over VND 39.1 trillion, down by more than 10%.

The balances of certificates of deposit, listed stocks and securities, unlisted stocks and fund certificates all decreased compared to the beginning of the year. Of which, certificates of deposit still accounted for the largest proportion in SSI’s portfolio, over VND 25 trillion, down 16%.

Compared to the beginning of the year, the value of the Company’s listed stock and securities portfolio decreased sharply by 35% to VND 655 billion. VPB is SSI’s most prominent investment with a cost price of VND 333.8 billion, accounting for more than 50% of the listed stock portfolio. At the end of Q3, the Company recorded a slight loss of nearly 2% on this investment.

In addition, SSI also holds a number of other prominent stocks such as STB, FPT, HPG.

Source: SSI

|