Decree 100/NĐ-CP regulating penalties for drunk driving has been officially enforced since 1/1/2020, completely changing the landscape of Vietnam’s beer industry. The tightened penalties over the past year, along with lower consumer purchasing power, have negatively impacted sales for most beer companies.

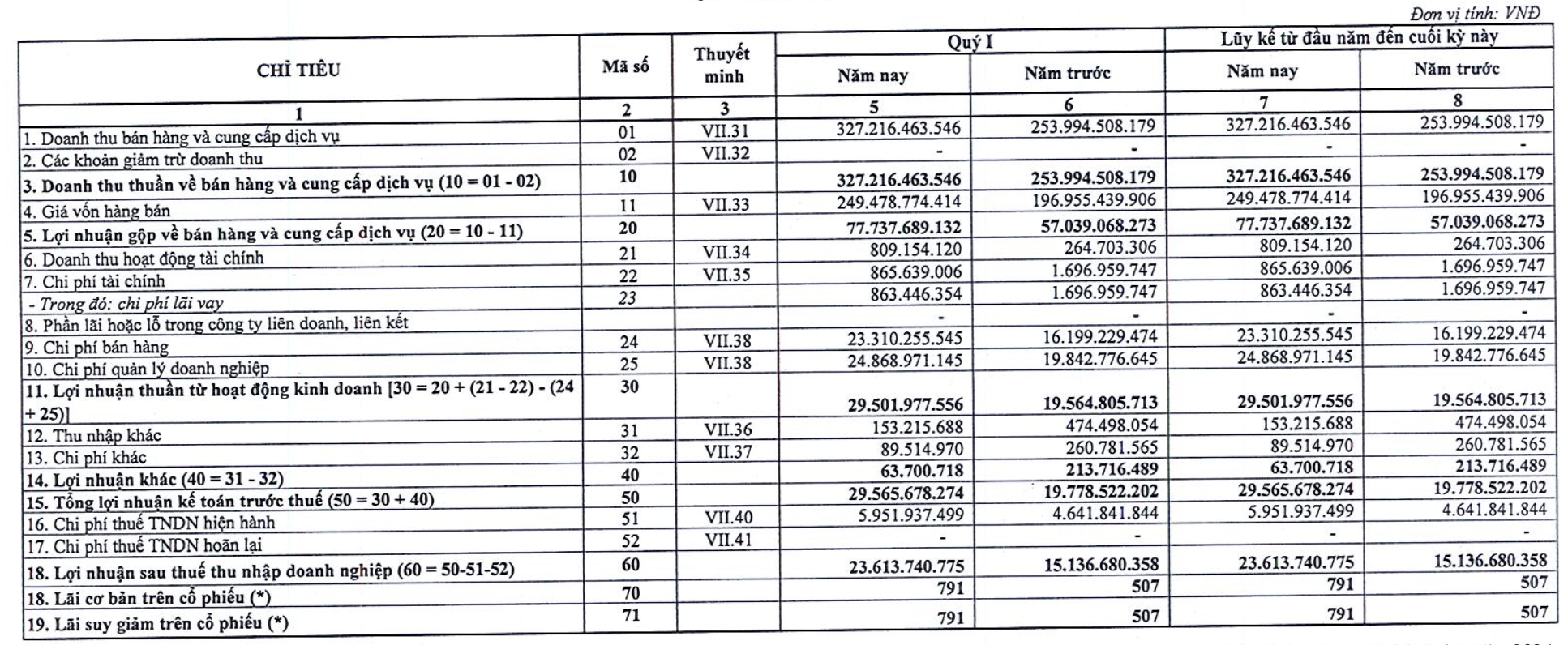

However, some companies have weathered the storm relatively well, including Saigon-Mien Trung Beer (SMB). In the first quarter of 2024, SMB reported revenues of over VND327 billion, a 29% increase compared to the same period in 2023. After deducting the cost of goods sold and expenses, SMB recorded pre-tax profits of VND29.6 billion, a nearly 50% increase over the previous year.

According to SMB, the global situation in 2024 is expected to remain volatile and unpredictable, with economic, trade, and investment growth continuing to decelerate. The Russia-Ukraine conflict, tensions between Russia and the West, and ongoing instability in the Middle East are creating upward pressure on inflation and financial market risks. Production and business activities in Vietnam remain somewhat dependent on foreign countries, leaving them vulnerable to global economic downturns.

Additionally, Decree 100 continues to affect beer and alcohol consumption. Furthermore, increasingly extreme weather events, such as droughts, storms, floods, and saltwater intrusion, will impact people’s lives and consumption. These risks have prompted the company to adopt a cautious approach.

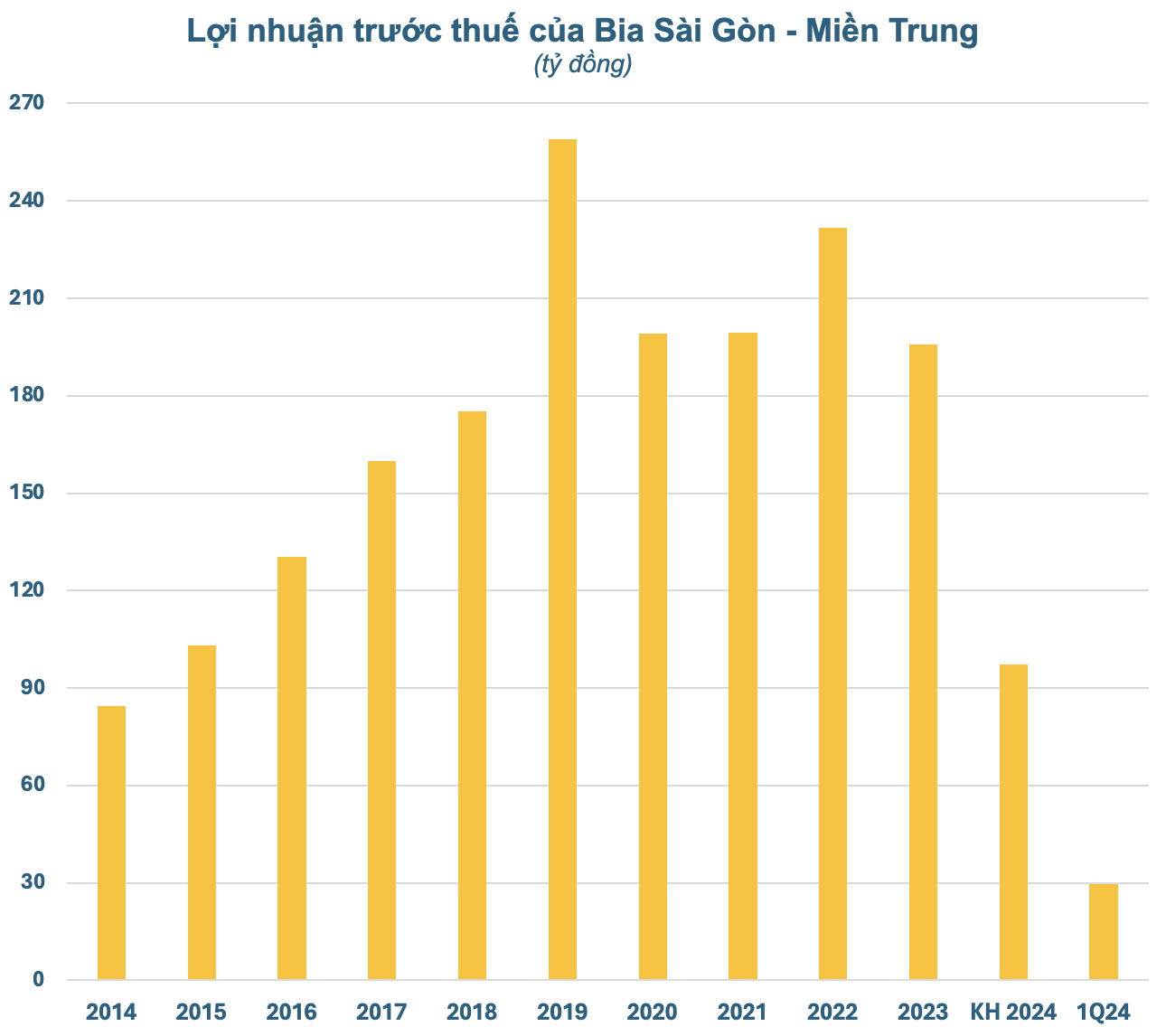

This year, SMB aims to achieve production and consumption output of 178.57 million liters, a slight 2% increase compared to 2023. Total revenue is expected to reach VND1,379 billion, an 11.5% increase compared to the previous year. Notably, pre-tax profit is projected to decrease by nearly 48% compared to 2023, falling to VND97.3 billion.

It is worth noting that SMB has a history of setting modest profit targets and consistently exceeding them. In 2023, the company set a pre-tax profit target of VND90 billion but ended up achieving more than double that amount. Nonetheless, compared to 2022, SMB’s profits still decreased by nearly 16%.

SMB specializes in the production and distribution of beer, alcohol, and soft drinks in the Central Highlands and South Central Coast regions. The company has four member units, including production plants and sales and distribution companies in Daklak, Binh Dinh, and Phu Yen provinces. It is a subsidiary of Saigon Beer-Alcohol-Beverage Corporation (Sabeco – SAB), which owns over 32%.

In 2019, SMB set records with revenues of over VND1,500 billion and pre-tax profits of nearly VND260 billion. However, business results declined due to the double whammy of COVID-19 and Decree 100. Despite these challenges, the company has still generated revenues of over VND1,000 billion and pre-tax profits of around VND200 billion annually. This level of profitability is significantly higher than before 2019.

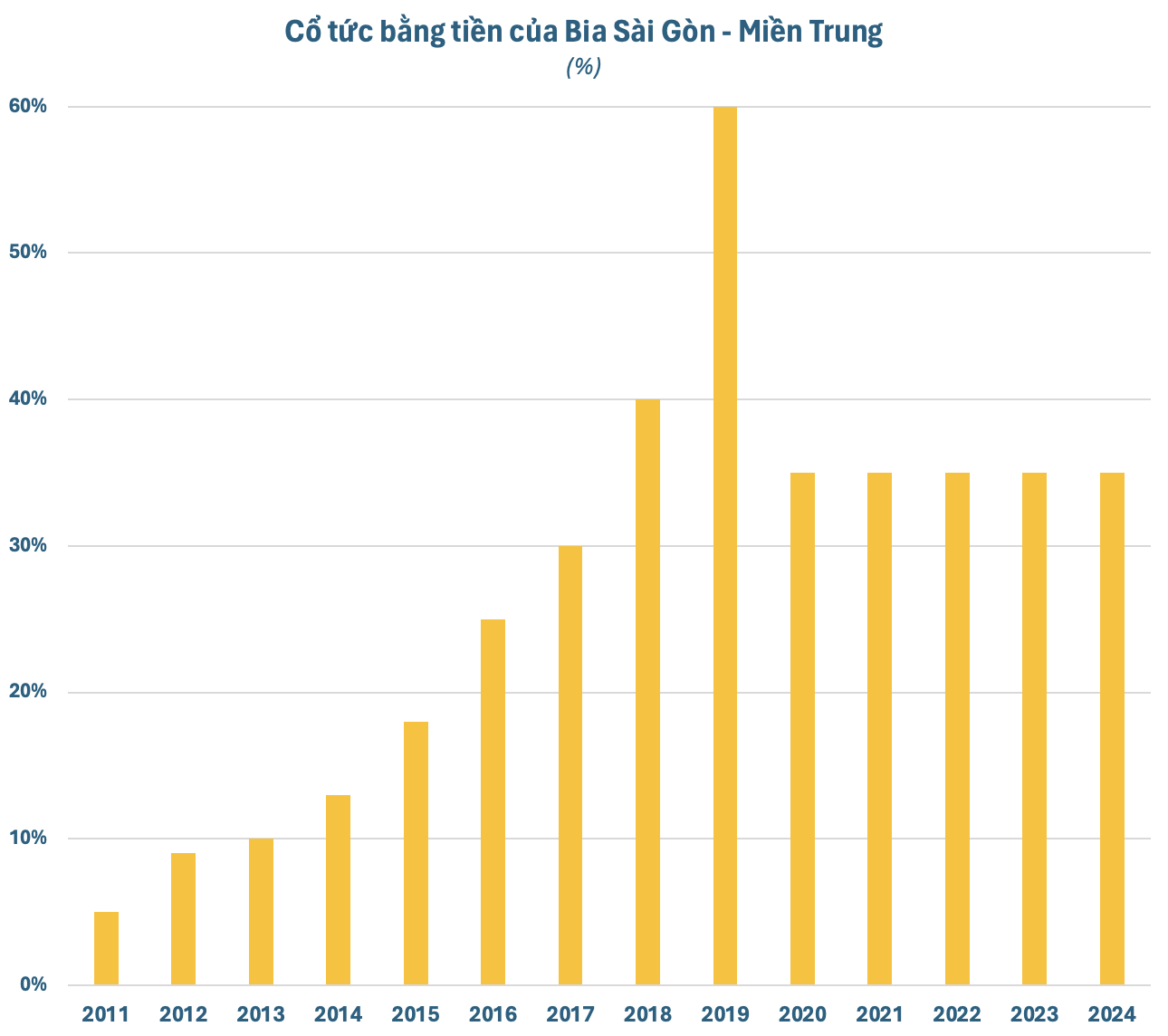

With stable profits, SMB has maintained a consistent dividend payout of 35% in cash over the past four years. While lower than the record 60% payout in 2019, it remains relatively high, representing a yield of 10% based on the current share price. In fact, since its listing on the stock exchange, the company has never failed to pay cash dividends to its shareholders.

SMB listed its shares on the UPCoM in September 2010 and transferred its listing to the HoSE in 2018. SMB shareholders have not only enjoyed regular dividends but have also benefited from the company’s rising stock price, which is currently at an all-time high. The company’s market capitalization now exceeds VND1,100 billion, 2.5 times higher than when it first listed 14 years ago.