Pressure on Emerging Market Economies

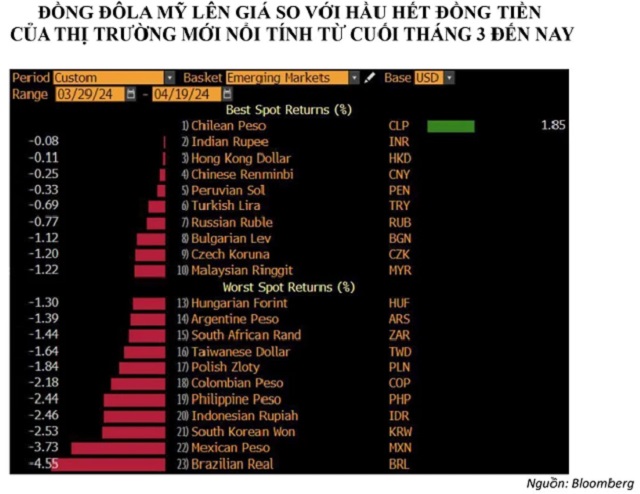

According to data from Bloomberg, over 13 emerging markets have lost more than 1% against the US dollar in just the first three weeks of April. Not only emerging market currencies, but also currencies of developed economies have also faced downward pressure against the US dollar.

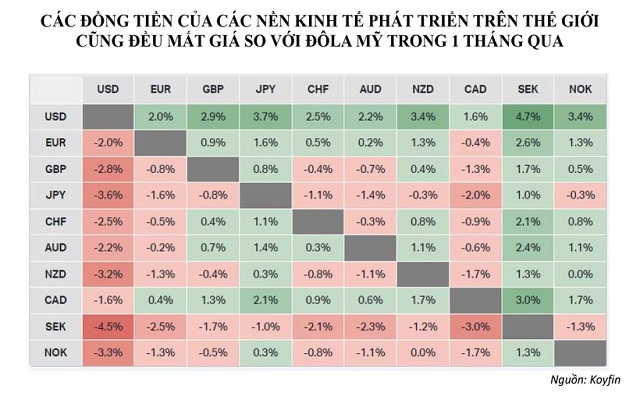

Koyfin’s matrix of major currencies shows that currencies such as the euro, British pound, Japanese yen, Swiss franc, and Canadian dollar have all lost between 1.6% and 3% against the US dollar in just the past month. Meanwhile, since the beginning of the year, the US dollar has gained nearly 10%, reaching a 34-year high against the Japanese yen, 8.3% against the South Korean won, and over 3.5% against many other major currencies.

There are many reasons for this, but the strength of the US economy, the slow decline in US inflation, and the prospect of US dollar interest rates remaining “higher for longer” are said to be the main factors behind the rise in the value of the US dollar. If at the end of last year, many expected five US interest rate cuts this year, with the earliest cut expected in the first quarter, now that expectation has been reduced to the point where there may be no interest rate cuts at all!

This change in expectations, against the backdrop of many central banks (CBs) indicating that they will still have to move towards cutting interest rates “early,” such as the European Central Bank (ECB), has made it clearer that the US will widen the interest rate gap with other currencies and boost the value of the US dollar.

DR. HO QUOC TUAN, Lecturer, University of Bristol, UK

|

The change in the Fed’s view that “we have to wait and see” has not only boosted the US dollar but has also put many other central banks in a difficult position. About two weeks ago, global central banks, finance ministers, and capital markets were almost unanimous in believing that the Fed, seen as the chief monetary policy maker in the US, would guide them all along the path of easing policy rates starting in June of this year.

However, things changed rapidly in just the past week. Speaking at the Wilson Center’s Policy Forum in Washington D.C on April 16, Fed Chair Jerome Powell left open the possibility that a delay in cutting interest rates might be necessary. According to him, recent data did not give the Fed enough confidence to cut interest rates.

Thus, the situation has changed, but some countries will not find it easy to maintain their interest rate policies and wait like the US. For example, Europe and the UK, where the economy has shown signs of faltering or technical recession, maintaining higher interest rates for longer will not be an easy task, even though inflation in these countries is also falling more slowly than expected, as in the US. The situation is even more difficult in emerging market economies, which have more debt, limited ability to control borrowing costs, or prevent sudden currency fluctuations from outside.

Officials at the International Monetary Fund (IMF) have urged central banks in Asia to stick to their own plans and avoid being tempted to bring their policy decisions too closely in line with the Fed’s anticipated moves. Krishna Srinivasan, the IMF’s director for Asia and the Pacific, said: “If central banks follow the Fed too closely, they could undermine price stability in their own countries.”

However, this also means that the market is correctly anticipating that the US will delay cutting interest rates, while many other economies will still have to cut rates between now and June. As a result, the interest rate gap between the US and many other economies will widen, and the upward pressure on the US dollar against local currencies in emerging market economies, or developed economies that maintain low interest rates like Japan, will increase.

Vietnam also faces pressure on its policy of stabilizing the exchange rate

On April 19, Mr. Pham Chi Quang, Head of the Monetary Policy Department, said that the State Bank of Vietnam (SBV) had taken steps to sell foreign currency to intervene in the market. According to Mr. Quang, the target of the purchase was banks with a negative foreign exchange position and a need. The maximum amount sold to each bank is equivalent to the amount needed to bring their foreign exchange position to a balanced level. Mr. Quang also said that “this is a very strong intervention measure, easing market sentiment, unlocking supply, and ensuring smooth foreign exchange liquidity.”

This was stated by the regulator in the context of a sharp increase in exchange rates and attention from government leaders and the SBV. Before the intervention on April 19, Deputy Governor Dao Minh Tu said that changes in the global economic and political situation have caused the domestic currencies of many countries to depreciate quite sharply, and Vietnam is also part of that trend. According to Mr. Dao Minh Tu, the VND/USD exchange rate has now depreciated by 4.9% compared to the beginning of the year.

| The strength of the US economy, the slow decline in US inflation, and the prospect of US dollar interest rates remaining “higher for longer” are said to be the main factors behind the rise in the value of the US dollar. Along with that, the change in the Fed’s view that “we have to wait and see” has not only boosted the US dollar but has also put many other central banks in a difficult position. |

According to Mr. Dao Minh Tu, the VND interest rate is currently negative compared to the US dollar interest rate on the interbank market. Raising the question of the SBV’s management of harmonious monetary policy, besides the demand for foreign exchange for the import of raw materials to ensure production, it is also a factor that has contributed to the increase in exchange rates in recent times. In addition, there is also the psychological factor of wanting to hoard USD.

The current challenge for Vietnam is to maintain a policy aimed at stabilizing the exchange rate, avoiding shocks caused by sudden currency fluctuations, but at the same time, it must be “harmonious” as Mr. Dao Minh Tu said, because it is also not possible to resist the force of the market.

The US dollar is appreciating against the world, so the psychology of hoarding and the demand for imports both play a certain role, sometimes beyond the control of policy makers like the SBV. And in that context, our foreign exchange reserves are limited, estimated at only 100 billion US dollars as of the end of last year according to information from the SBV.

The difficult problem for the SBV now is to live within its means, not to intervene indefinitely, but also not to “let go” and allow the exchange rate to fluctuate as sharply as in 2011, which contributed to the inflationary spiral. In the context of gold prices rising worldwide and domestically as they are now, a sharp depreciation of the domestic currency also creates the risk of excessive accumulation of gold and other speculative instruments, as well as the potential to push inflation up beyond a stable level.

In the current context, there are two points to note. First, the SBV should not make any commitments to maintain a certain exchange rate level, because if it cannot keep it, it will lose market confidence. Second, the government should not exert unnecessary pressure on the exchange rate based on its own wishes.

When the market has clearly shown the direction of development, the driving forces and pull on prices, then let the visible hand of the SBV massage and adjust the market’s heartbeat in the most appropriate way, given the foreign exchange reserves and various practical conditions in order to meet policy objectives.

No one understands this exchange rate story better than the SBV and the market. Therefore, the best thing to do at this point is not to add any more pressure to “stabilize the exchange rate,” “intervene,” “pull down the exchange rate,” etc. And if necessary, it is also necessary to narrow the gap between US dollar and VND interest rates, even though the economy still faces pressures that require interest rate support. Administrative, non-market, and unrealistic orders will be difficult to implement if the SBV’s capacity to intervene is limited.

What the SBV in particular and government leaders in general need to do at this time is to achieve consistency, consensus, and unity in sending messages to the market. Previous guidance on policy direction will be helpful at this time. For example, what are the tools that can be used, what indicators will be monitored instead of pressures and demands