At approximately 9:05 AM, 265 shareholders representing over 2.7 billion shares attended Techcombank’s 2024 Annual General Meeting, which represents more than 77.7% of total voting shares.

Focus on Wealth Management Division

Mr. Jens Lottner – Techcombank’s CEO addressed at the General Meeting. Photo: BTC

|

In his address to the board, Mr. Jens Lottner – Techcombank’s CEO stated that the bank will continue to focus on four pillars in its strategy: CASA 55%, a $20 billion capitalization, fee income contributing 30% of total revenue, and ROE 20%. “We believe that Vietnam is fully capable of achieving a 6% GDP growth rate. Vietnam has a young population, is highly technological, and is increasingly affluent. As the country becomes wealthier, people will increase their usage of banking services,” shared Mr. Lottner, Techcombank’s CEO.

Mr. Jens Lottner predicted that by 2030, the standard of living for the Vietnamese people will exceed that of Malaysia, Indonesia, etc., and that people will require better wealth management services. This is why Techcombank is targeting the affluent segment and will expand its wealth management division alongside TCBS.

Techcombank’s 2024 Annual General Meeting was held on the morning of April 20 in Hanoi. Photo: BTC

|

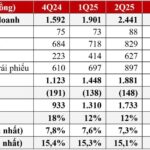

Pre-tax profit target for 2024 to increase by more than 18%

In 2024, Techcombank aims to achieve pre-tax profit of VND 27,100 billion, an 18.4% increase compared to 2023, based on the expectation of a 16.2% growth in outstanding loans, reaching VND 616,031 billion (according to approval from the State Bank of Vietnam). Customer deposits will be commensurate with loan growth. The NPL ratio will be controlled below 1.5%.

|

Techcombank’s pre-tax profit from 2015-2023 |

At the General Meeting, Techcombank’s shareholders reviewed and approved the election of the Board of Directors (BOD) and Supervisory Board (SB) for the 2024 – 2029 term. Accordingly, the Board of Directors will have nine members, including two independent members. The Supervisory Board will have three members, including two full-time members.

The BOD and SB for the 2024 – 2029 term of Techcombank were introduced at the General Meeting. Photo: BTC

|

In the BOD election, all candidates were elected to the 2024 – 2029 BOD, including Mr. Hồ Hùng Anh; Mr. Nguyễn Đăng Quang; Mr. Nguyễn Thiều Quang; Mr. Nguyễn Cảnh Sơn; Mr. Hồ Anh Ngọc; Ms. Nguyễn Thu Lan; Mr. Saurabh Narayan Agarwal; Mr. Phạm Nghiêm Xuân Bắc (Independent Member); Mr. Eugene Keith Galbraith (Independent Member).

The SB election results for the 2024 – 2029 term include Mr. Hoàng Huy Trung; Ms. Bùi Thị Hồng Mai; Ms. Đỗ Thị Hoàng Liên.

Cash Dividend at 15% and Bonus Shares at 100%

Regarding the distribution of profits in 2023, after deducting all funds, Techcombank’s undistributed profit after tax (retained earnings) was over VND 36,993 billion. The bank plans to allocate nearly VND 5,284 billion to pay cash dividends to shareholders at a rate of 15% (VND 1,500 per share). The expected implementation time is in Q2 or Q3 2024.

This is also the first year that Techcombank has paid cash dividends after a decade of retaining earnings to strengthen its capital base and develop its business.

In addition, the General Meeting also approved the issuance of shares from its equity capital, at a ratio of 100% (for every 100 shares owned, the shareholder will receive an additional 100 new shares).

Specifically, Techcombank plans to issue over 3.5 billion additional shares in order to increase its charter capital from VND 35,225 billion to VND 70,450 billion. These shares will not be subject to any restrictions on transfer. The expected issuance period is within 45 days from the date the SSC receives all required issuance reporting documents.

DISCUSSION:

Opportunities for other investors to acquire TCB shares at an attractive price

Does Techcombank intend to acquire or establish a consumer finance company?

CEO Jens Lottner: Techcombank has no such intention as it already has several core business lines. The bank will consider and analyze Home Credit and FE Credit, but this is not a risk management model that we pursue.

Has the rate of customer growth slowed down, and what solutions are in place to change this?

CEO Jens Lottner: Techcombank pays close attention to and focuses on more active customers, and to do this, the bank must ensure that its customer service systems are the most efficient. Currently, Techcombank’s profits come from a small number of customers, rather than the majority of customers. Even though the customer base is small, these customers are valuable, and Techcombank places greater importance on the quality of its customers rather than pursuing the number of customers that need to be acquired.

Currently, Techcombank’s brand recognition in the market is quite good due to the quality of its services, asset quality, products, and solutions provided to customers, even though its customer base may not be as large.

Banks often pay dividends in shares over multiple tranches. As Techcombank is offering a 1:1 ratio, this could significantly dilute the stock, and how will this affect the stock price?

CEO Jens Lottner: In reality, a bonus share issue does not affect the equity, but rather shifts it from one part to another. While the stock price may be diluted and experience a slight decrease, this also creates an opportunity for other investors to acquire TCB shares at an attractive price. The stock price will then rebound if the bank performs well.

First quarter 2024 profitability was very good

Preliminary business results for the first quarter of 2024?

Mr. Hồ Hùng Anh – Chairman of the BOD: The Q1 financial statements have not yet been published, but the results are still on track, and the Q1 profit is very good.

|