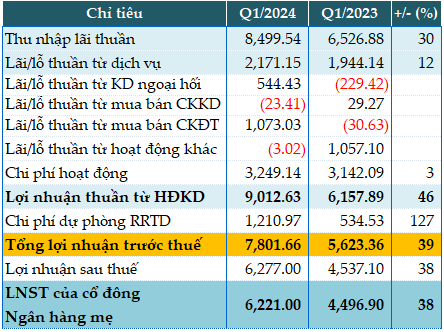

In the first quarter, the bank’s credit income increased by 30% compared to the same period, reaching nearly VND 8,500 billion.

Non-interest sources have diversified. Service income increased by 12% to over VND 2,171 billion, thanks to higher income from payment services, cash, and brokerage services for securities trading.

Foreign exchange business earned a profit of over VND 544 billion, while in the same period last year, it had a loss of over VND 229 billion. Notably, the buying and selling of investment securities earned a profit of over VND 1,073 billion, compared to a loss in the same period last year.

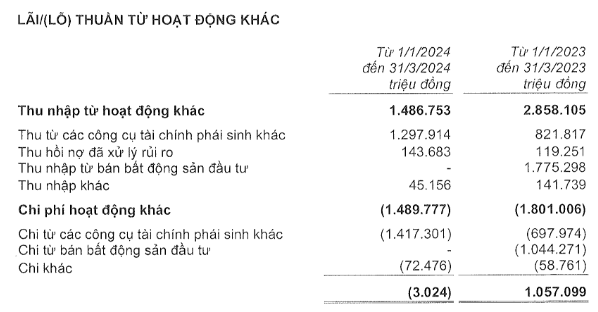

On the contrary, other operations lost over VND 3 billion, while in the same period, they earned a profit of VND 1,057 billion, as this period did not record VND 1,775 billion of income from the sale of investment real estate.

During this quarter, Techcombank set aside nearly VND 1,211 billion for credit risk provision, 2.3 times higher than the same period last year. Despite this, the bank’s pre-tax profit was nearly VND 7,802 billion, an increase of 39%.

Compared to the pre-tax profit plan of VND 27,100 billion set for the whole year, Techcombank has achieved nearly 29% after the first quarter.

|

TCB’s Q1/2024 Business Results. Unit: Billion VND

Source: VietstockFinance

|

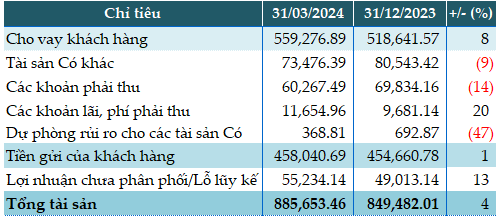

As of the end of the first quarter, the bank’s total assets increased slightly by 4% compared to the beginning of the year, to VND 885,653 billion. Of which, deposits at the SBV decreased by 50% (to VND 13,587 billion), credit granted to other commercial joint stock banks decreased by 32% (to VND 16,384 billion)…

In terms of capital sources, government and SBV debts recorded nearly VND 939 billion, only VND 131 million at the beginning of the year; deposits from financial institutions increased by 51% (VND 76,496 billion); customer deposits remained unchanged at VND 458,040 billion…

|

TCB’s Financial Indicators as of March 31, 2024. Unit: Billion VND

Source: VietstockFinance

|

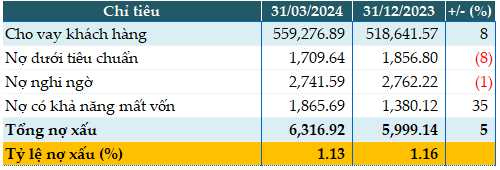

Total bad debts as of March 31, 2024 were VND 6,317 billion, a slight increase of 5% compared to the beginning of the year. However, the quality of loans has shifted towards potentially lost loans, increasing by 35%. The ratio of bad debts to outstanding loans decreased slightly from 1.16% at the beginning of the year to 1.13%.

|

TCB’s Loan Quality as of March 31, 2024. Unit: Billion VND

Source: VietstockFinance

|