Illustrative photo

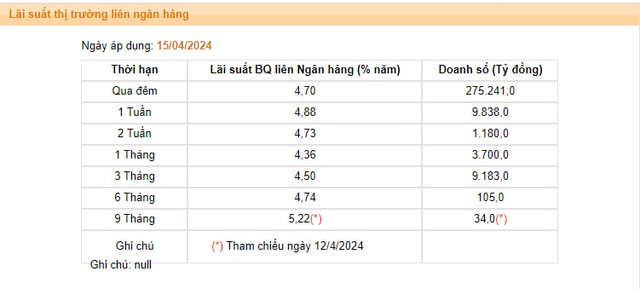

According to the latest data released by the State Bank of Vietnam (SBV), the interbank VND interest rate at the overnight maturity (the main maturity accounting for about 90% of transaction value) in the session of April 15 increased to 4.7%/year – the highest level since mid-May 2023.

Along with the overnight maturity, the interest rates of most other key maturities have all exceeded 4%/year and reached the highest level in nearly a year, such as: 1-week maturity is 4.88%; 2-week maturity is 4.73%; 1-month maturity is 4.36%.

Not only reflected in the interbank interest rate, the liquidity of the system also signals a tighter situation when recent trading sessions have seen more and more banks seeking support from the regulatory authority.

Accordingly, in the session of April 16, there were 10 market members borrowing VND 12,000 billion through the State Bank of Vietnam’s secured repurchase agreement (OMO) channel, with a term of 7 days and an interest rate of 4% /year. Previously, there were 8 members and 2 members seeking support from the SBV in the sessions of April 15 and April 12, with the OMO winning volume reaching nearly VND 12,000 billion and VND 10,000 billion, respectively.

Despite actively “pumping money” to support the system, the SBV still maintains the auction of 28-day Treasury bills with increasing winning interest rates. By April 16, 3/4 of the participating members won the Treasury bill with a volume of VND 550 billion and an interest rate of 3.59% – the highest level since the beginning of the cycle and the highest level since the issuance ended in mid-March. 2023.

Analysts said that the use of both Treasury bills and OMO shows that the SBV wants to establish a stable price floor for interbank interest rates through the Treasury bill winning rate and OMO rates. Therefore, the sharp increase in interbank interest rates is considered a consequence as well as the SBV’s management orientation.

Specifically, after withdrawing a large amount of excess liquidity through Treasury bills, the SBV continues to implement new Treasury bill issuances to send a message to the market that: The regulatory authority is willing to offer an attractive interest rate for banks with excess liquidity to seek methods of saving Treasury bills instead of lending low interest rates on the interbank market, thereby reducing the interest rate on the interbank market; for banks in need of support, the SBV is willing to lend through the OMO channel, but banks must accept a fixed, non-discounted interest rate of 4%/year.

This management activity is aimed at meeting the dual goal of ensuring liquidity for the banking system in order to maintain a low interest rate level in the market, while reducing pressure on exchange rates (by narrowing the USD – VND interest rate differential). in the interbank market) in the context of the continuous increase in USD prices at banks in recent sessions.

It was noted that in the session of April 17, although the SBV continuously increased the central exchange rate to raise the ceiling price by 5%, major banks such as Vietcombank, VietinBank, BIDV, MB, Techcombank still listed the USD selling price at the same level, even catching up with the permitted ceiling of VND 25,443/USD.

“The SBV’s management actions in the open market, in order to reduce exchange rate pressure, will also not cause rapid changes in liquidity in the banking system; instead, maintaining a low interest rate, supporting access to capital for businesses and people is still being prioritized”, said VCBS.