Experts believe that the economy is recovering well, but the macroeconomic context is still considered a challenge for the Vietnamese banking industry. What is your opinion on this issue, sir?

The year 2023 was a challenging one for the Vietnamese economy. However, there were some signs of recovery towards the end of the year, with the recovery of exports and imports, investment activities gradually stabilizing, and policies in some important areas being approved.

Credit growth also nearly reached the target of 14% in 2023, after a rather modest growth in the first half of the year. The bond market also showed signs of recovery during the year, although still relatively slow compared to the previous year. Vietnam’s interest rate level is currently at a low level after several interest rate cuts and is expected to remain low in 2024 before it can rise again.

Besides, we see that 2024 will face some challenges, such as the weaker-than-expected recovery of the Chinese economy, a strategic economic partner of Vietnam, as well as geopolitical conflicts that may become more complex and escalate, affecting commodity prices as well as exports and imports.

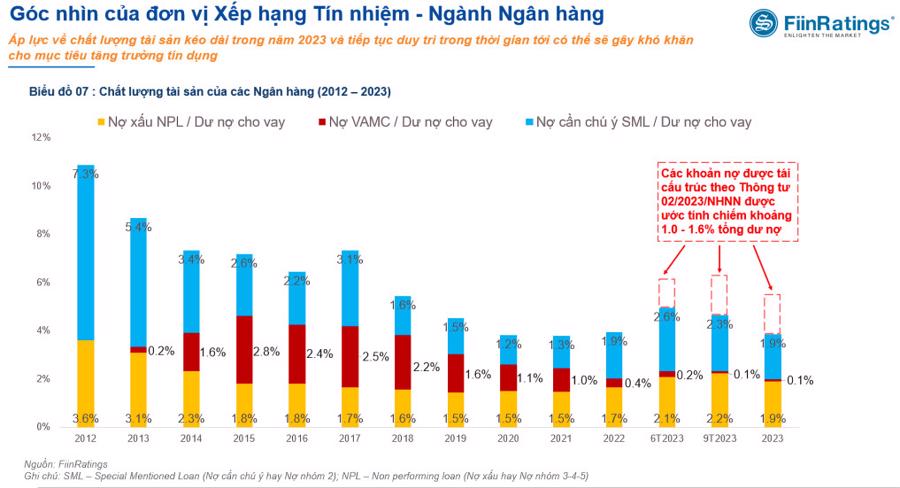

The low domestic interest rate environment is unlikely to be maintained due to the influence of the high international interest rate environment, as well as exchange rate fluctuations. For the banking industry in particular, the pressure on asset quality, balancing between credit growth and risk management, and the fact that profitability is affected by the decline in non-interest income sources are also specific challenges that banks have and will continue to face in the year 2024.

The debt capital market in general and corporate bonds in particular have improved but still depend on the participation of commercial banks, both in terms of demand (purchasing corporate bonds) and supply (as the group of primary issuers). How do you explain this phenomenon?

Although the environment and context are somewhat more favorable, from a credit rating perspective, FiinRatings believes that the capital market is still facing many barriers and challenges, requiring breakthrough solutions to support the unlocking of capital sources.

Over the past 3 years of operation, we have rated around 40 companies and financial institutions, including announcing the credit ratings of a number of companies and institutions (including 4 commercial banks). Having the opportunity to conduct credit ratings and access to work with companies with prominent positions and reputations in key industries such as banking, real estate, energy, etc. has also helped us to some extent grasp the supply and demand story of capital sources in a number of industries, including the banking industry.

On the demand side, or as investors, we believe that while large capital sources from insurance companies and funds are still concentrated in bank deposits and Government bonds, the main source of capital for the economy still comes from commercial banks.

Commercial banks are considered one of the most professional bond investor groups, with the ability to oversee issuers that are the banks’ clients.

In addition, in the context that the State Bank of Vietnam is drafting a Circular to amend and supplement a number of articles of Circular No. 16/2021, in which banks may buy back corporate bonds after they have been sold, this is expected to increase liquidity, contribute to supporting the corporate bond market, and solve difficulties for the market.

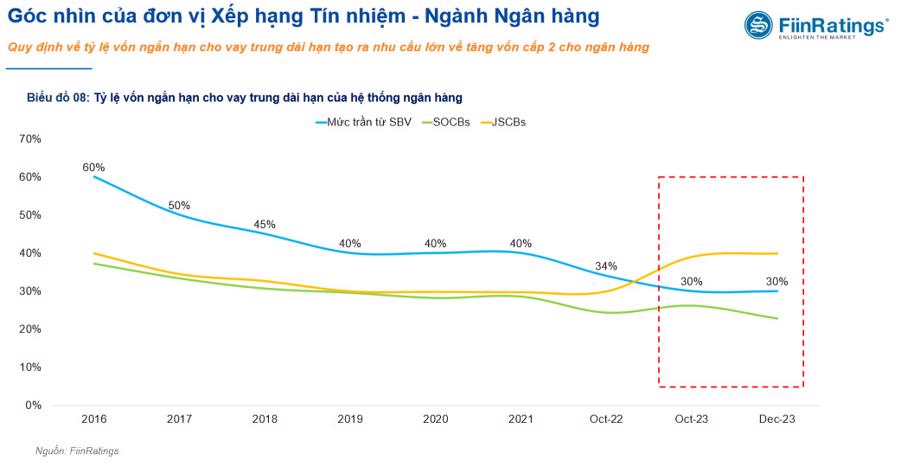

On the supply side, or as an issuer, the banking industry is currently one of the sectors with the largest volume of bond issuance. According to figures from the State Bank of Vietnam, as of January 31, 2024, the short-term capital ratio for medium and long-term lending of joint-stock commercial banks was about 40.1%, much higher than the 30% prescribed level since October 2023.

Thus, in 2024, in order to reduce the short-term capital ratio for medium and long-term lending, banks will step up the mobilization of medium and long-term capital sources, increase the issuance of financial instruments, and especially bonds to handle this ratio.

In 2024, we believe that the focus on raising Tier 2 capital to quickly increase buffer capital (as it usually takes less time than Tier 1 capital) will be a trend of the year for commercial banks in order to support growth recovery. This will also contribute to increasing the capital adequacy ratio (CAR), bringing the ratio of commercial banks in Vietnam closer to that of commercial banks in the region.

From a credit ratings perspective, what is your outlook for the banking industry in the coming period of 2024-2025?

Credit growth in the second half of 2023 was driven mainly by the corporate segment, especially a number of enterprises in industries with high capital demand at the end of the year. On the other hand, retail lending has not shown any signs of recovery in 2023 due to weaker consumer spending and demand and retail customers being more sensitive to the impact of the economic downturn.

In 2024, we expect this trend to continue with retail lending showing signs of recovery towards the end of the year. The corporate segment will continue to drive credit growth in 2024, as many companies will benefit from government growth and investment support policies.

For lending segments, we expect trade, manufacturing, real estate, and construction to be the main contributors to business lending in 2024, especially those related to infrastructure development.

2024 was predicted by analysts that bad debts would increase due to the policy of postponing the classification of debts under Circular 02 ending after June 30, 2024. How do you view this issue, sir?

In terms of asset quality, 2023 was a relatively difficult year, with some banks facing liquidity pressure at the beginning of the year and asset quality during the year. In the context of pressure on asset quality, from FiinRatings’ perspective, it will continue to persist in 2024 from loans restructured under Circular 02/2023/NHNN. Banks’ efforts to boost credit growth may face difficulties in balancing growth with risk management.

In particular, with the fact that information on many enterprises is still incomplete and unclear, limiting management by industry also affects the ability of banks to provide capital to the market. Through the credit ratings of banks, we also see that some banks are actually in a state of excess capital but have not yet been able to disburse it.

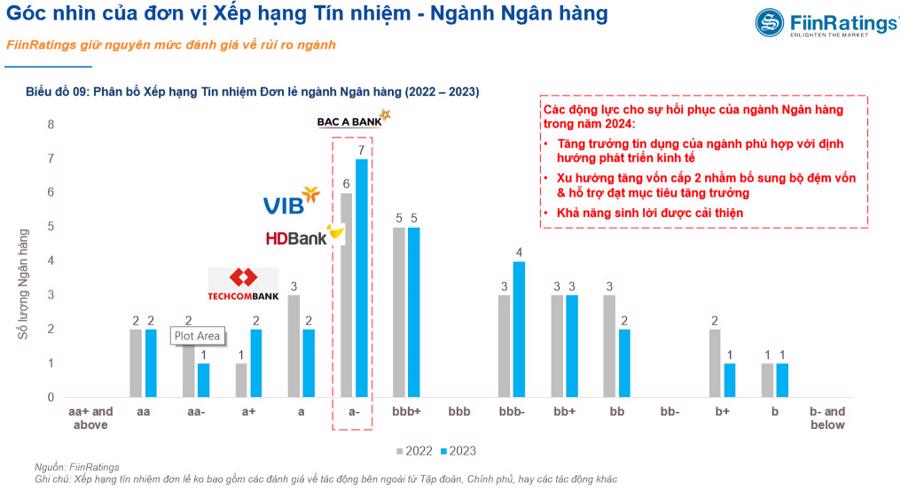

Finally, regarding the outlook for banks in 2024, I maintain my view on the relatively low risk assessment of the banking industry, as reflected in the industry risk assessment score of a-, with preliminary score ranges of banks as shown in the figure, based on our quantitative scoring model. It is noteworthy that all banks that we conduct credit ratings on share one common feature: the final rating score (when including forward-looking assessments) is equivalent to or higher than the preliminary assessment score based on the scoring model.

This also partly reflects FiinRatings’ view on credit quality, the ability of these banks to meet their obligations is equivalent to or better than the figures shown. In the context that the main source of capital supply for the economy is banks, and the fact that some banks themselves are facing problems in terms of input and output, while credit quality is still relatively good, is a challenge for the industry that needs to be addressed.