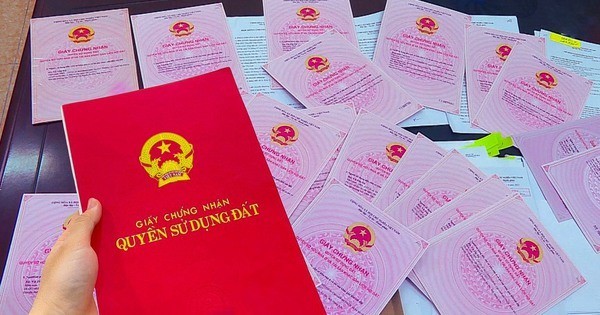

Land Use Fee Calculation While Issuing Land Use Rights Certificates

Regarding the calculation of land use fees when issuing land use rights certificates and property ownership rights attached to land (red books) for households and individuals, according to the Ministry of Finance, the 2024 Land Law includes provisions on the issuance of certificates for households, individuals, and communities that are currently using land with or without land use documents; have origins in land law violations prior to July 1, 2014; have origins in incorrect allocations of authority; and accordingly, certain provisions stipulate the payment of land-related financial obligations when certificates are issued.

Proposed new regulations on calculating land use fees when issuing land use rights certificates. Illustrative photo.

Therefore, Articles 9, 10, 11, and 12 of the draft Decree contain specific provisions on the fee levels for each case where a certificate is issued in accordance with the Land Law, following the current provisions on land use fees as stipulated in the 2013 Land Law.

However, adjustments have been made to balance between different land use scenarios based on the duration of land use and the origin of the land; the land value used to calculate the land use fee is the land value according to the land price list as defined in the Land Law.

Specifically, in the case of households and individuals who have been using land with residential buildings or residential and auxiliary structures before December 18, 1980, the land area will be recognized as one time the limit for land recognition and no land use fee will be payable when a certificate is issued for that land area.

When a certificate is issued for the portion of land area that exceeds the land recognition limit for the plot with residential buildings or residential and auxiliary structures, then in accordance with Clause 1(a) of Article 138 of the 2024 Land Law, land use fees must be paid.

However, the 2013 Land Law stipulated that in such cases, the land area would be recognized as five times the land allocation limit and no land use fee would be payable.

After studying the fee levels in previous documents, the Ministry of Finance believes that to balance the fee level in this case, Clause 1(a) of Article 9 of the draft Decree states: “For the portion of land area that exceeds the land recognition limit for the plot with residential buildings or residential and auxiliary structures as stipulated in Clause 1(a) of Article 138 of the Land Law, the land user shall pay 20% of the land use fee calculated according to the residential land price.”

Furthermore, the 2024 Land Law has eliminated the land price framework and stipulates that the land price list is to be developed by region, location, or down to each land parcel based on the value zone, standard land parcel, and expands the cases where the land price list is applied to calculate land-related financial obligations.

Therefore, the draft Decree, based on the cases where certificates are issued; simultaneously, based on current regulations, balances the levels and percentages (%) of land use fees appropriately, ensuring the objective of providing certificates for households and individuals who are currently using land and ensuring social well-being.

New Regulations on Land Rent Exemptions and Reductions

One notable aspect of this draft Decree is the provisions on land rent exemptions and reductions.

The Ministry of Finance stated that regarding the principles of land rent exemptions and reductions, the 2024 Land Law does not specify what constitutes a land rent exemption or a land rent reduction.