The latest statistics from VnEconomy from more than 70 brokerage firms in the market show that, as of the end of March 2024, the balance of customer deposits reached more than VND 100,000 billion, mainly deposits of investors trading in securities through brokerage firms management. Compared to the end of 2023, the deposit balance has increased by more than VND 20,000 billion.

Thus, this is the fourth consecutive quarter that the balance of investor deposits at brokerage firms has increased compared to the previous quarter, and is also the highest level ever recorded.

With more than VND 100,000 billion, the deposit balance is equivalent to the period early 2022 when the VN-Index peaked at 1,528 points in January 2022. During this period, the balance of investor deposits at brokerage firms continuously maintained above the threshold. VND 90,000 billion and a record VND 100,000 billion, immediately after that, the amount of money poured into the market pushed liquidity to a record high of more than 2 billion USD, VN-Index reached the mark of 1,528 points twice in the first quarter of 2022.

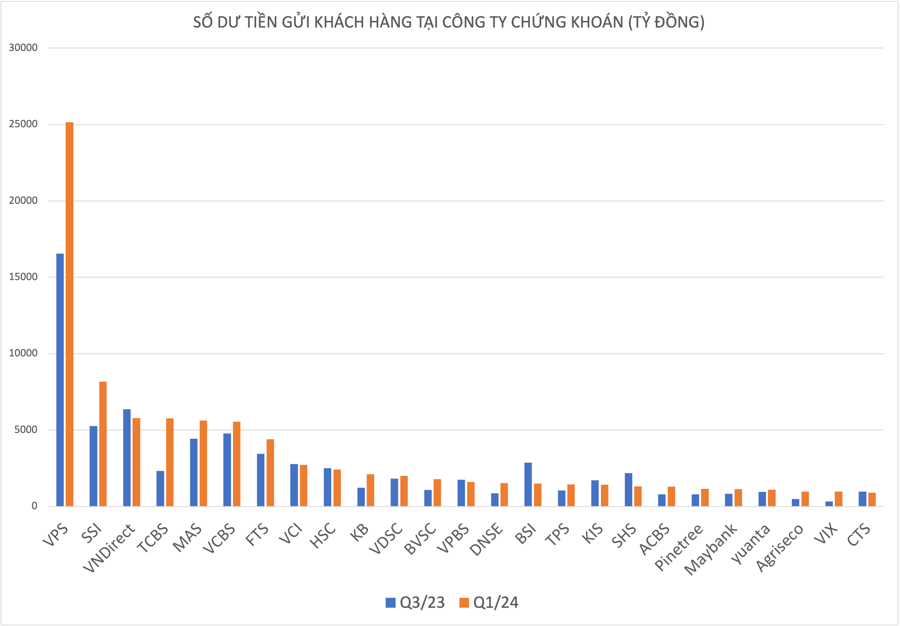

VPS is still the brokerage firm recording the highest customer deposit balance of VND 25,155 billion, a sharp increase of nearly VND 9,000 billion compared to the beginning of the year. Next is SSI with VND 8,175 billion, up nearly VND 3,000 billion; TCBS increased by VND 3,400 billion from the beginning of the year to VND 5,774 billion; similarly, MAS also increased by VND 1,200 billion compared to the beginning of the year; VCBS increased by nearly VND 1,000 billion.

Meanwhile, VnDirect securities went against the trend, decreasing from VND 6,366 billion at the beginning of the year to VND 5,784 billion. Currently, the anomaly at VnDirect can be mainly explained by the fact that this brokerage firm’s system was suddenly attacked in late March. The incident lasted nearly 2 weeks, affecting trading, the interests of investors, leading to the high possibility that a lot of money has been withdrawn to switch to other brokerage firms in the market.

The strong increase in deposits in the first quarter of 2024 is in line with the decrease in savings deposits in the banking system in the recent past. This means that a large amount of money has flowed from banks to the stock channel to seek profit opportunities. Total deposits at the end of March 2024 were 13.4 million billion, a decrease of 0.76% compared to the beginning of the year, close to 13.5 million billion. Of the 500,000 billion withdrawn from the banking system, in addition to securities, there were also investments in gold, real estate, digital currency, etc.

The increase in deposit balance is also in line with the high growth in the number of new individual investor accounts opened from the beginning of the year to the present. According to statistics from the Vietnam Securities Depository Center (VSD), the number of domestic investor accounts increased by 163,621 in March 2024.

In which, individual investors opened 163,524 new accounts, a 44.5% increase compared to March and the highest since November 2023. Meanwhile, corporate investors only increased by 97 accounts. As of the end of March 2024, Vietnam has more than 7.6 million individual securities accounts, equivalent to about 7.6% of the population.

Experts say that the pressure on interest rates mobilized is predicted to increase slightly by 0.3-0.5% from now to the end of the year, but it is not a concern for the securities market because the overall interest rate level is still very cheap.

Meanwhile, market valuation is at an attractive level. Mr. Le Anh Tuan, Director of Dragon Capital’s investment bloc, said that in terms of valuation, the P/E of 80 enterprises is at 11 times, and with an EPS growth rate projected to be at 18-19%, this valuation is relatively attractive, if looking at medium-term, ignoring short-term fluctuations.

P/B valuation is still around 1 time, which is the tolerance compared to the average of more than a decade. With this probability, it is extremely difficult for the market to decrease by 10-15-20%. When price corrections occur, think about investing sustainably in the medium and long term, not the time to leave the market.

“The market can correct by 10%, but a 15% correction should have a strong attitude towards speculation. If the credit rating upgrades happen, that would be extremely good, but even if it doesn’t happen, it is enough to show us that even if the stock market decreases, it is attractive for investment”, said Mr. Tuan.

Sharing the same view, Mr. Nguyen The Minh, Director of the Research and Development Division for individual customers of Yuanta Vietnam Securities, said that the most positive news now is still the attractive valuation because the market has been discounted enough, there has also been a large amount of money withdrawn in March-April and then disbursed again. “In essence, this year the cash flow will not stay out of the game for long and must return soon for many reasons such as reduced interest rates and real estate is not attractive enough to attract investment channels”, emphasized Mr. Minh.