Recent market volatility in the stock market has made it difficult for investors. Many seek to sell stocks at any cost, while some rush to “catch the bottom” only to lose even before the stock reaches their account.

Warren Buffett, the stock market guru, once said: “The stock market is a device for transferring money from the impatient to the patient.” This quote implies that instead of holding stocks for long-term gains, most investors rush to buy and sell frequently in the hope of “buying the bottom – selling the peak”.

While this method can be effective for professional investors, it is extremely risky for beginners. Most successful investors in the stock market choose robust strategies based on patience and long-term vision.

During Dragon Capital’s “Investor Day Q1/2024,” Mr. Le Anh Tuan, Dragon Capital’s Investment Director, pointed out that despite his 20 years of experience in the market, buying the bottom and selling the peak wasn’t easy. Stock bottoms tend to be unpredictable as investors are usually fearful then. Engaging in a “game of psychology” and going against the trend poses significant risks and is feasible for only a few.

Therefore, instead of “catching the bottom,” investors should buy regularly if they can identify the market’s uptrend cycle. Mr. Tuan outlines the formula for an average annual profit of 15-17%: “When the market experiences a 10% drop, it’s a good time to buy. Conversely, when the market has risen by 10% compared to the previous year-end, it’s time to reduce stock exposure. Buying when the market falls and reducing exposure when it rises can lead to fantastic returns, potentially doubling or tripling the interest rate on deposits,” Mr. Tuan emphasized.

Mr. Vo Nguyen Khoa Tuan, Senior Business Director of Dragon Capital’s securities division, agrees that during market volatility, investors tend to worry about what will happen if they don’t sell their stocks and they continue to fall tomorrow. “One of the things I’ve learned is to accept that the stock may continue to fall tomorrow, next week, or even next month. However, I have faith that good companies will continue to grow steadily over time,” advised the expert.

It’s human nature to want to buy low and sell high, but Mr. Tuan believes that long-term holding generates sustainable returns. For example, the famous investor Warren Buffett, while not having the best annual returns, has remained one of the wealthiest investors due to consistent and sustainable investment growth year after year.

Instead of trying to predict the market, Dragon Capital’s experts suggest that investors consider entrusting funds to experienced and trustworthy investment funds. Dragon Capital, for example, takes advantage of market corrections to refine its portfolio. During periods of change, the team evaluates stock potential to restructure and acquire stocks with strong potential within an excellent price range.

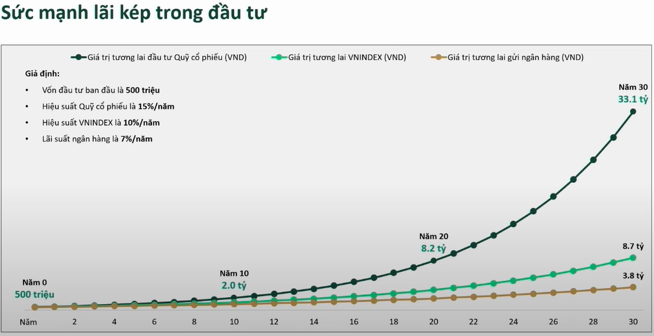

“If you invest in fund certificates and the stock market grows by 10%, Dragon Capital can achieve a performance rate of 15%. This is because the DCDS/DCDE portfolio managed by Dragon Capital primarily consists of companies that have exhibited constant yearly growth, such as Hoa Phat, The Gioi Di Dong, and FPT. Our belief in a 15-20% annual increase in our fund’s portfolio stems from our investment in companies predicted to experience a 20% average annual revenue and profit growth.

This means that investing 500 million in fund certificates could result in a 33-billion return within 30 years. Investing 1 billion in fund certificates could lead to a 66-billion return within the same period,” stated a Dragon Capital expert.