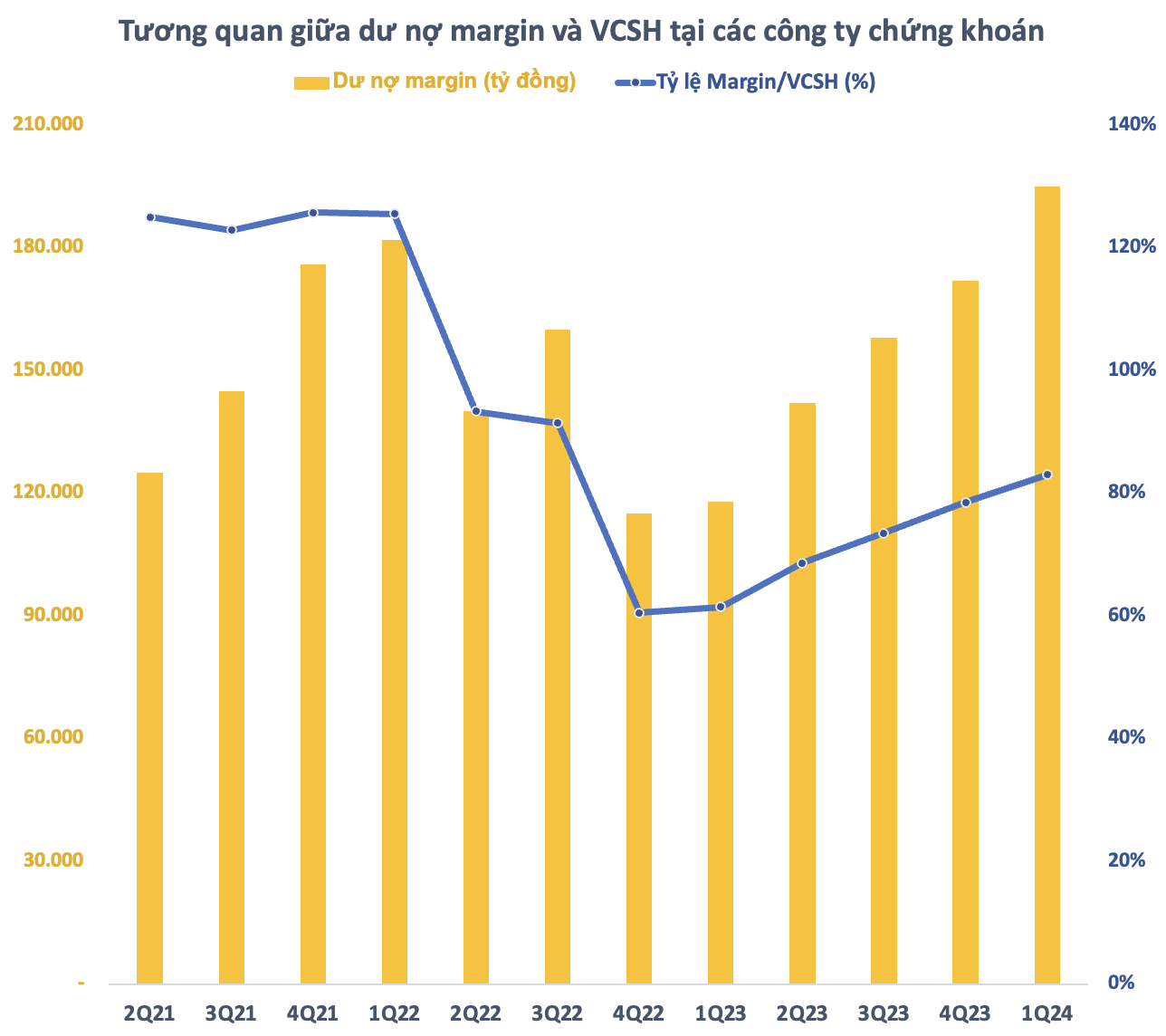

According to statistics, the outstanding margin loan balance at securities companies at the end of the first quarter of 2024 is estimated to have increased by VND 23,000 billion compared to the end of 2023, reaching approximately VND 195,000 billion. This is a record high in the history of the Vietnamese stock market, surpassing even the first quarter of 2022 when the VN-Index was at its historical peak of 1,500 points.

However, the equity of securities companies also increased sharply in the first quarter of the year thanks to strong profit growth and capital increase activities. As of March 31, 2024, the total equity of the group of securities companies was about VND 235,000 billion, an increase of VND 16,000 billion compared to the beginning of the year. Thus, the Margin/VCSH ratio at the end of 2023 was estimated to be approximately 83%, the highest in six quarters.

According to the regulation, securities companies are not allowed to lend on margin more than twice their equity at the same time. With the current Margin/VCSH ratio, it is estimated that securities companies can still lend up to VND 277,000 billion to investors on margin in the coming period. It should be noted that this figure is only a theoretical calculation and in practice the Margin/VCSH ratio of the entire market has never reached the threshold of 2 times, even during the most explosive trading period.

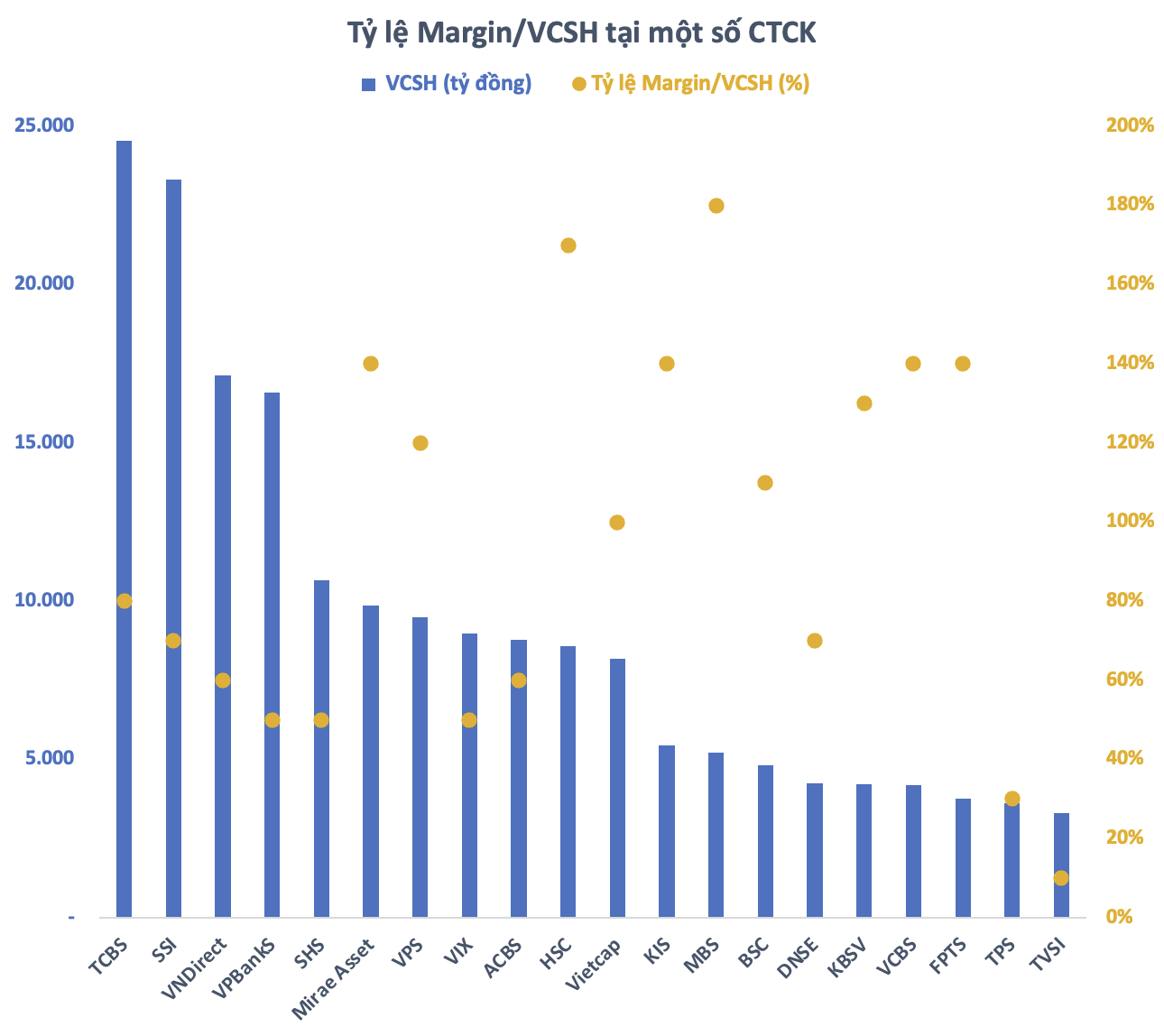

Looking at each securities company, most of them still have a lot of “room” to lend, with the Margin/VCSH ratio mainly ranging from 100-140%. In particular, the top names in terms of equity such as TCBS, SSI, VNDirect, and VPBankS all have this ratio below 80%. Meanwhile, only a few securities companies are in a fairly tight margin situation, such as HSC, MBS, which are also planning to increase capital this year.

Overall, if only serving margin lending activities, securities companies are not under too much pressure on capital at this time. However, in order to serve the market upgrade process, in the future, foreign investors may not need to deposit 100% before trading. This requires securities companies to have large capital resources, sufficient to ensure the role of supporting payments. Therefore, most securities companies have plans to increase capital in the 2024-25 period, in which some notable names include:

Vietcap (VCI) plans to offer more than 143.6 million private shares to domestic and foreign investors with financial capacity and professional securities investors. The offering price will not be lower than the book value at December 31, 2023, which is VND 16,849 per share. The minimum amount raised from the offering (VND 2,420 billion) will be used to supplement capital for margin lending activities (VND 2,100 billion) and proprietary trading activities (VND 300 billion). In addition, Vietcap also plans to issue 132.5 million bonus shares (ratio 10:3) and issue 4.4 million ESOP shares at a price of VND 12,000 per share.

Similarly, MBS will also offer more than 109.4 million shares to existing shareholders (exercise ratio is 4:1). The offering price is VND 10,000 per share. In addition, this securities company plans to offer a maximum of more than 28.7 million shares to less than 30 professional securities investors in accordance with legal regulations, in order to supplement resources for business activities.

Previously, shareholders of SSI also approved the plan to issue 453 million shares to increase charter capital from equity. In which, SSI will issue 302 million bonus shares with a ratio of 100:20 and offer 151 million shares to existing shareholders at a price of VND 15,000 per share, ratio 100:10. If completed, SSI’s charter capital is expected to increase to VND 19,645 billion, continuing to be the champion of charter capital in the securities group.

VNDirect also plans to offer nearly 244 million shares to existing shareholders in the ratio of 5:1, with an offering price of VND 10,000 per share. At the same time, it will distribute dividends in the form of shares at a rate of 5%, corresponding to the issuance of nearly 61 million new shares. If both of the above plans are successful, VND’s charter capital will be increased from VND 12,178 billion to nearly VND 15,223 billion. The implementation time within 2024 after obtaining the approval of the State Securities Commission (SSC).

In the 2024 strategy report, SSI Research stated that, except for a small number of securities companies that increased capital to restructure their corporate bond portfolio, the capital increase will expand the margin lending capacity of these companies and maintain a healthy balance sheet, as well as meet the capital safety requirements set by the State Securities Commission (SSC).

The capital increase race is expected to continue to strengthen the capital base of securities companies in the coming period. According to SSI Research, the current Margin/Market Capitalization ratio is high, but the possibility of a repeat of the broad-based deleveraging scenario as in late 2022 is unlikely if we look at the Margin/VCSH ratio of the market (which is well controlled).