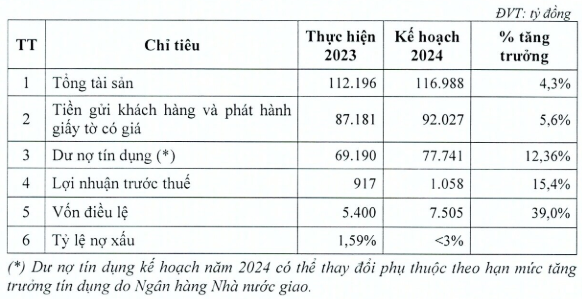

Authorized capital increases to VND7,505 billion

VAB plans to issue a maximum of 210.6 million shares to increase its charter capital from its equity, equivalent to a ratio of 39% (shareholders owning 100 shares will receive an additional 39 new shares). These shares are not restricted from transfer.

The source of capital used from equity includes undistributed profits after deducting full provisions for funds and reserve funds to supplement charter capital. If the issuance is successful, VAB‘s charter capital will increase from nearly VND5,400 billion to VND7,505 billion.

The implementation time is after the approval of the competent state agency.

The additional capital aims to help VAB enhance its financial capacity, scale, and quality of income-generating assets, increase its capacity for asset investment and business, and upgrade and modernize its information technology system to serve its network expansion strategy. At the same time, it helps VAB enhance its competitiveness, increase its resilience to operational risks, and ensure safety indicators.

Source: VietstockFinance

|

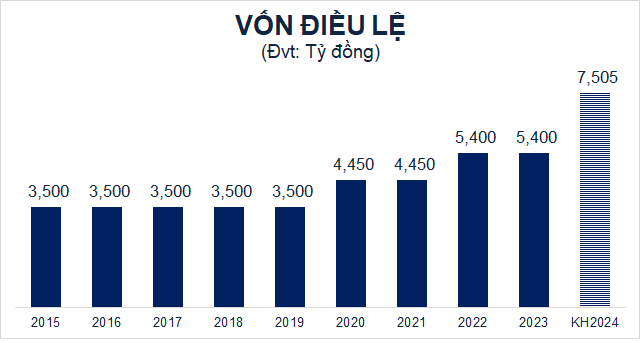

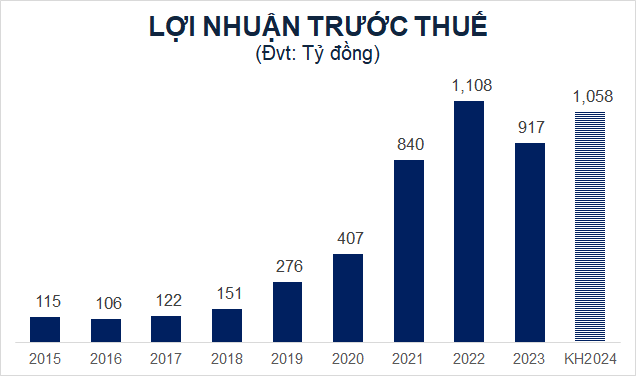

Pre-tax profit target of VND1,058 billion, up 15%

Based on the additional capital, in 2024, VAB sets a pre-tax profit target of VND1,058 billion, an increase of over 15% compared to the results of 2023. The bank also expects total assets by the end of 2024 to expand to VND116,988 billion, an increase of 4% compared to the beginning of the year. Customer deposits and issuance of valuable papers will reach VND92,027 billion, an increase of nearly 6%. Outstanding loans will reach VND77,741 billion, an increase of over 12%, and will be adjusted according to the indicators set by the SBV. The bad debt ratio is controlled below 3%.

Source: VietstockFinance

|

Listing shares on the stock exchange

VAB forecasts that the economic situation in 2024 will be favorable, the stock market will flourish, transparency will be enhanced, and investor confidence will be strengthened. In order to enhance its reputation, position, and brand, facilitate the transaction of VAB shares, and at the same time attract investment capital to promote banking activities with foreign strategic investors and international financial institutions, the Board of Directors plans to submit to the General Meeting of Shareholders (GMS) the listing of VAB shares at the Stock Exchange when market conditions are favorable. The Board of Directors will be responsible for choosing the Ho Chi Minh Stock Exchange (HOSE) or the Hanoi Stock Exchange (HNX) for the listing.

On the UPCoM exchange, VAB shares are currently trading around VND9,500/share (morning of April 10), up 35% compared to the beginning of the year, despite liquidity of only around 700,000 shares/day.

| VAB share price development since the beginning of the year |

The upcoming GMS will also elect to add 1 member to the Board of Directors for the 2023-2028 term, increasing the total number of Board members to 6 (including 1 independent member). At the same time, the GMS will elect to replace 1 member of the Supervisory Board for the 2023-2028 term, with Mr. Tran Ngoc Hai being the proposed candidate.