Novaland: Shareholdings Diluted Amidst Financial Turmoil

The shareholder group related to Chairman Bui Thanh Nhon currently holds only around 40% of shares. Photo: Int

Share Sale

Novaland, a leading real estate investment group in Vietnam, has embarked on an aggressive expansion through M&A across various industries, aiming to establish a vast ecosystem. However, impending bond maturities in late 2022 have pushed Novaland into a series of challenges. Amidst these difficulties, Mr. Bui Thanh Nhon officially reassumed the role of Chairman on February 3, 2023, to navigate the company through the turbulence.

Over the past challenging year, Mr. Bui Thanh Nhon’s ownership in Novaland has witnessed a substantial decline of over 400 million shares. This includes shares pledged as collateral by the NovaGroup ecosystem for loans, which were subsequently liquidated to recover funds by brokerage firms due to the decline in stock price.

Additionally, two of Mr. Nhon’s companies, Novagroup and Diamond Properties, have actively sold off significant shares of NVL to restructure and support the group’s debt obligations. Since the beginning of the year, Novaland’s two largest shareholders, Novagroup and Diamond Properties, have sold a combined total of nearly 30 million NVL shares due to continuous forced liquidations.

Ownership percentage related to Chairman Bui Thanh Nhon over the past two years.

Following multiple divestments, the shareholder group associated with Chairman Bui Thanh Nhon currently controls approximately 40% of Novaland shares. This represents a 12% decrease compared to a year ago and over 406 million fewer shares since June 2022, equivalent to a decline of over 20%. Given NVL’s share price over the past year and a half, the estimated value of these shares is between VND 7,000-8,000 billion.

Underperforming Core Business

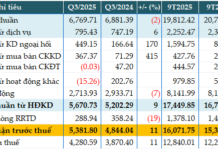

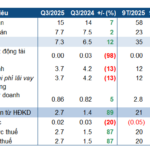

According to audited financial statements for 2023, Novaland reported revenue of nearly VND 4,769 billion, a 57% decrease year-over-year. Revenue from project management and development consulting witnessed the most significant decline of 71.2%, dropping to over VND 505 billion. Real estate transfer revenue also fell by 55.5% to VND 4,102 billion.

Gross profit in 2023 likewise experienced a sharp decline of 69% compared to 2022, reaching VND 1,322.2 billion, while gross profit margin decreased by 10.3% to 27.8%.

Notably, in 2023, Novaland recorded VND 5,128 billion in financial revenue, primarily from interest on investment cooperation contracts and divestments of subsidiaries. Under other income, the company recognized over VND 1,035.9 billion from contract violation penalties, 2.7 times higher than the same period in 2022. Other expenses amounted to VND 348.7 billion, resulting in an other income of VND 726.3 billion.

After deducting expenses, Novaland achieved pre-tax profit of VND 1,998.8 billion and net income of VND 485.8 billion. Thus, without the penalty income of over VND 1,035.9 billion, Novaland would have recorded a net loss of VND 550.1 billion.

It is evident that while operating in the real estate sector, financial activities and other income have become significant sources of revenue for Novaland, providing financial support and enabling the company to report a profit in 2023.

As of the end of 2023, Novaland’s equity stood at VND 45,302 billion, while its liabilities amounted to VND 196,183 billion. Financial debt reached VND 57,712 billion, a decrease of nearly VND 7,200 billion compared to the beginning of the year. The company owes VND 9,355 billion to banks, with outstanding bonds amounting to VND 38,626 billion.