MB’s 2024 Annual General Meeting of Shareholders was held in Hanoi on the morning of April 19. Photo: BTC

|

As of 8:30 AM, 1,166 shareholders and proxies were present at MB’s 2024 Annual General Meeting of Shareholders, representing 63.96% of the voting shares. The meeting was valid (over 50%).

All shareholders attending the 2024 Annual General Meeting received a cash envelope from MB worth VND 500,000 per share. Thus, the bank plans to prepare a “gift” of nearly VND 600 million for shareholders.

Last year, MB shareholders also received a cash envelope worth VND 500,000 per share when attending the 2023 Annual General Meeting of Shareholders. The meeting was attended by approximately 1,000 shareholders, making it one of the banks with the highest number of shareholders attending the Annual General Meeting of Shareholders.

MB is known as a bank that is quite “considerate” in its shareholder relations work. In previous years, the bank has also often prepared gifts, sometimes bank cards with a balance of VND 500,000, and sometimes electronic scales, etc.

A large number of shareholders attended MB’s 2024 Annual General Meeting. Photo: BTC

|

At the meeting, MB shareholders will review and approve the election of the Board of Directors (BOD) and the Supervisory Board (SB) for the 2024 – 2029 term. Accordingly, the number of members in the Board of Directors is 11, including 1 independent member. The number of members of the SB is 5. However, at the beginning of the meeting, Mr. Luu Trung Thai – Chairman of the Board of Directors of MB said that at this Annual General Meeting, the procedures for electing the new Board of Directors and SB would not be carried out; the election would be held later, at the Annual General Meeting of Shareholders as soon as possible, in accordance with regulations.

Chairman Luu Trung Thai speaks at the meeting. Photo: BTC

|

Dividend of 5% in cash and 15% in shares

Regarding the profit distribution plan for 2023, after setting aside funds, MB’s total after-tax profit is nearly VND 19,000 billion. The bank plans to use over VND 10.6 trillion to pay dividends to shareholders at a total rate of 20%, including 5% in cash and 15% in shares.

Specifically, MB plans to spend over VND 2.6 trillion to pay cash dividends at a rate of 5%. At the same time, the bank plans to issue nearly 796 million shares to pay dividends to shareholders (15%) to increase its charter capital by nearly VND 7.8 trillion.

These shares are not subject to transfer restrictions. The expected implementation time is in 2024 after being approved by the State management agency and the market conditions are suitable.

After paying the dividend, MB’s after-tax profit will still be over VND 8.3 trillion.

Charter capital is expected to increase to over VND 61.6 trillion

In 2024, MB will continue to implement the plan to issue 62 million private shares at a price of VND 10,000 per share to increase its charter capital by VND 620 billion. This plan has been approved by the 2023 Annual General Meeting of Shareholders and approved by the State Bank of Vietnam (SBV).

The offering targets are professional securities investors. The offered shares will be subject to transfer restrictions under an agreement between MB and investors. The expected implementation time is in 2024 or by the second quarter of 2025.

If 100% of the two private share issuance plans and dividend payment in the form of shares are completed, MB’s charter capital is expected to increase from over VND 52.1 trillion to over VND 61.6 trillion.

Pre-tax profit target for 2024 to grow by 6-8%

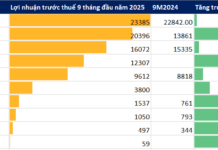

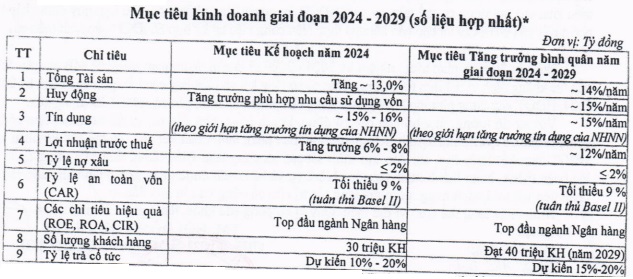

In 2024, MB set a target of pre-tax profit growth of 6 – 8% compared to the implementation in 2023, corresponding to a range of VND 27,884 billion – VND 28,410 billion. For the period 2024 – 2029, the bank plans for profit to grow by an average of approximately 12% per year.

|

MB’s Business Situation for the period 2015-2023 |

Regarding total assets, MB set a growth target of 13% in 2024, equivalent to more than VND 1,000 trillion. For the period 2024 – 2029, the target growth is an average of approximately 14% per year.

Credit is expected to grow by 15 – 16% in 2024, with an average growth target for the period 2024 – 2029 of approximately 15% per year, according to the limit assigned by the State Bank of Vietnam (SBV). The bad debt ratio is controlled below 2%, and the capital adequacy ratio complies with Basel II, at a minimum of 9%.

Source: MB

|

Mobilization in 2024 aims