Credit Growth Remains Subdued in Early 2024 amid Economic Headwinds

Credit Growth Declines in First Two Months

Credit growth in the first two months of 2024 contracted across most sectors of the economy (Figure 1), with the exception of real estate and securities businesses. As of February 2024, credit to the real estate sector had increased by 0.23% and credit to the securities sector had risen by 2.56% compared to the end of 2023.

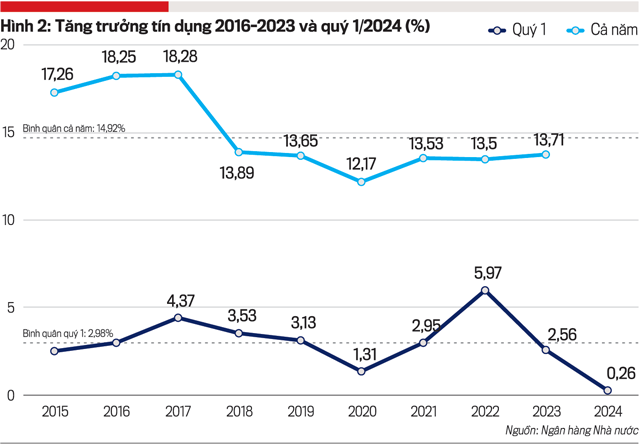

Average credit growth prior to the COVID-19 pandemic, during the period 2016-2019, stood at 16.3% per annum, significantly higher than the average growth rate of 13.2% per annum recorded during 2020-2023. However, excluding Q1 2020, when credit growth was suppressed to 1.31% due to social distancing measures, credit growth in the first quarters of 2021-2023 remained close to or even surpassed the average rate for the 2015-2024 period.

Data over the past decade indicate that Vietnam’s monthly and quarterly credit growth have never contracted compared to the previous year-end, although Q1 growth has consistently been lower due to seasonal factors. The economy’s expansion requires continued credit utilization.

Despite declining average lending rates, credit growth has not picked up as expected. The State Bank of Vietnam has stipulated average lending rates for new and outstanding loans held by commercial banks at a range of 7.8% to 10.1% per annum.

Average short-term VND lending rates for priority sectors are approximately 3.7% per annum, lower than the maximum short-term lending rate set by the State Bank of Vietnam (4% per annum).

The bank with the lowest average lending rate is VietinBank, at 6.3% per annum, while SaigonBank has the highest lending rate, at 9.9% per annum. The average lending rate across all commercial banks (excluding those that do not disclose information) is 7.9% per annum. In general, smaller banks tend to maintain a larger interest rate spread between lending and mobilization.

Bottlenecks to Credit Growth

Credit growth remained virtually stagnant during the first four months of 2024, despite lower interest rates, reflecting the challenges faced by businesses amidst ongoing global and domestic market uncertainties, as well as their ability to access capital.

Q1 2024 witnessed a gradual recovery in major global economies. In the US, GDP growth for Q1 2024 is projected to be 2.4% year-on-year, lower than the 3.2% growth recorded in Q4 2023 and the 2.5% achieved for full-year 2023, which was higher than the 1.9% growth rate in 2022.

In the EU, Q1 growth is forecast to be modest but improved compared to the 0% growth in Q4 2023, with major economies such as the UK and Germany recording negative growth of 0.3% in Q4 2023. This marks the sixth consecutive quarter of negative growth for the UK and Germany, dating back to Q1 2020.

In China, Q1 2024 GDP grew by 5.3%, with full-year 2023 growth projected at 5.2%, up from 3% growth in 2022. However, recovery across sectors remains uneven. Japan grew by 0.54% in Q1 2024, recovering from 0.1% growth in Q4 2023 and -0.8% in Q3 2023, escaping a technical recession.

Global Economy Faces Challenges

The global economy has encountered significant challenges in the first four months of 2024, largely due to intense strategic competition among major powers. Heightened geopolitical tensions between Russia and Ukraine, Israel and Hamas, and Iran have led to a surge in gold and energy prices in April 2024, with gold prices hitting record highs (USD 2,378 per ounce on April 18, 2024, the highest in history, with no signs of abating). The conflict in the Red Sea has also pushed up logistics costs from USD 750 to 6,800 per container (Suez Canal Authority).

According to the Vietnam Maritime Administration, current container shipping costs from Asia to Europe and the Americas are approximately 88% higher than pre-COVID-19 pandemic levels. Accordingly, freight rates from Vietnam to ports in the US West Coast region are USD 2,650 per 40-foot container, to ports in the US East Coast region are USD 3,900 per 40-foot container, and to Europe are USD 4,900 per 40-foot container. These developments raise concerns about potential disruptions to global supply chains, impacting inflation and central bank plans to pivot monetary policy.

The USD Index (DXY) ended Q1 2024 with a gain of nearly 3% and has increased by another 1-2 percentage points from its average of 104 points at the end of March 2024, after the Fed indicated that it would not initiate an interest rate cut cycle until at least June 2024 due to persistent inflation.

Amidst pressure from the strengthening US dollar, China’s renminbi (CNY) has depreciated to its weakest level in four years, as the People’s Bank of China’s (PBoC) efforts to maintain the currency’s value have proved ineffective. Lower-priced Chinese goods have triggered a race to the bottom among businesses, weakening the competitiveness of Vietnamese exports.

At the same time, slowing growth in China is dampening aggregate demand in a country that accounts for 17.6% of the world’s population. This poses challenges for Vietnam, given its export dependency and the reduced cost advantage of raw materials as consumer demand wanes.

In conjunction with declining exports, cheaper raw materials from China are increasing Vietnam’s imports. China’s excess supply is also driving growth in e-commerce, informal trade, and formal trade between the two countries. The influx of low-priced Chinese goods into the Vietnamese market is hurting the health of domestic businesses and causing Vietnamese companies to lose market share on their home turf.

Article published in Vietnam Economic Journal No. 17-2024, issued on April 22, 2024.

Readers are invited to access the full article here:

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam