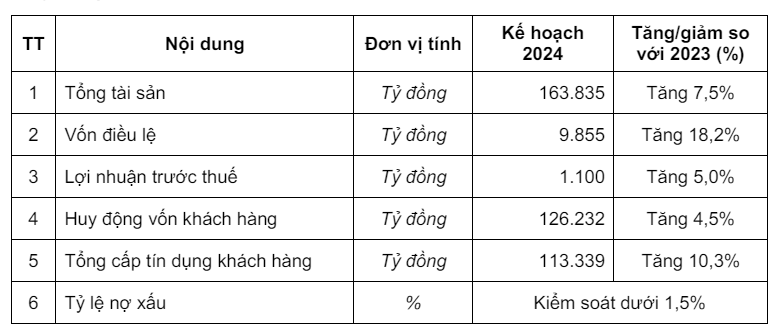

2024 Pre-Tax Profit Target: 1,100 Billion VND, a 5% Increase

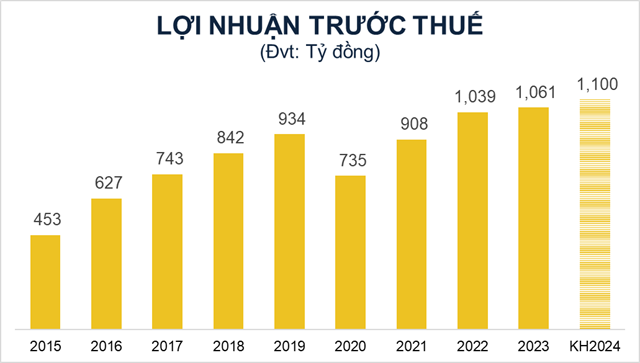

In 2024, BAB aims to achieve a pre-tax profit of 1,100 billion VND, a 5% increase compared to the 2023 results. The bank plans to increase its total assets by 7.5% to 163,835 billion VND by the end of 2024. Its charter capital will reach 9,855 billion VND, representing an 18% increase.

Mobilization and lending are projected to reach 126,232 billion VND and 113,339 billion VND respectively, representing a growth of 4.5% and 10.3%.

The bad debt ratio will be controlled below 1.5%.

Source: VietstockFinance

|

Plan for 2024-2029 Phase

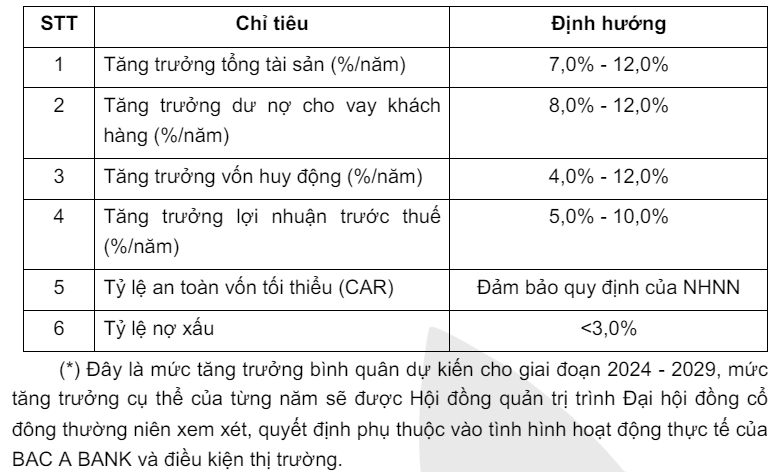

During the 2024-2029 phase, BAC A BANK will continue to focus on investment consulting and lending to projects and industries that apply high technology in agricultural, forestry, and fisheries production, as well as manufacturing, ancillary technology, healthcare, education, ecotourism, resorts, elderly care, and rural agricultural restructuring – areas that drive substantial benefits and significance to the community and society. Building and developing BAC A BANK will occur in line with modern, advanced governance practices aligned with international standards, providing a comprehensive range of financial services. The Board of Directors has set several key business objectives for the 2024-2029 phase.

Bac A Bank aims to increase its pre-tax profit by 5-10% per year. Total assets are projected to grow by 7-12% annually, while loans to customers will increase by 8-12%. Capital mobilization is forecasted to rise by 4-12% per year. The minimum capital adequacy ratio (CAR) will meet the State Bank of Vietnam’s requirements, while the bad debt ratio will be controlled below 3%.

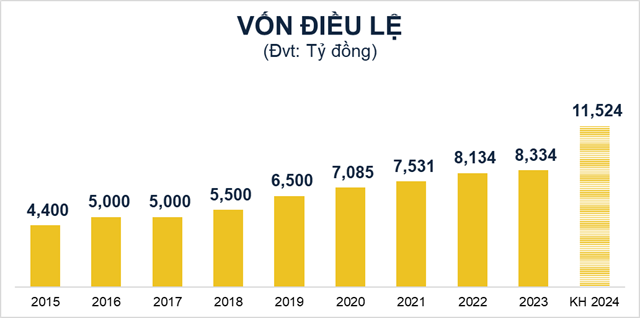

Charter Capital Increase to 11,524 Billion VND

In 2023, BAB recorded a consolidated after-tax profit of 854 billion VND. After setting aside funds and provisions, BAB had over 620 billion VND in retained earnings. Combined with retained earnings from previous years, BAB has approximately 629 billion VND of profits available for dividend distribution.

The dividend payout for 2023 is approximately 621 billion VND, equivalent to a ratio of 6.93% on the charter capital of 8,959 billion VND as per the proposal. However, the bank will continue to implement the second phase of its charter capital increase, which was approved by the 2023 General Meeting of Shareholders. BAB plans to issue 89.6 million shares (nominal value of 10,000 VND/share) to existing shareholders for a total value of approximately 896 billion VND. As a result, the dividend distribution ratio in the future may vary depending on the results of the share offering.

BAB expects to increase its charter capital by an additional 1,668 billion VND in 2024 through two methods.

Firstly, the issuance of common shares as dividends to existing shareholders for a total value of 620 billion VND, representing a ratio of 6.93%. This will be funded from retained earnings accumulated up to the end of 2023.

Secondly, the issuance and sale of up to approximately 104.8 million common shares to existing shareholders for a total value of approximately 1,048 billion VND at nominal value, with an expected issuance ratio of 10%. The offering price is expected to be 10,000 VND/share and may be adjusted based on actual conditions.

The charter capital at the end of 2023 was 8,334 billion VND. The charter capital at the time of proposal submission was 8,959 billion VND. If the capital increase is successful, BAB will increase its charter capital in 2024 to nearly 11,524 billion VND.

Source: VietstockFinance

|

The bank stated that the additional capital raised under the 2024 plan (over 1,668 billion VND) will be used for fixed asset purchases (10 billion VND), software upgrades (10 billion VND), investments in government-guaranteed bonds or bonds of other credit institutions (500 billion VND), and customer lending (1,150 billion VND).

In the upcoming general meeting, BAB will also conduct elections for the Board of Directors and Supervisory Board for the 2024-2029 term.