According to the Financial Times, cocoa prices hit a record high on Monday after an industry report showed a poor crop in West Africa in the first quarter had exacerbated a global shortage of the chocolate making beans.

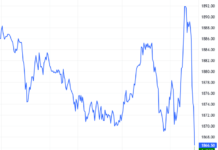

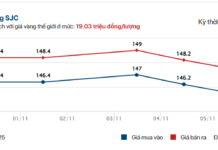

Futures in London rose as much as 9.6 per cent to an all-time peak of £9,477 a tonne, extending a rally that has been building since the start of the year as poor harvests in the world’s key growing regions in West Africa tightened supplies. The beans are now worth more than some precious metals and have risen in value faster than Bitcoin this year.

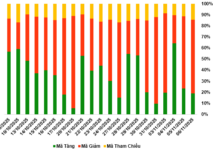

Grindings, which is when the beans are processed by the industry into products that will eventually become chocolate, fell by 2.5 per cent in the first three months of the year compared with the same period last year, according to the European Cocoa Association. The trade body collates data from 19 cocoa processors and chocolate manufacturers operating in Europe.

Global cocoa prices have more than doubled this year as investors have become increasingly worried that a deficit in supplies will continue. Years of low prices left farmers with little cash to invest in improving ageing plantations.

The grind figures are used as a measure of chocolate demand but analysts and industry insiders said the latest numbers reflected the challenges traders, processors and manufacturers are having in sourcing enough beans.

“The low grind is reflecting the fact that there are no beans available,” said Fuad Mohammed Abubakar, the head of operations at Ghana Cocoa Marketing Company, which sets the country’s farmgate buying price. “The issue is not about demand for chocolate,” he added, noting that factories in West Africa are operating at less than 30 per cent of their installed capacity.

The grind figures are likely to put further upward pressure on prices, which in New York rose 7 per cent on Monday to $10,800, up from about $3,000 a tonne at this time last year.

Cocoa prices have been rising since the beginning of 2024

Farmers in Ghana and Ivory Coast, which together account for about two-thirds of the global cocoa supply, have been battling an outbreak of crop disease, adverse weather related to climate change and the impact of the El Niño weather pattern. This has cut output in Ivory Coast, the world’s biggest producer, by more than a quarter.

Both countries have been forced to renegotiate contracts with traders to delay shipments.

Last week, Ghana’s cocoa regulator, Cocobod, which sells the country’s cocoa crop forward, began talks with trading houses to shift as much as 250,000 tonnes of cocoa beans into the next season, which starts in October.

Earlier this month, its Ivorian counterpart also asked traders to defer taking delivery of 130,000 tonnes.

In an effort to encourage farmers to invest in their plantations and improve yields, regulators in both Ghana and Ivory Coast this month raised the fixed price paid to farmers. Ivory Coast increased its price by 50 per cent to $2.48 a kilogramme. Three days later, Ghana followed with a similar increase, taking its price to $2,481 a tonne.

“Higher cocoa farmgate prices over the long term could encourage planting, with a three- to five-year lag, to meet a projected 2 per cent annual increase in global grinding demand through to 2030,” said Paul Hutchinson, chief strategist at OFI, one of the world’s largest soft commodity brokers.

With an area under cocoa of over 600,000 hectares and an output of over 1.6 million tonnes, Vietnam was the world’s 10th largest cocoa producer as of 2023. The Central Highlands is the largest cocoa growing region in Vietnam, accounting for about 60% of the area and output. Dak Lak, Dak Nong and Lam Dong are the three provinces with the largest cocoa growing areas.

Cocoa is one of Vietnam’s important export commodities. In 2022, Vietnam’s cocoa exports reached 3.2 billion USD, up 17.5% compared to 2021. The Netherlands, the US, Belgium and Germany are the major import markets of Vietnamese cocoa.