Data from FiinTrade’s Q1/2024 financial report of 52 securities firms representing 94% of the industry’s equity ownership shows that the balance of margin lending reached nearly VND193.3 trillion at the end of Q1/2024, up 62.4% year-on-year and 11.2% compared to the end of 2023.

This margin balance has surpassed the previous peak set in early 2022. However, the correlation between Margin and some liquidity-related indicators is currently at a lower level than the peak period in 2022.

Specifically, the leverage ratio (Margin/Total capitalization ratio) is still on a slight downward trend at 7.5%, compared to 7.8% at the end of Q1/2024 and 8.8% at the end of Q3/2022.

The ratio of margin debt to average trading value decreased to 7.7 times at the end of Q1/2024 from 11.3 times at the end of 2023, thanks to significant improvement in liquidity.

The ratio of margin debt to total equity inched up to 0.87 times at the end of Q1/2024, from 0.75 times at the end of 2023. Although it has shown a gradual upward trend, it is still significantly lower than the 1.3x level of Q1/2022, thanks to the strong increase in equity capital of securities companies in recent times, providing them with more room to increase lending.

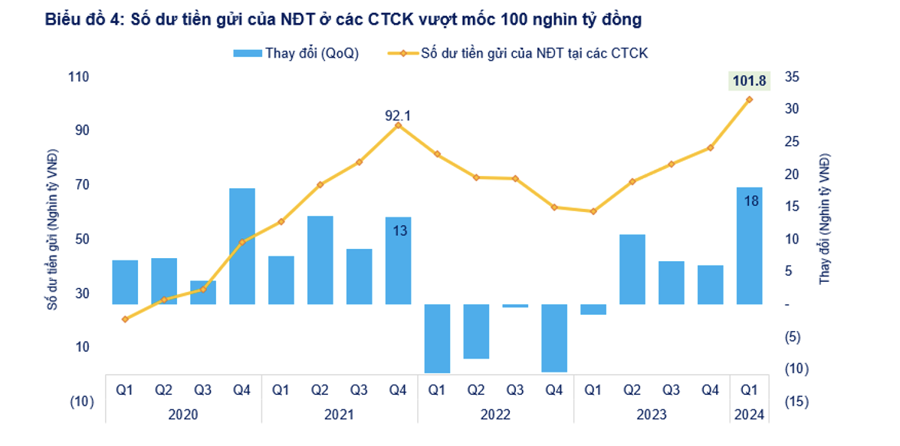

Investors’ cash deposits at securities companies also increased by more than VND21 trillion (+26%) compared to the end of 2023, reaching nearly VND100.8 trillion. This is the strongest quarterly increase in the past 5 years.

In the market, both supply and demand for margin are increasing. Specifically, with equity capital increasing by nearly VND40 trillion (+22%) since the beginning of 2023, securities companies have more room to increase capital for margin lending.

On the demand side, the number of new investors entering the market has continuously increased by approximately 1.68 million new accounts opened since the beginning of 2023, bringing the total number of individual investor trading accounts to over 7.63 million at the end of March 2024. In Q1/2024, individual investors bought a net VND15.8 trillion on HOSE, roughly equivalent to the additional margin increase of VND19.4 trillion in the same quarter. This is the fourth consecutive quarter of net buying by individuals.

Thus, although the scale of margin debt at the end of Q1/2024 is at its highest level ever, the ratios related to margin debt do not indicate a high-risk situation, as in early 2022.

Looking back at the end of Q1/2022, when the VN-Index was at its historical peak, the market showed many risk signals related to margin, including the margin debt reaching its peak, margin funding sources often being in a “tight” state with the ratio of margin debt to equity capital of over 1.2 times in many consecutive quarters, high leverage ratios, a sudden decrease of over VND10.7 trillion in investors’ cash deposits, and a sharp decline in liquidity. In fact, the pressure of “margin calls” appeared shortly after.

Last week, the VN-Index recorded its steepest decline in the past two years, falling 101.75 points or 7.97%. The number of stocks with a drop of more than 8% accounted for about 1/3 of the listed stocks on HOSE. This sharp and widespread decline could put pressure on accounts with high leverage if the market continues its correction trend this week.

Earlier, commenting on the margin figure, Mr. Nguyen The Minh, Head of Retail Research and Development at Yuanta Securities Vietnam, said that margin is not a cause for concern. The margin story is back, but the previous peak in 2021-2022 was when securities firms did not have much capital increase, their capital is now very high after the recent massive capital increase, so margin is not a concern, when the surplus is still comfortable.

Besides securities companies, margin is now also available from banks, investors can use their assets to borrow from banks at 6-8% interest rates, which is cheaper than margin, low interest rates are also a motivation to borrow margin from banks.