On the afternoon of April 17, 2024, FPT Digital Retail Joint Stock Company (HoSE: FRT) successfully held its 2024 Annual General Meeting of Shareholders in Ho Chi Minh City.

2024 Business plan with revenue expected to increase by 17%

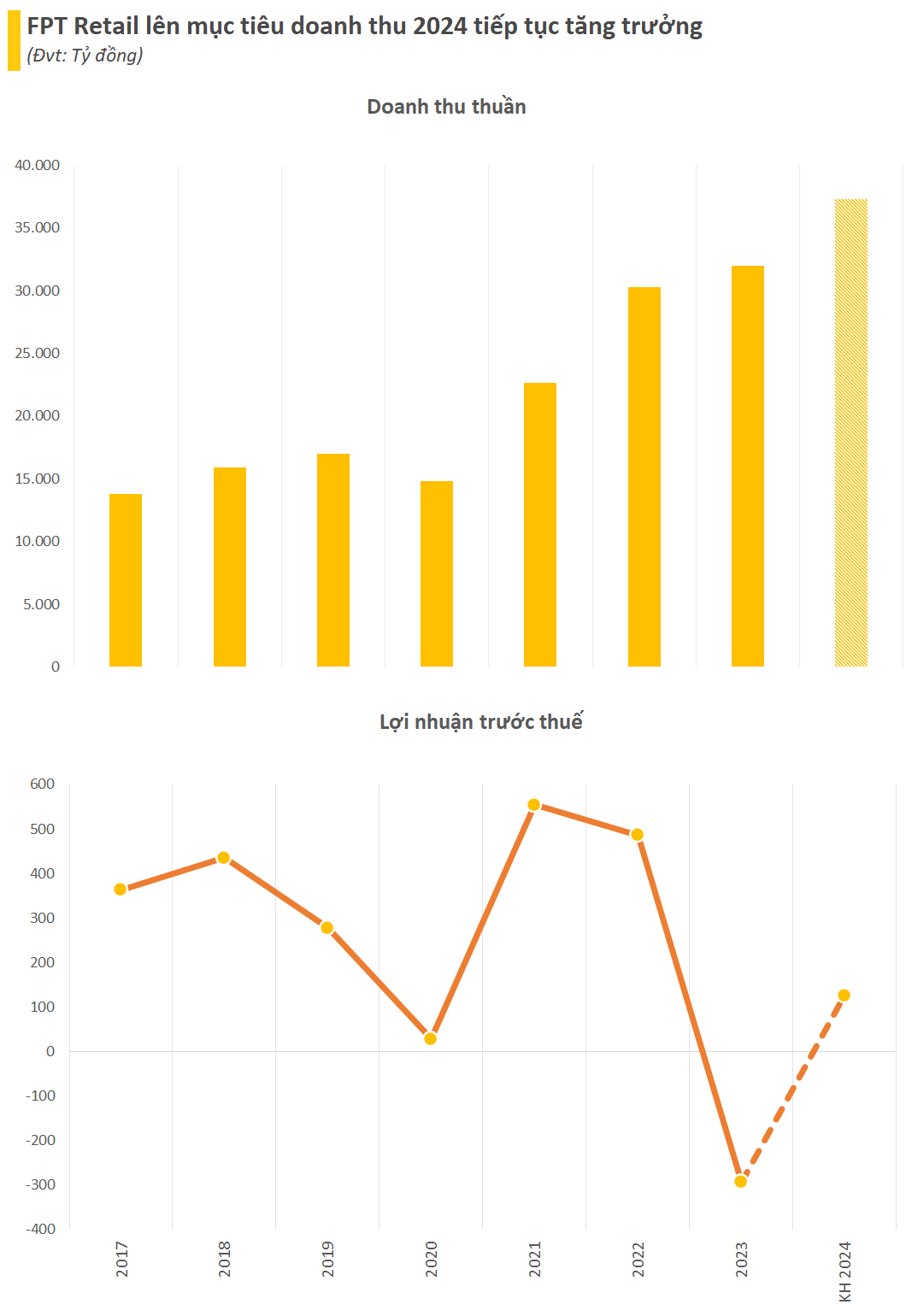

FRT Shareholders at the general meeting unanimously approved the 2024 plan with revenue target of VND 37,300 billion – up 17% and profit before tax of VND 125 billion. Revenue from the FPT Shop chain is expected to be sideways, while revenue from the FPT Long Chau chain is expected to increase by about 34%. FPT Retail’s business plan was developed in the context of a challenging overall market with unpredictable developments alongside growth expectations in new areas.

In 2024, the technology market is expected to continue to face many challenges due to a difficult economic context, while high inflation will motivate consumers to continue to tighten spending, especially on non-essential items. FPT Retail said it will continuously strive to innovate, flexibly implement multi-platform business models, and enhance customer experience. The company expects the revenue of the FPT Shop chain to continue to be secured. Not only sideways, FPT Retail’s business operations are expected to see positive changes, better than the “trough” 2023 thanks to the main growth drivers from the FPT Long Chau chain and the new area of the Vaccination Center system.

Target of opening 100 new Vaccination Centers, plan to offer up to 10% private placement of shares

FPT Retail continues to invest in expanding and developing the FPT Long Chau chain, introducing additional new services and products into the FPT Shop chain to meet the diverse needs of customers, and building and improving the system of warehouses, personnel and technology. At the same time, FRT continues to apply technology comprehensively in all aspects, from operations to user experience with great support from FPT Corporation in order to bring customers the best shopping experiences.

With the FPT Shop chain, FRT will resolutely implement and synchronize a series of solutions to optimize operating costs and complete the system. Accordingly, FPT Shop continues to supplement and diversify product groups such as electronics, refrigerators, household appliances, … in order to exploit and maximize the potential of each store, gradually improving gross profit margin. Besides, the company also continues to develop MVNO service, focusing on investing heavily in multi-platform online business.

In the pharmaceutical and healthcare sector, after 6 years of operation, FPT Long Chau still maintains its position as the No. 1 pharmacy chain in Vietnam. In 2023, the FPT Long Chau chain recorded success with 560 newly opened pharmacies, revenue increased by 66%, raising the contribution rate to 50% of total consolidated revenue.

In 2024, the company plans to open 400 more pharmacies, bringing the total number of pharmacies by the end of 2024 to about 1,900. Aiming to provide comprehensive healthcare for customers, FPT Long Chau has launched the vaccine vaccination center chain after the initial success of the retail pharmacy chain. After a period of testing the vaccine vaccination center, along with the market experience and operation already available in the healthcare industry, FPT Retail set a goal of opening 100 new vaccine centers in 2024. This is an important step contributing to building FRT’s comprehensive healthcare ecosystem in the future.

Speaking at the conference, Ms. Nguyen Bach Diep, Chairwoman of FPT Retail’s Board of Directors, said that FRT expects to develop FPT Long Chau into a health ecosystem with Long Chau Healthcare Platform following the health life cycle of a person from disease prevention to health care, medical examination and treatment. In the FPT Long Chau health ecosystem, customers are the center and FRT will strive to gradually complete the ecosystem according to the strategic model. The chain of pharmacies, vaccination centers, and eCommerce systems will continue to develop, researching and adding other services to complete the ecosystem.

“We are confident about the available resources of FPT Long Chau and what we have studied and learned from models that have similarities with FRT in general and Long Chau in particular in the world. To invest in the Long Chau Healthcare Platform strategy, we plan to raise capital through private placement of shares to investors with a maximum offering value of 10%”, said Ms. Diep.

At the same time, the FPT Long Chau chain also aims to maintain its position as the No. 1 pharmacy for medicines, especially prescription drugs, in order to bring customers the best, highest quality, and most suitable price options in the market. The system also strives to become a pioneer in developing LC 24/7, insurance, and rare and difficult-to-find drugs services in order to bring customers the best possible experience.

In parallel, FPT Long Chau always focuses on investing and improving its human resources. The company plans to continuously recruit and apply technology in training, fostering, and improving the professional and service capacity of the pharmacist team in order to bring the best possible service to customers.

Regarding the dividend payment plan, based on the forecast that 2024 will continue to be a relatively difficult year for the market for retailing electronics, hence, to ensure the maintenance of business operations and the capital demand for business production, expansion of the FPT Long Chau chain and other projects, … FPT Retail will not pay dividends in 2024.