Leveraging its strong and trusted brand, VIB has also carried out many hi-tech and digital transformation projects to enhance its service capacity, thereby offering the very best customer experiences.

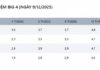

Revenue maintains stable growth, industry-leading profitability

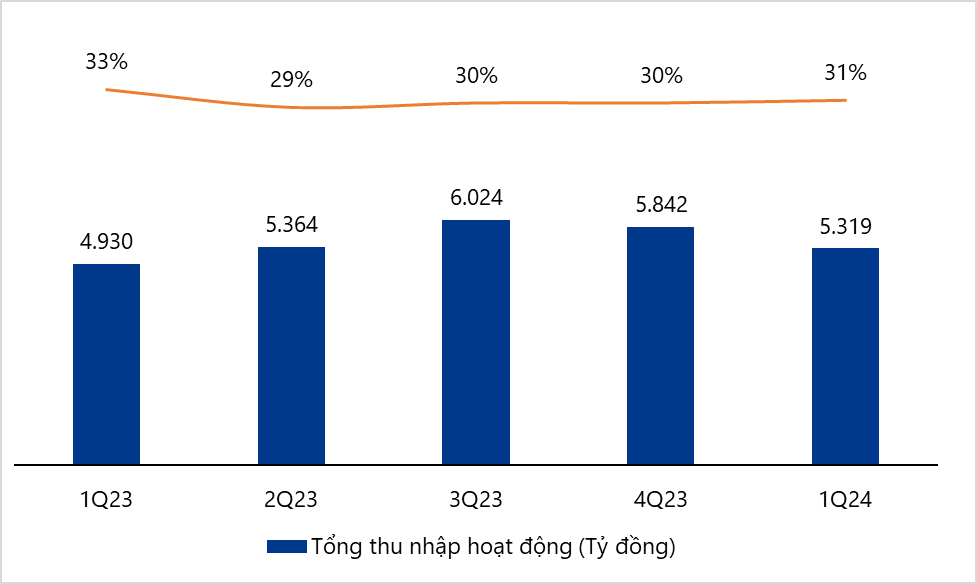

At the end of the first quarter of 2024, VIB recorded pre-tax profit of over VND2,500 billion, with total operating income reaching VND5,320 billion, an 8% increase year-on-year. Non-interest income accounts for nearly 25% of revenue, with positive contributions from credit cards, foreign exchange and income from loans with settled risks.

The bank maintains a net interest margin (NIM) of 4.5% in the context of both deposit interest rates and loan interest rates decreasing significantly. Operating expenses are well-controlled, helping the cost-to-income ratio (CIR) stay at around 30%, among the lowest for retail banks with the highest cost management efficiency. Consequently, the bank’s pre-provision profit reached over VND3,440 billion, a more than 2% growth year-on-year.

With the general market context and seasonality in the first quarter, VIB’s NPL ratio temporarily increased from 2.2% to around 2.4%. However, the bank has actively increased its provision buffer by allocating provisions for risk up to nearly VND950 billion in the first quarter, an increase of more than 40% year-on-year. For the whole first quarter, VIB reported a pre-tax profit of over VND2,500 billion, with this profit, the bank can maintain its ROE at 24%, continuing to generate industry-leading profitability.

Solid asset summary table, industry’s lowest concentration risk

VIB’s total assets reached VND414,000 billion at the end of March 2024, a 1% increase compared to the beginning of the year. In terms of credit growth, in the context of interest rates remaining at the lowest level in many years, the real estate market, consumption and investment gradually warming up have helped VIB’s credit increase by 1% compared to the beginning of the year.

VIB continues to be one of the banks with the lowest concentrated credit risks in the market, with retail lending accounting for 85% of the total loan portfolio. Notably, over 90% of loans are secured by assets, mainly residential and land with sufficient legal documentation and good liquidity.

VIB also has the lowest outstanding corporate bond balance in the industry, accounting for only 0.2% of total outstanding credit. All bonds belong to the manufacturing, trade and consumer sectors. For over four years, outstanding loans for activities and sectors such as BOT, renewable energy, corporate bond underwriting and real estate bond investment have all been zero.

As of the end of March 2024, VIB’s mobilized capital reached over VND360,000 billion, including customer deposits, commercial paper, and mobilization from international institutions such as IFC, ADB. Notably, with the successful disbursement of a USD100 million loan from IFC and the largest syndicated loan in the banking industry in 2023 of USD280 million from UOB and 12 leading financial institutions worldwide, VIB’s total international mobilization currently amounts to over USD1.1 billion, with a credit limit from these organizations of over USD2.5 billion.

Capital management and optimization activities through strategies to attract individual customers with attractive deposit products and integrate with the MyVIB digital banking app, along with establishing a position and reputation in the international capital market, have helped VIB to reduce mobilization costs by more than 2% year-on-year, thereby creating more room to lower lending rates, supporting customers and stimulating credit demand.

Highest industry rating from the State Bank of Vietnam for optimal safety ratio management and pioneering international standards

At the end of 2023, VIB received the highest industry rating from the State Bank of Vietnam thanks to its high business efficiency, safety in both quantitative and qualitative terms. As a result, VIB is also among the group of banks granted a 16% credit growth limit for 2024, the highest in the industry.

Safety ratios are optimal, with the loan-to-deposit ratio (LDR) at 71.89% (regulated below 85%), the short-term capital ratio for medium- and long-term loans at 25.31% (regulated below 30%), the capital adequacy ratio (CAR Basel II) at 11.8% (regulated above 8%) and the stable funding ratio according to Basel III (NSFR) at around 116% (the minimum requirement of Basel III is 100%).

VIB’s brand reputation is also tied to its pioneering role in applying international standards in Vietnam. In 2019, VIB became the first Vietnamese bank to successfully implement the three pillars of the Basel II risk management standard. By August 2023, VIB was once again selected by the State Bank of Vietnam along with nine other commercial banks to participate in the Steering Committee for Enhanced Basel II and Basel III standards. At the same time, VIB and another joint-stock commercial bank completed and issued audited reports under International Financial Reporting Standards (IFRS) since 2019, six years ahead of the Ministry of Finance’s plan.

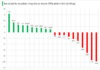

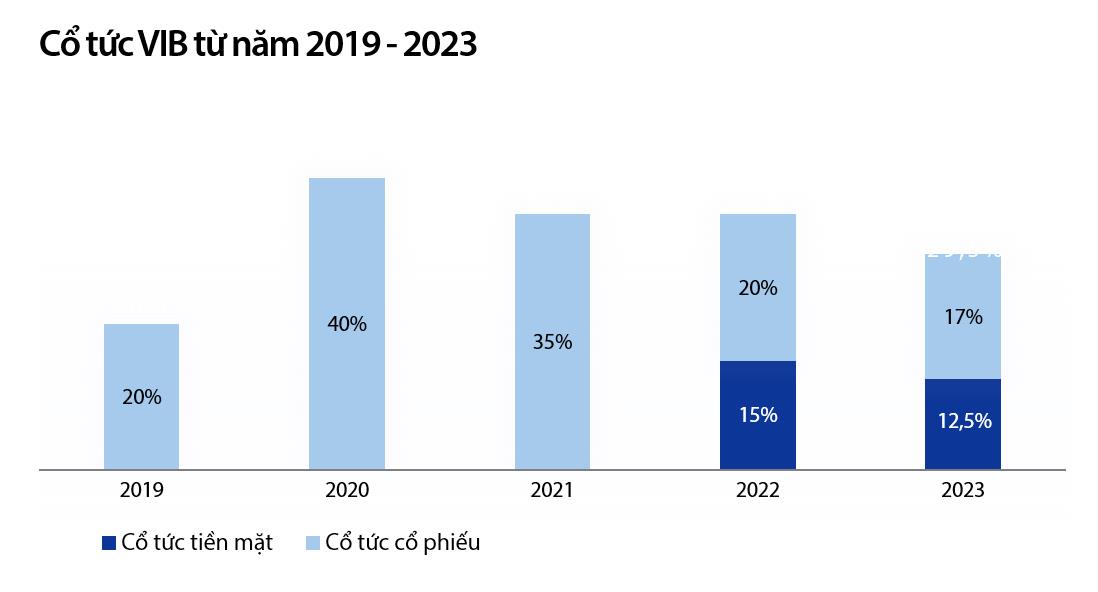

Dividend payout of 29.5% on equity and high capital adequacy ratio

In April 2024, VIB’s General Meeting of Shareholders approved a dividend payment plan of 29.5%, including 12.5% in cash dividends and 17% in stock dividends. In early January 2024, the bank completed the distribution of 6% cash dividends. VIB is currently in the process of paying 6.5% cash dividends and 17% stock dividends to shareholders, along with 11 million stock dividends to employees (ESOP).

Chart: VIB’s dividend rate 2019 – 2023

With a return on equity (ROE) that has been among the highest in the industry for many consecutive years, VIB has stable retained earnings, contributing to supplementing equity to improve and ensure capital safety, serving the bank’s growth plan while maintaining attractive cash dividends, ensuring long-term and sustainable benefits for shareholders. After paying 6% cash dividends in January, the bank’s capital adequacy ratio (CAR Basel II) remained high, reaching around 11.8% as of March 31, 2024, and is expected to remain at 11%-12% in 2024, compared to the State Bank of Vietnam’s minimum requirement of 8%.

Continuing to invest heavily and pioneering in technology infrastructure and information security

With a consistent strategy focused on its customers, throughout its digital transformation and digital transition, VIB has pioneered in applying new technologies and building value chains to offer its customers better experiences. As a result, over the past year, VIB has witnessed a remarkable growth with the number of digital banking transactions increasing by more than 100% year-on-year and currently reaching a 96% transaction rate through digital channels. To