Oil edges higher

Oil rose slightly in the last trading session of the week but ended lower overall, after Iran signaled it would not retaliate following an alleged Israeli attack on its territory, a sign that a broader escalation in the Middle East may be averted.

Brent futures settled up 18 cents, or 0.21%, to $87.29 a barrel. U.S. West Texas Intermediate (WTI) crude for May delivery settled 41 cents, or 0.5%, higher at $83.14. The more active June contract settled up 12 cents at $82.22 a barrel.

Both benchmarks rose more than $3 a barrel earlier in the session after explosions were heard in the Iranian city of Isfahan in what sources described as an Israeli attack. Gains were capped, however, after Tehran downplayed the incident and said it had no plans to retaliate.

Meanwhile, the United States added sanctions on Iranian oil exports to a pending Ukraine aid package after Tehran’s drone strike on Israel late last week.

The International Monetary Fund (IMF) expects OPEC+ to start raising oil production from July, media reported on Friday.

OPEC+, led by Saudi Arabia and Russia, agreed last month to extend their 2 million-barrel-per-day voluntary output cut until the end of June. That has helped keep oil prices elevated. However, investors are not ruling out the chance that Middle East tensions could disrupt supply.

Gold rises for fifth straight week as Middle East risks linger

Gold prices edged higher and notched a fifth consecutive weekly gain, as concerns over a conflict between Iran and Israel spurred safe-haven demand.

Spot gold rose 0.7% to $2,395.15 an ounce by 1745 GMT after rising to a high of $2,417.59 earlier in the session. It has gained 2.2% so far this week. U.S. gold futures settled up 0.7% at $2,413.8.

Longer term, however, gold’s upside is seen as limited as the Federal Reserve may not cut interest rates as soon as the market is expecting.

Gold, which has rallied this year, is set to gain further support from strong demand prospects in China and macro uncertainties, said state-backed Chinese researcher Antaike.

Spot silver rose 1.6% to $28.66. Spot platinum fell 0.4% to $931.22, and palladium eased 0.6% to $1,016.91. Both metals posted weekly declines.

Copper holds near two-year high; nickel at 7-month peak, tin at 22-month high

Copper prices held within sight of a two-year peak as funds extended buying on supply concerns, while nickel surged on talk of stockpiling by the Chinese government.

Three-month copper on the London Metal Exchange (LME) rose 1.4% to $9,866 a tonne after touching $9,913.50, its highest since April 2022.

Nickel prices scaled their highest in seven months, lifted by plans for state reserves buying in China and worries over tighter supply from top exporter Indonesia. Three-month nickel on the LME jumped 3.7% to $19,250 a tonne, having earlier reached $19,440, its highest since September.

LME aluminium gained 1.7% to $2,660 a tonne as the market digests moves by Washington and London to ban Russian supply of the metal, along with copper and nickel, on the LME and the Chicago Mercantile Exchange (CME).

Tin on the LME climbed 4.5% to a 22-month high of $35,505 a tonne, extending sharp gains this week on fund buying and supply concerns.

Zinc rose 1.6% to $2,856 a tonne and lead added 1.7% to $2,217.50.

Iron ore rises for a second straight week on improved China demand

Iron ore futures edged down on Friday, but were on track for a second consecutive weekly gain as demand improved in top consumer China.

The Dalian Commodity Exchange’s most-traded iron ore contract for September delivery closed down 0.34% at 871 yuan ($120.30) a tonne. It has, however, gained 5.3% so far this week.

Iron ore futures on the Singapore Exchange for May delivery fell 0.12% to $116.70 a tonne, but have risen 5.1% this week.

Coking coal and coke futures both inched up 0.39% and 0.37%, respectively.

On the Shanghai Futures Exchange, steel rebar fell 0.3%, hot-rolled coil slipped 0.26%, wire rod declined 0.54%, while stainless steel shed 2.09%.

London cocoa surges 14% on week, nears record 10,000 pounds a tonne

London cocoa futures have jumped 14% this week to reach a record high near 10,000 pounds a tonne as demand outstripped supply.

July London cocoa rose 417 pounds, or 4.4%, to 9,835 pounds a tonne, having jumped 9.7% on Thursday. The contract earlier reached a record high of 9,980 pounds.

Data showed North American cocoa grindings rose 3.6% in the first quarter from a year earlier, comfortably beating market forecasts of a 4%-8% decline. First-quarter cocoa processing in Europe and Asia was also stronger than expected, data showed.

Coffee rises 6% on the week

July robusta coffee rose $18, or 0.4%, to $4,080 a tonne, having hit a record high of $4,292 on Thursday. It has gained 6% this week.

Farmers in top robusta producer Vietnam are holding back supplies in anticipation of higher prices, while the outlook for the next crop continues to deteriorate due to dry weather.

Arabica coffee for July delivery settled up 0.3% at $2.3185 per pound, having hit its highest since February 2022 at $2.4540 on Thursday.

Sugar edges up

March raw sugar rose 0.14 cents, or 0.7%, to 19.73 cents per lb, recovering some ground after hitting a 16-month low on Wednesday.

Brazil’s new cane crop is forecast to fall by 8.5%, while India’s sugar output is set to improve, USDA said.

Thailand’s sugar production is expected to fall by 21.2% in the current 2023/24 season, the Office of the Cane and Sugar Board said.

White sugar for August fell 0.9% to $563.50 a tonne.

Soybeans, corn futures gain on bargain buying, geopolitical tensions

U.S. corn and soybean futures rose as geopolitical tensions fueled buying after the benchmark contracts in both markets had fallen to their lowest in more than six weeks, traders said.

Grain traders said corn futures were supported by news that the U.S. Environmental Protection Agency will temporarily expand summertime sales of higher ethanol-blended gasoline this year.

Chicago Board of Trade corn for July delivery rose 6-3/4 cents to $4.43 a bushel. Soybeans for July finished up 16-3/4 cents at $11.65-3/4 a bushel, rebounding after falling to $11.45-3/4, the lowest for the contract since Feb. 29. Wheat ended up 13-3/4 cents at $5.66-3/4 a bushel.

Japan rubber falls on the week on ample supply, lackluster demand

Japanese rubber futures rebounded after two days of declines, lifted by firmer oil prices, although they still ended the week lower amid ample rubber supply and weak demand.

The Osaka Exchange’s rubber contract for September delivery settled up 1.2 yen, or 0.39%, at 310.8 yen ($2.01) per kg. However, it lost 1.55% over the week, marking a third consecutive weekly decline.

The most-active rubber contract on the Shanghai Futures Exchange (SHFE) for September delivery rose 15 yuan to finish at 14,565 yuan ($2,011.60) a tonne. The front-month June 2024 rubber contract on the Singapore Exchange settled at 162.0 US cents per kg, up 0.62%.

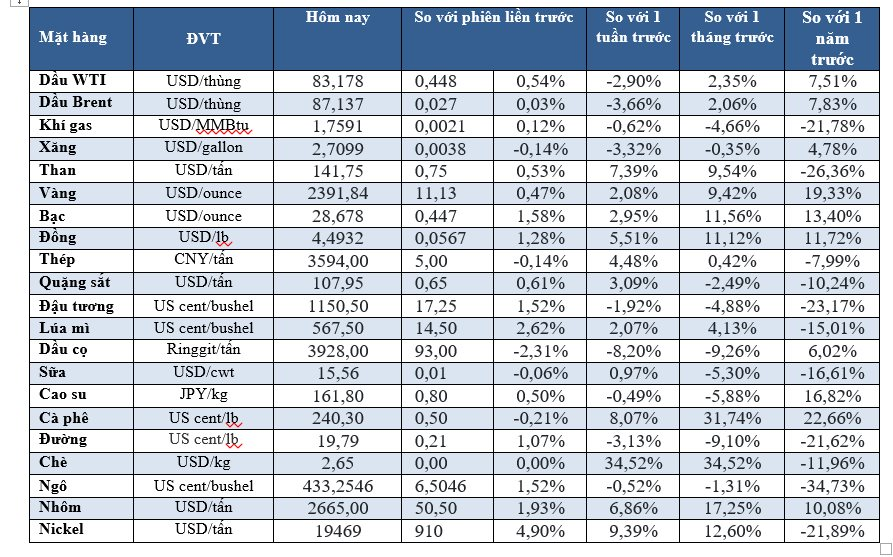

Key commodities prices at 0420 GMT, April 20, 2024

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)