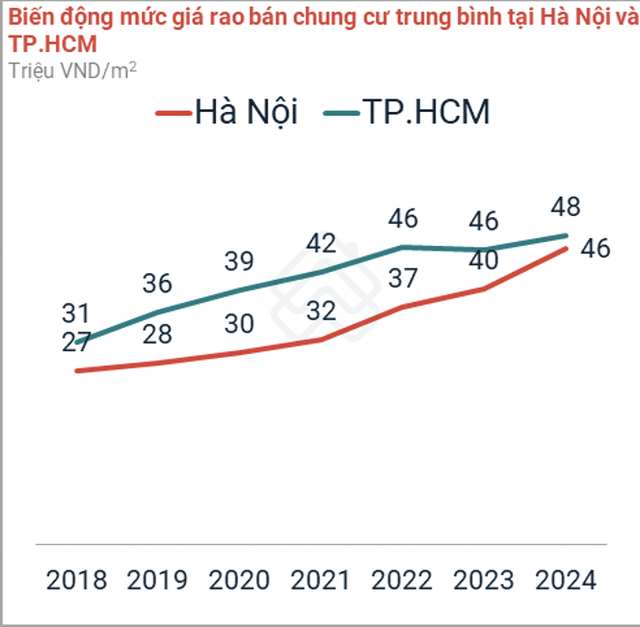

According to the first quarter of 2024 real estate market report by PropertyGuru Vietnam, after 6 years, the average price increase of apartments in Hanoi has reached 70%. Specifically, apartments in Hanoi have an average price of VND 46 million/m2, while the price of apartments in Ho Chi Minh City is VND 48 million/m2. Meanwhile, at the beginning of 2018, the asking price for apartments in Hanoi and Ho Chi Minh City was only VND 27 million and VND 31 million/m2.

Data from PropertyGuru Vietnam.

According to the first quarter of 2024 report by the Vietnam Association of Realtors (VARS), for the housing segment, the supply in the first quarter of 2024 reached 20,541 products, including 4,300 completely new products, and the rest are inventory from previous opening phases. Many real estate projects have started construction simultaneously, with a scale of tens of thousands of hectares, to billions of USD, and many real estate businesses have also started to stir with a plan to “release products”.

In terms of transactions, in the quarter, there were 6,200 transactions, an increase of 8% compared to the fourth quarter of 2023 and double that of the same period last year. The absorption rate continued to improve, reaching nearly 31%, an increase of 5% compared to the fourth quarter of 2023 and 19% compared to the same period last year. Apartment projects with prices below VND 50 million/m2 are almost “sold out”, while apartment projects in the luxury segment have slower absorption.

According to CBRE statistics, in Hanoi, most of the new supply continues to be in the high-end segment, which has pushed up the primary selling price of apartments in Hanoi. The average primary selling price in Hanoi is currently VND 56 million/m2 (excluding VAT and maintenance costs), an increase of 5% quarterly and 19% annually.

In particular, the selling price in the secondary market of Hanoi apartments in the first quarter recorded the highest annual increase ever, up 17% compared to the same period last year and reaching an average of over VND 36 million/m2. Strong growth was recorded in almost all districts of Hanoi and concentrated in the western districts where the current supply is abundant and the population is dense.

According to Cushman & Wakefield, from 2014 to 2023, the selling price of apartments in Hanoi increased by 109%, an average of 9%/year. In Ho Chi Minh City, the price of apartments increased by 158%, an average of 11%/year.

“The average primary price has been increasing continuously for the past 10 years despite market fluctuations,” the unit emphasized.

It can be seen that in the recent past, the price of apartments has increased sharply, making it difficult for many people to own a house. According to the latest report by Numbeo.com (a website specializing in statistics on the cost of living in cities and countries around the world through surveys), the average house price in Vietnam in 2024 is nearly 24 times the average annual income of a household.

Dr. Le Xuan Nghia – a member of the National Financial and Monetary Policy Advisory Council, said that the house price increase rate is too great. Mr. Nghia admitted that the house price is too high, making it difficult for people to own a house: “Currently, there are new apartment projects with prices of up to VND 280 million/m2, projects with prices of VND 100-120 million/m2 are normal. With this price, I myself cannot afford to buy it!”

Faced with the high house prices in the recent past, the Ministry of Construction recently sent a document requesting the Hanoi People’s Committee to inspect and review the real estate trading activities of businesses, investors, trading floors, and brokers, especially apartment projects with abnormal price increases.