The Vietnamese stock market has just closed an unforgettable trading week with 4 consecutive losing sessions, including 3 strong downturns. VN-Index lost 101.74 points (-8%), marking the strongest losing week in a year and a half, since the week of October 3-7, 2022. In absolute terms, the last time the index “dropped” more than 100 points in a week was nearly 2 years ago, in the week of May 9-13, 2022.

The steep week-long decline “blew away” nearly VND 413,700 billion (~USD 17 billion) of capitalization on HoSE. Considering all 3 exchanges, Vietnamese securities have “evaporated” nearly VND 480,000 billion (~USD 20 billion) of capitalization in just one week. The total market capitalization currently stands at around VND 6.28 million billion, of which HoSE accounts for 76%.

Before the rapid fall of more than 100 points last week, VN-Index had been hovering around the 19-month peak for quite a long time. Therefore, strong profit-taking pressure was inevitable. Moreover, negative information flows, such as the US CPI being higher than expected for the third consecutive month, which could slow down the Fed’s interest rate cut path; the conflict driving up the commodities market, creating potential inflationary pressures; and the climbing exchange rate putting pressure on maintaining a loose monetary policy, also impacted market sentiment.

In fact, this market correction wave has been predicted by many experts. In a talkshow last weekend, Mr. La Giang Trung – CEO of Passion Investment said that, typically, in uptrend market periods of about 5-6 months, there will be a correction, and in terms of time, the current market is just enough, but the increase is quite low.

Mr. Trung’s initial view was that the market would increase to the 1,350 point zone, but when it approached the 1,300 point zone, the cash flow seemed weak, some short-term factors were no longer very good, so it is likely that the market could correct 12-15% from the 1,300 point zone before creating a short-term bottom to continue rising above the old peak.

“This is a healthy market correction in a period of growth that has two corrections every year in an uptrend,” said expert La Giang Trung.

In the same vein, in a report early in April, SGI Capital also stated that the period of best interest rates and liquidity has passed. “A period of correction and accumulation is necessary for the market to find equilibrium and reallocate cash flow more reasonably for the long-term positive trend with the general recovery of the economy,” the fund’s report emphasized.

SGI Capital pointed out many pressures on cash flow in the stock market, such as the rapid increase in margin rates in the past 3 months; continuous net selling pressure from foreign investors; pressure from the issuance plans of many listed companies in the second quarter and increased net selling by domestic shareholders. The market’s liquidity has recently been attracted to a number of highly speculative and expensive stocks with a huge supply. As a result, buying demand was quickly met, and the market is at risk of a short-term correction.

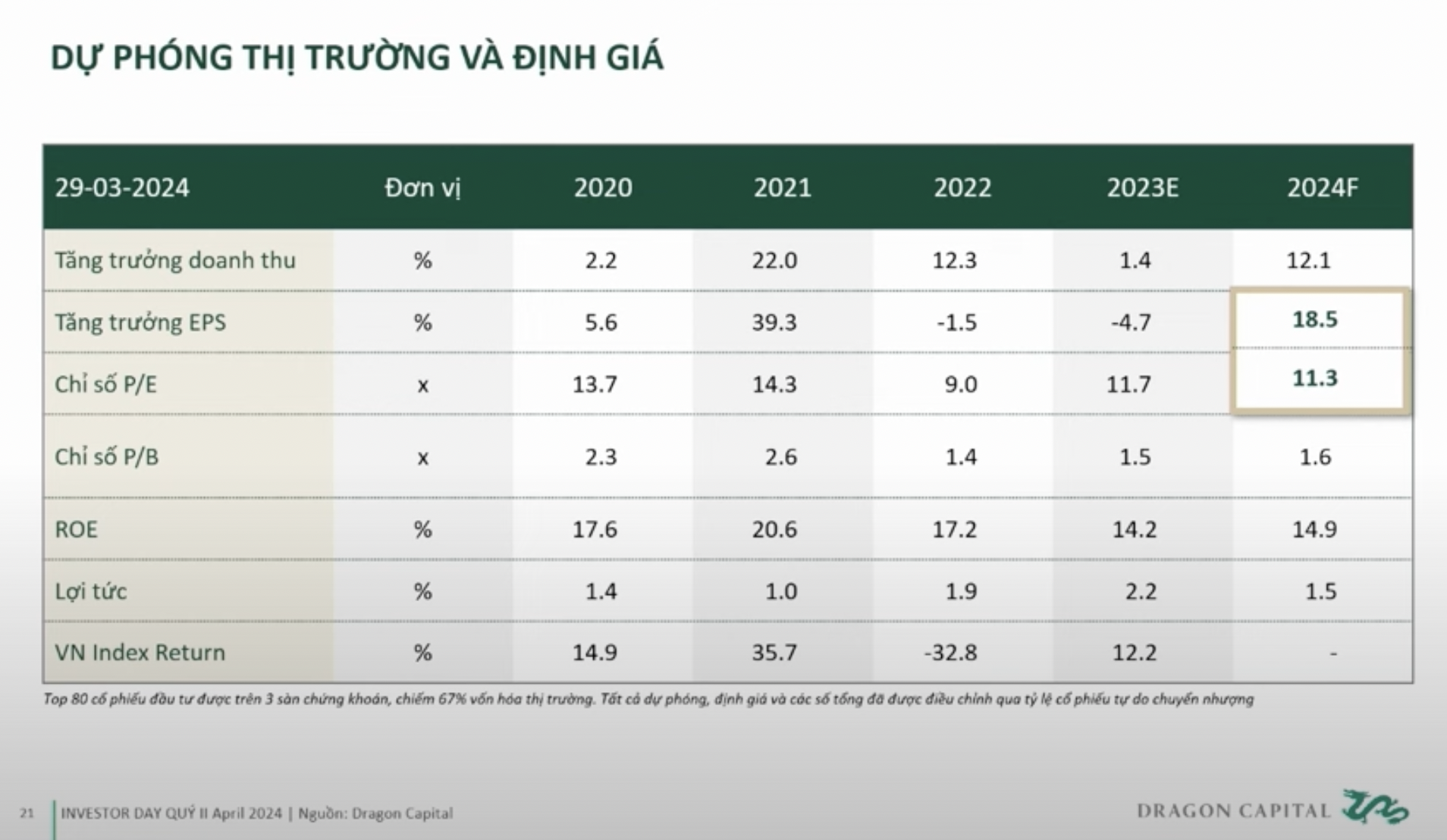

On the other hand, foreign fund Dragon Capital has a more positive view from a medium to long-term perspective. Accordingly, Dragon Capital’s statistics show that the valuations of the top 80 businesses are at 11 times, while EPS growth is up to 18.5%. This means that the valuation is relatively attractive in the medium term.

“The adjustment period is not the time for investors to leave the market, but to take advantage of it for the medium to long-term perspective. With attractive valuations, the probability of the market falling a further 10-15-20% is highly unlikely, 10% is possible, but if it falls more than 15%, investors should take decisive action in investing,” said a Dragon Capital expert.