In the Economic Talk on Vietnam and the World in Q1-2024: “Identifying the Economy in Q1-2024: Paving the Way for the 2024 Economy” co-organized by Vietnam Economic Times and the University of Economics, National University of Hanoi, Dr. Nguyen Dinh Cung, former Director of the Central Institute for Economic Management Research, shared that after more than 30 years of witnessing economic reform and development efforts, the time has come when Vietnam’s economy is facing its most severe challenges.

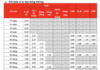

Specifically, the GDP growth rate in Q1-2024 was 5.66% compared to the same period last year, which is the highest growth rate in the same period in the 2020-2023 period. The added value of the entire industrial sector in Q1-2024 increased by 6.18% compared to the same period last year, contributing 2.02 percentage points to the total added value growth of the entire economy.

UNUSUAL FLUCTUATIONS IN THE “FIGURES”

However, the growth rate of the Industrial Production Index (IIP) for each month in Q1-2024 was not stable (January increased by 18.3%, February decreased by 6.8% and March increased by 4.1%). At the same time, the Purchasing Managers’ Index (PMI) for the manufacturing industry in March 2024 was below 50 points. “Therefore, I believe that the recovery of the economy in Q1-2024 is not sustainable,” said Dr. Nguyen Dinh Cung.

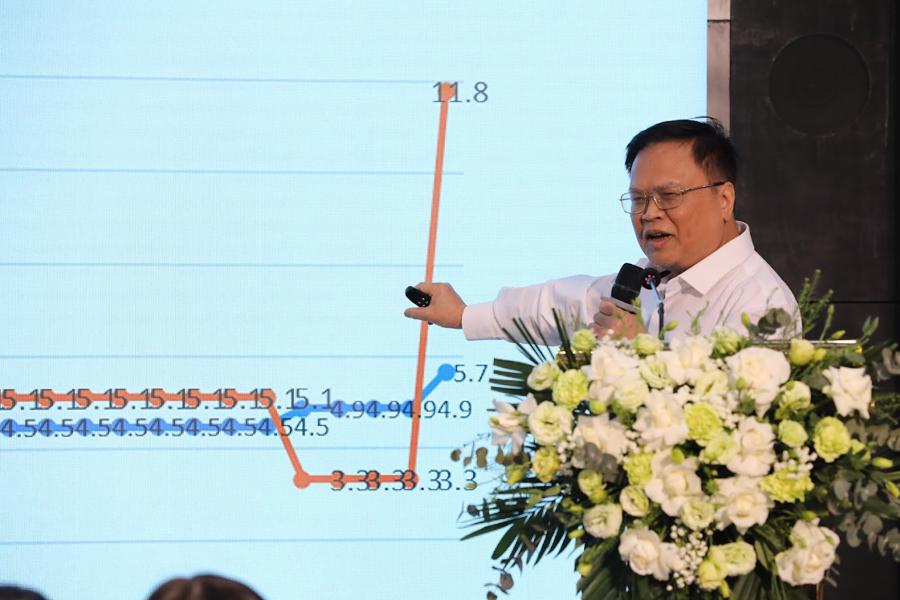

Another anomaly to note is the relationship between industrial production value and added value in the process of industrial production. Dr. Nguyen Dinh Cung expressed that in the period before the Covid-19 pandemic and during that time, the average growth of industrial production value was often higher than the average growth of industrial production added value, or the two indices would be stable at nearly the same level.

However, in 2023 and Q1-2024, the added value of industrial production far exceeded the industrial production value. “This makes me doubtful because wage and material costs have increased, while sales have not changed, but profits have increased,” said expert Nguyen Dinh Cung.

In addition, the ratio of enterprises entering the market and enterprises withdrawing from the market in Q1-2024 also recorded notable fluctuations. Specifically, in the period from 2018-2022, on average, for every four enterprises entering the market, only one enterprise withdraws from the market. However, from 2023 to Q1-2024, this ratio changed significantly when for every one enterprise entering the market, two enterprises will withdraw from the market.

According to information from the Department of Business Registration Management (Ministry of Planning and Investment), 36,244 enterprises registered to establish new in Q1-2024, an increase of 6.9% compared to the same period last year. However, in contrast to the number of newly registered enterprises, up to 73,978 enterprises withdrew from the market in Q1-2024, an increase of 22.8% compared to the same period last year.

Of the businesses that withdrew from the market, there were: 53,365 businesses temporarily suspending operations within a short time; more than 15.5 thousand enterprises suspending operations and waiting for dissolution procedures; 5.1 thousand enterprises completed the dissolution procedures, an increase of 10.1%. On average, more than 24 thousand enterprises withdrew from the market each month.

Thus, comparing the number of newly registered enterprises and returning to operation with the number of enterprises withdrawing from the market, in Q1-2024, the total number of enterprises in our country decreased by 14 thousand enterprises, with an average decrease of 4.7 thousand enterprises per month.

According to Dr. Nguyen Dinh Cung, the increase in the number of businesses withdrawing from the market in most sectors is a clear indication that enterprises and the economy are facing significant difficulties, and this situation raises many issues concerning the stability and development momentum of businesses. as well as the entire economy in the future.

MODERATE RECOVERY AND NO BREAKOUT

In the first quarter of 2024, the export value of goods was estimated at 93.06 billion USD, an increase of 17% compared to the same period last year, however, this growth rate was not significant and is likely to continue to go sideways in the near future. Dr. Nguyen Dinh Cung commented: If the export situation does not improve, the recovery of the industrial sector will be difficult, as the activities of Vietnam’s industrial production sector mainly depend on attracting foreign direct investment (FDI) and export activities. Therefore, if the export situation does not improve, it could put significant pressure on the development and stability of the Vietnamese economy.

The service sector has long been considered one of the main drivers of economic growth in Vietnam. However, since Q3/2022, the indices related to the service sector such as service growth, service growth at current prices and service growth excluding the deflating factor have undergone unforeseen fluctuations.

In Q1-2024, service growth reached only 6.12%, service growth at current prices reached 8.2% and service growth excluding the price factor reached 5.1%. This represents a new challenge to the stability and sustainable development of the service industry in Vietnam’s economy.

“The figures for the service sector are much lower than before the pandemic and are showing a downward trend because inflation may increase while people’s incomes are not increasing. When a growth driver of Vietnam’s economy is showing signs of erosion, the economy is unlikely to recover strongly,” emphasized Dr. Nguyen Dinh Cung.

Another issue of concern is that investment growth by economic components in Q1 has not yet recovered. Specifically, the growth rate of public investment is considered “out of breath” when it decreased from 21.2% in Q4-2023 to only 3.7% in Q1/2024; growth of social investment decreased from 6.2% to 5.2%; investment of state-owned enterprises and other sectors decreased from 5.4% to 4.2%; investment of the private sector increased from 2.7% to 4.2%; foreign direct investment increased from 6.2% to 8.9%. These results reflect the instability in investment and the difficulty of increasing investment in the key sectors of the economy.

Regarding the foreign direct investment capital (FDI) in Vietnam, according to figures from the Ministry of Planning and Investment, in the first quarter of 2024, more than 6.17 billion USD of FDI capital was registered in Vietnam, an increase of 13.4% compared to the same period in 2023. In that, the newly registered capital reached more than 4.77 billion USD, an increase of 57.9% compared to the same period last year; additional capital reached 934.6 million USD, a decrease of 22.6%; investment capital through capital contribution, share purchase reached more than 466 million USD, a decrease of 61.7% compared to the same period.

Overall, although the FDI capital figure in the first quarter of 2024 has increased, according to Dr. Nguyen Dinh Cung, this increase is not significant. He predicts that the total amount of FDI into Vietnam in 2024 will not exceed the 36 billion USD threshold. In addition, the investment scale of each FDI project, from 2015 to now, is lower than the average level of more than 30 years of attracting foreign investment in Vietnam.

The content of the article is published in Vietnam Economic Times No. 17-2024 issued on April 22, 2024. We invite our readers to read at here:

<