The ‘Green Credit’ Market is Booming

Green credit is the new competitive force for domestic and foreign banks in Vietnam. In addition to having another channel for disbursing loans, through ‘green credit’ packages, banks can also demonstrate social responsibility, making ESG practices more effective.

According to Darryl James Dong, Chief Economist of the International Finance Corporation (IFC) in Vietnam, IFC estimates that to achieve the dual goals of high income and carbon neutrality, Vietnam needs to invest 6.8% of GDP annually from now until 2040. This figure corresponds to $368 billion, at current value, for development, adaptation, and mitigation. Half of this investment is expected to be covered by the private sector.

Vo Quoc Khanh, Deputy General Director of EY Vietnam, shared at the end of 2023 that the demand for green credit in Vietnam is significant. However, the ratio of green credit to total outstanding debt in the economy is less than 5%, and banks have only started exploring green credit in the past five years. In a broader global perspective, the ratio of green credit to total banking system assets for banks in the European Union is close to 8%.

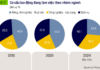

Specifically, in 2017, only 15 credit institutions reported on green credit, with a modest scale. However, by the end of 2023, 40 credit institutions had reported providing financing for green projects, with a growth rate of over 20% per year.

In the early stages, banks and financial institutions in Vietnam often prioritized projects related to green energy (solar/wind power), environmental protection – waste treatment, and saving natural resources. Currently, banks have expanded their customer base to include specific industries at different stages, such as textiles, plastics, and agriculture.

Of all, HSBC, MB, and BIDV are the most active banks in the green credit sector. HSBC Vietnam plans to support arrangements of up to $12 billion for the Vietnamese market and businesses in Vietnam by 2030. As of the end of 2023, HSBC has supported arrangements of 16%, equivalent to nearly $2 billion, of the aforementioned plan.

In 2020, MB’s green credit disbursement reached VND 14.5 trillion, while in 2023 it stood at VND 55 trillion, accounting for 11% of MB’s total outstanding debt. By 2026, MB is expected to have 15% of its total outstanding loans (approximately VND 1.3 million billion) in green credit, equivalent to approximately VND 200 trillion.

Compared to the ratio of total green credit to total credit outstanding in the Vietnamese economy at the end of 2022, which was 4.2%, MB’s green project financing is more than double.

Towards the end of 2023, Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) launched a VND 4.2 trillion green credit package for businesses in the textile industry. The program runs until June 30, 2024, or until the budget is fully disbursed.

Most recently, UOB announced that it had signed a green financing agreement with BETRIMEX, a leading enterprise in the Vietnamese coconut industry. This is the first time UOB has provided green credit to an agricultural company. Prior to this, UOB Vietnam had provided green credit to 17 renewable energy and clean energy projects, as well as 7 green industrial projects, as of Q4/2023.

Regionally, UOB’s green trade financing portfolio has reached a scale of SGD 44.5 billion as of the end of 2023, exceeding the bank’s previous target of SGD 30 billion in green and sustainable trade financing by 2025.

Water Still Flows to the Deepest Point

However, upon observing the market, we can see that Vietnamese SMEs still have limited access to green credit. Banks’ green credit is still flowing into the pockets of leading enterprises, and even Betrimex is not exactly a small business. For example, HSBC has invested green credit in the Duy Tan Plastic Recycling Plant, Vingroup, and REE.

Explaining this situation, according to Mr. Pham Như Anh, General Director of MB, “Currently, preferential interest rates for green credit are 0.5-2% lower than normal interest rates, but not many businesses have access to this source of credit.”

“This is because the banks themselves are also facing difficulties in the green transition, such as the lack of a clear legal framework for a national green taxonomy to serve as a basis for financial institutions to mobilize capital and provide green credit,’ he added.

“In addition, green investment projects require a long payback period, high investment costs, and high market risks. Therefore, credit institutions will face many challenges in balancing their capital for lending. Meanwhile, we still lack mechanisms and policies to support credit institutions in accessing sources of long-term capital and incentives.”

Thus, MB has temporarily adopted the ESG standard of reducing greenhouse gas emissions by 20% or more. At the same time, it applies standards in industries and business sectors to assess green enterprises for the purpose of providing green credit.

“Finding the right projects to finance our green development is not easy. We will base our decision on the 3 Ps: people, planned business, and profit,” said Mr. Anh.

“We will examine how the company treats its employees, partners, and customers, how its business plan impacts the environment and people, and whether its business benefits direct and indirect stakeholders. Companies that practice ESG must adhere to global standards.”

“Applying stringent international standards such as Fairtrade has helped BETRIMEX contribute more positively to the environment and the community, especially ensuring the livelihoods of coconut farmers, stabilizing the raw material region, and thereby promoting the sustainable development of Vietnamese agriculture, creating greater economic value. BETRIMEX has transformed ordinary farmers into managers,” said Mr. Lim Dyi Chang, Senior Director of Corporate Banking, UOB Vietnam.

Vietnam is the fourth largest country in the Asia-Pacific region in terms of total export value of coconut and coconut products, with an export turnover reaching over USD 900 million in 2023, according to statistics from the General Department of Customs.

Coconut trees are generating income for approximately 390,000 Vietnamese farming households. Besides their direct economic value, coconut trees also contribute significantly to combating climate change, as 1 hectare of coconut trees can filter 70-75 tons of CO2 per year.

BETRIMEX is a leading enterprise in the production and export of coconut products in Vietnam, with an impressive output of nearly 40 million liters in 2023. Furthermore, only 10% of their production is sold domestically, with the remaining 90% being consumed in 70 countries. In the coming years, BETRIMEX consistently plans to double its production output each year, preparing to compete directly with international rivals and potentially going public in 2025.

“As a person with experience in customer operations, we did not encounter many difficulties when working with UOB. When UOB approached BETRIMEX, the first thing they did was to stay with the company’s staff and executives to observe how we manage and operate our business. They then inquired about ESG certificates, quality standards, and financial aspects,” said Ms. Dang Huynh Uc My, Chairman of BETRIMEX.

“The reason we chose to partner with UOB instead of domestic