Reducing tariffs by misclassifying goods

On February 20, the Investigation Agency of the Ministry of Public Security completed the investigation and proposed the prosecution of the following individuals: Doan Manh Duong (Director of Tan Dai Duong Trading and Services Import-Export Company Limited), Do Hai Phong (Director of Van Don Investment Company Limited), Nguyen Quoc Dung (Director of Minh Khanh Investment and Trading Company Limited), and Nguyen Thu Hang (Director of Ha Nguyen Trading Import-Export and Tourism Company Limited) for the crimes of “Smuggling,” “Forgery of documents of agencies and organizations,” and “Illegal purchase and sale of invoices.”

In the same case, two former customs officials were charged with the “Serious consequences due to irresponsibility” offense.

Investigation findings indicate that, since 2009, Duong established and served as director of Tan Dai Duong Company with the purpose of importing goods from abroad and trading them domestically.

After about a year of establishing the company, Duong invited Phong to work at Tan Dai Duong, responsible for financial and accounting tasks.

From November 10, 2010, Duong and Phong jointly established Van Don Investment Company Limited, with Phong as the director and the legal representative.

From the end of 2013 to mid-2017, Tan Dai Duong filed 106 import declarations for frozen buffalo meat from Allanasons Limited Company in India at customs offices, including 68 declarations at the Hanoi Customs Department, 34 declarations at four customs departments under the Hai Phong Customs Department, and four declarations at two customs departments under the Ho Chi Minh City Customs Department, subject to a 14% import tax, with a total quantity of over 3,000 tons and a declared customs value of $6.1 million.

To carry out the smuggling activities, when filing the customs declaration, Duong deliberately misstated the type of frozen buffalo meat, changing it from “loin, leg, thigh, and tenderloin” to “scraps, edges, and tendons” to reduce the declared customs value and the amount of tax payable.

Duong used Tan Dai Duong Company to pay for the frozen buffalo meat from Allanasons Limited according to the declared customs value. The shortfall in payment was settled by Duong and Phong through the use of Van Don Company as a legal entity.

Investigation results concluded that, from December 26, 2013, to November 10, 2016, Duong smuggled 81 shipments of frozen buffalo meat from India to Vietnam, with a total weight of 2,356 tons; the total amount paid for the buffalo meat to Allanasons Limited Company was $10.4 million. Comparing this with the customs documents filed by Tan Dai Duong Company, the discrepancy amount was $5.4 million.

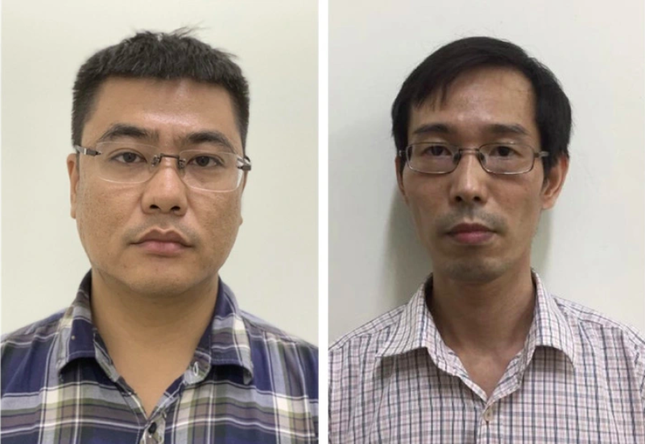

Defendants Do Hai Phong and Doan Manh Duong.

Illegal invoice trading

According to the investigation agency, the activities of the defendants have caused a loss of $764,000 in import tax revenue for the state (equivalent to over 16 billion dong).

In the case, Duong played the main role and directed Phong to forge 34 customs declarations. Despite being aware of Duong’s wrongdoing, Phong still assisted him.

In addition, Duong directed employees or directly contacted Ha Nguyen Trading and Tourism Company Limited and Minh Khanh Investment and Trading Company Limited, of which Hang and Dung were the directors, to issue and use value-added tax invoices without actual trading of goods.

As for the two former customs officials under the Bac Ha Hanoi Customs Department, from late 2015 to early 2016, they were assigned the task of jointly conducting on-site inspections of five shipments registered by Tan Dai Duong Company. According to regulations, during the inspection of goods, customs officials must verify the goods’ names, codes, quantities, weights, types, qualities, origins, and declared customs values. However, during the inspection process, the two officials violated these regulations.