In April 2022, the memory of the sharp decline in the stock market became an unforgettable milestone for many investors. After a long period of “finding no bottom”, the market started to recover at the end of 2023. Among them, the group of “king stocks” were not out of the trend, as many bank stocks have started to “take off”, even surpassing the historical peak after a difficult period.

According to VPBankS’s 2024 Outlook Report, in terms of valuation, both P/E and P/B of the banking industry have not reached the average level since 2013, so the industry is still trading at a quite attractive level.

With such valuation, the group of “king stocks” is expected to have more room for price increase in the future, especially those stocks that are priced lower than the industry average.

Many banks have opportunities for breakthrough growth from a solid fundamental foundation

According to the banking industry report of MB Securities Company (MBS), banks with solid fundamentals in 2023 are forecasted to have positive business results in 2024.

Firstly, banks with low cost of capital and CASA advantages such as Vietcombank, Techcombank and MB are expected to have sustainable NIM, resisting the erosion caused by cutting lending rates to compete for credit growth.

Secondly, banks with good and stable credit growth thanks to having their own customer base such as HDBank, Techcombank have many positive prospects in 2024.

Thirdly, banks with significantly improved asset quality, implementing prudent strategies in 2023 will reduce significant pressure this year such as VIB, Techcombank, and VietinBank.

Notably, HDBank was selected by MBS as a potential bank in 2024 thanks to the expected continued growth in credit demand when focusing on the rural customer segment. According to the audited financial statements, in 2023, the outstanding loans to customers reached VND 343,400 billion, an increase of 30%, among the highest in the industry despite the difficulties in credit demand.

Along with credit growth, MBS highly appreciated HDBank’s asset quality control platform better than the whole industry. Specifically, the ratio of non-performing loans is controlled at 1.5%, consolidated at 1.79%; the capital safety CAR (Basel II standard) reaches 12.6%, reaching 150% compared to the regulations of the banking industry.

In 2023, HDBank recorded a pre-tax profit of VND 13,017 billion, up 26.8% compared to 2023 ROE were 2.0% and 24.2%, respectively, leading the industry.

Many banks with good fundamentals are being valued at low levels

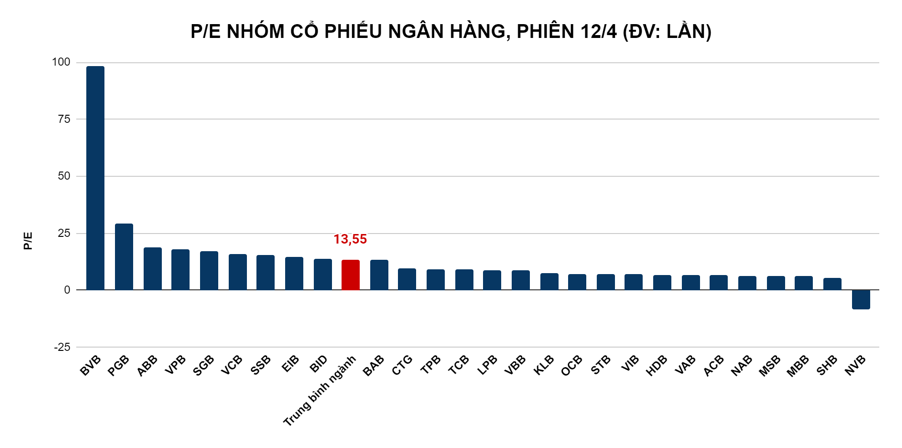

Many bank stocks are trading at a P/E valuation cheaper than the industry average

For the 2024 outlook, MBS forecasts that the after-tax profit of the monitored banks will increase by 23.6% thanks to higher credit growth of the Big4 group; NIM slightly increasing or remaining stable; fee collection, gold and foreign exchange trading are expected to recover. Notably, some banks are forecasted by MBS to have high after-tax interest growth rates such as: VPB (+90.1%), OCB (+29.3%), HDB (+31.5%), TCB (+26.2%), BID (+23.4%).

However, despite good results in 2023 and a positive profit outlook in 2024, the market prices of some stocks are still relatively cheap. According to the statistics of the session on April 12, with the average P/E of the industry being 13.55 times, stocks with the above characteristics such as HDB are being traded at a cheap price (P/E reaching 6.85 times).

Notably, in 2023, HDB stock was among the group with the strongest market capitalization gain. The price increase of HDB continued to be maintained in 2024, according to data from FiinGroup, this stock increased by 19% in the first 3 months of the year, and was one of the few “king” stocks to reach the peak.

Despite the strong increase in 2024, many brokerages agreed that HDB stock still has great potential for price increase when there is still room for growth. Accordingly, VNDirect Securities Company gave a target price of VND 29,700/ share for HDB stock, SSI assessed the target price of VND 27,700/ share; or MBS gave a price of VND 27,760/ share.

Thus, with a good fundamental foundation and high growth potential, according to MBS, stocks such as HDB, VIB, and VCB are expected to have better business results than the industry. Before that prospect, many bank stocks are trading at P/E cheaper than the industry and compared to the forecast of expected financial results, and so it is expected to continue to catch the attention of investors in the stock market.