The Vietnamese Stock Market Faces a Turbulent Week with a Record Drop

The Vietnamese stock market concluded a volatile trading week marked by significant declines. The VN-Index shed 101.74 points (-8%), marking its worst weekly decline since October 2022. The total market capitalization “evaporated” by 480,000 billion VND in just a week, with the current value standing at around 6.28 million billion VND.

Experts unanimously agree that margin pressure in the current market is immense. With the current “margin strain,” if the market continues to decline, it could trigger a widespread “margin call.” Therefore, short-term investors should observe cautiously, while long-term investors may consider gradual disbursement with a small allocation.

“Margin call” phenomenon may be triggered

Mr. Nguyen Anh Khoa – Head of Securities Analysis at Agriseco Securities believes that a correction is necessary in the index’s upward trajectory, especially since the VN-Index has gained nearly 15% since the beginning of the year without any significant discount. Technically, the VN-Index is showing signs of balancing selling pressure as it retreats to the MA200 zone around 1,175-1,180 points. Buying force is expected to increase actively in this region, helping the market maintain a medium-term uptrend.

However, short-term market expectations are also being influenced by geopolitical tensions, predictions of the FED postponing interest rate cuts, and exchange rate pressure in Vietnam. In the context of the exchange rate continuing to rise, the NHNN was forced to sell USD last week, which is considered a decisive intervention. However, to ensure that foreign exchange reserves reach 12-14 weeks of imports (as recommended by the IMF), the NHNN will find it difficult to continue selling USD amidst the current high import demand. And if the exchange rate does not cool down, interest rates may have to increase to control the exchange rate. This will affect the cash flow in the market and the cash flow into the stock channel.

Regarding the possibility of widening the decline range, Mr. Khoa believes that if buying force does not increase significantly around MA200, the 1,120-1,130 support zone will be an immediate support for the index.

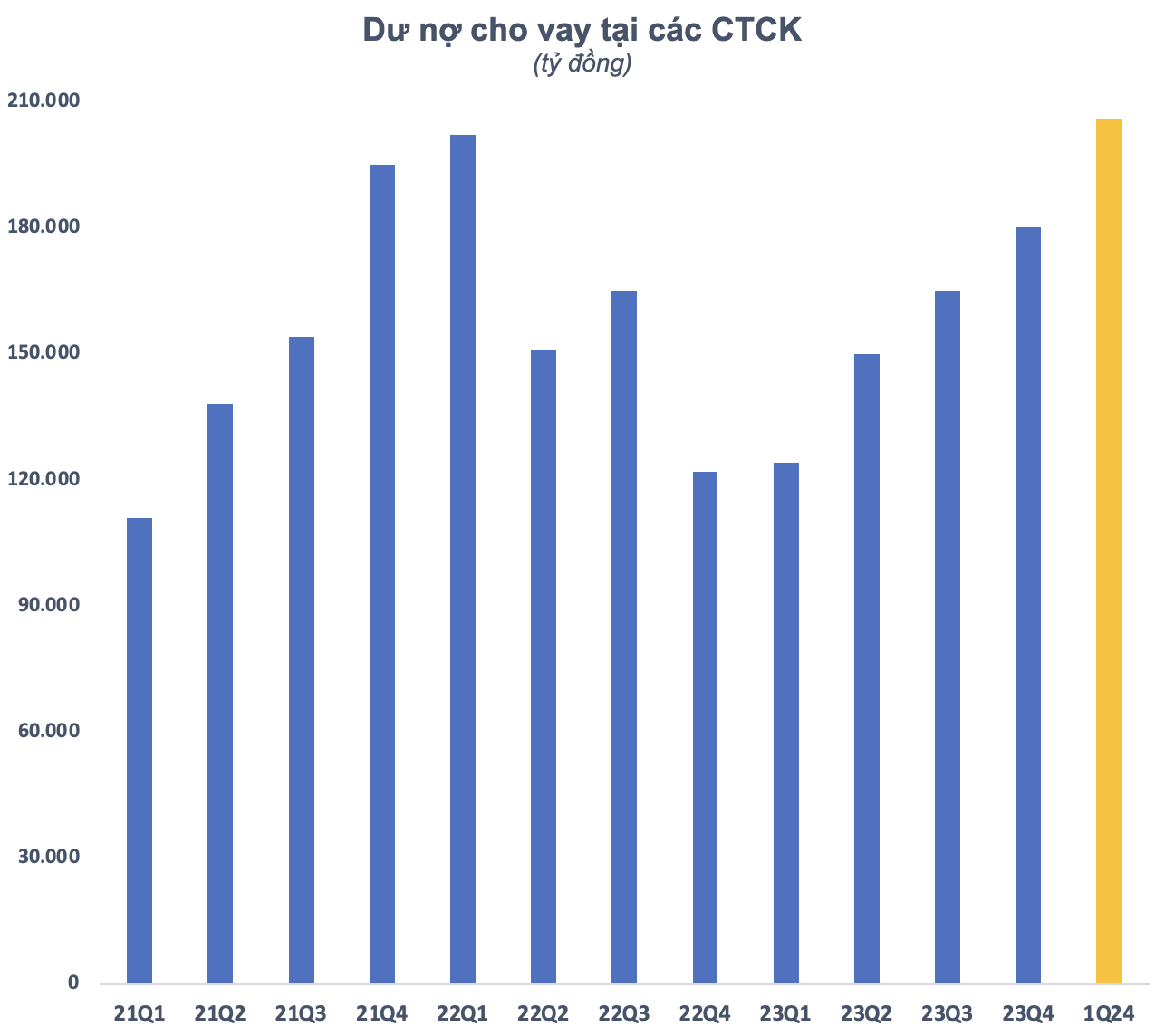

Regarding margin pressure, data from securities companies shows that estimated margin debt reached nearly 200,000 billion VND at the end of Q1/2024, an increase of 23,000 billion VND compared to the end of 2023. This is the highest level ever, even exceeding the margin debt level in early 2022 when the VN-Index peaked at 1,500 points.

With the current “margin strain,” Agriseco experts assess that the market’s correction may become more severe with the “margin call” effect from securities companies. In just the past week, the VN-Index has fallen more than 100 points, equivalent to an 8% decrease, and many stocks have fallen between 15-20% in just 1 week. If the market continues to decline, the “margin call” situation at securities companies will occur on a large scale, resulting in a sharp decline to reduce the current margin debt.

The bright spot is that after the recent sharp decline, market valuations and many stock groups have returned to more reasonable levels. Specifically, the VN-Index’s P/E valuation has fallen to 13.7 times, lower than the average of the past 5 years. In the context of businesses reporting strong growth in their first-quarter earnings on a low base, the market valuation may continue to decline and become more attractive to investors.

With many stocks returning to more attractive price levels after the market’s deep correction, Mr. Khoa recommends that investors consider increasing their allocation to the VN30 and blue-chip stocks in the upcoming sessions when selling pressure is balanced. Conversely, investors should gradually reduce their allocation and limit new disbursements for speculative stocks during the recovery and adhere to stop-loss discipline.

Mr. Bui Van Huy – Director of DSC Securities Branch recognizes that the market is heavily influenced by unpredictable global variables such as geopolitical tensions, inflation, interest rates, bond yields, and the strong rise of the Dollar. Domestically, there are also several negative factors such as inflation, rising interest rates, and especially the rapid exchange rate increase due to interest rate differentials and recent global developments.

However, Mr. Huy believes that exchange rate pressure under normal conditions will only lead to short-term corrections and not a bear market unless it creates a macroeconomic imbalance. A macroeconomic imbalance implies that the State Bank of Vietnam (NHNN) is no longer able to intervene with foreign exchange reserves or administrative measures, or must consider raising interest rates.

Nevertheless, the DSC expert believes that the market’s short-term concern is margin pressure: “The market will likely ‘pay the price’ for margin being at a record high, and a “margin call” could occur on Monday of next week.”

Although not overly optimistic, Mr. Huy believes that a 15-20% decline in the VN-Index is unlikely. The level around MA200, equivalent to 1,170 points, will provide strong support for this round of price decline. The stock market can only “break” the above level when domestic growth pillars are clearly breached, and global stock markets experience a severe decline.

With domestic pillars such as a low-interest-rate environment, monetary easing, economic recovery, and expectations for market and KRX upgrades, the current risk is only at a warning level and does not threaten a sharp reversal of monetary policy.

While there are still some other factors, the DSC expert believes they are not major concerns. Additionally, with banks still having the “game” of capital increases and stock splits, bank stocks still have room for recovery, and the VN-Index will find it difficult to decline significantly.

Regarding the action strategy, the DSC expert believes that when the market rises, everything looks good, and when it “falls,” everything looks bad. It is important to remain calm, assess the situation, and understand your own position before taking any action. For those who trade based on trends and want confirmation, waiting for the situation to improve before entering is essential, and there is clearly a risk of “catching a falling knife” at the moment. However, it is important to realize that when things become clearer, the valuation level will be higher. For those who act early and rely on speculation, Mr. Huy recommends a gradual disbursement around MA200 with an appropriate allocation.

Short-term investors should not rush to “buy the dip”

Mr. Tran Truong Manh Hieu – Head of Securities Analysis at KIS predicts that in the short term, the index could continue to correct towards 1,150 points, accumulate around this level, and then rebound. A further decline in the VN-Index is unlikely due to ongoing supportive market fundamentals.

Presenting his action strategy during this period, Mr. Hieu suggests that investors remain on the sidelines and observe: “Trying to buy the dip now is like ‘catching a falling knife.’ It is a dangerous move not suitable for most investors but only for professional investors. Notably, when the downward trend may continue and the risk remains high without confirmation of a market reversal, opening new buy positions could lead to significant losses. Therefore, buying when the market has established an uptrend will mitigate risk since even low-priced stocks can fall further.”.

Despite the short-term market risks, the KIS expert believes that investors should also consider the market’s long-term outlook. Accordingly, the market’s upward trend is still supported by macroeconomic factors such as Vietnam’s economic recovery, FDI inflows, and an expansionary fiscal policy.

Hence, this correction should be viewed as an opportunity to allocate funds for medium and long-term positions. The challenge lies in choosing the right time to invest. That moment may arise when the market shows signs of reversal or when substantial cash flow returns, indicated by a surge in liquidity.