VN-Index has just experienced its worst weekly decline globally, losing crucial support levels. Market sentiment has shifted from “greed” to “fear” in just 2 weeks.

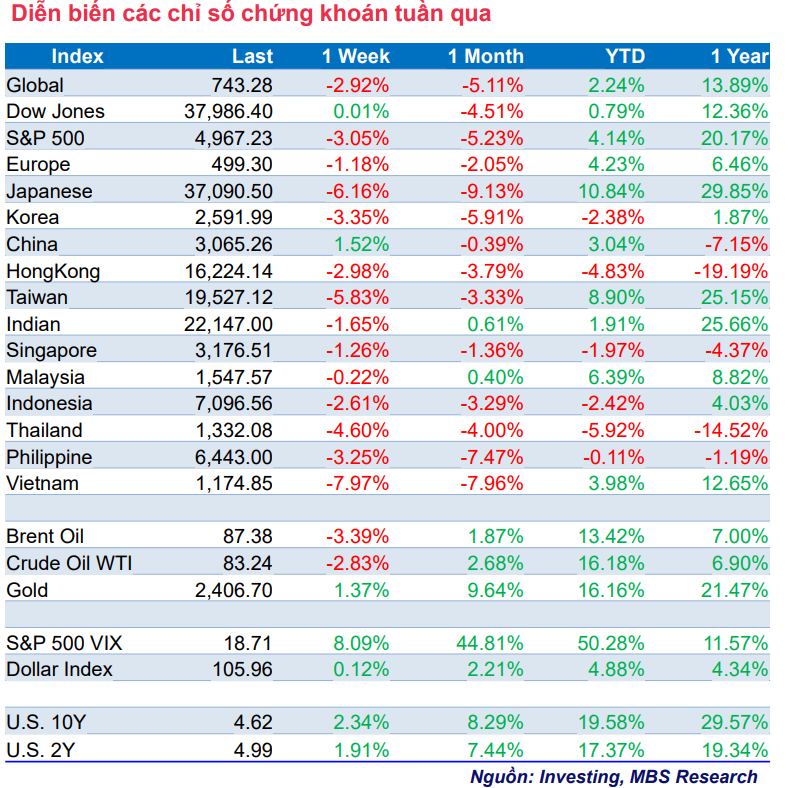

The VN-Index fell by -101.75 points (-7.97%) last week, closing at 1,174.85 points. According to statistics, VN-Index also had the sharpest decline globally last week and recorded its steepest drop since October 2022.

The Midcap group suffered the most significant decline during the week (-10.29%), while the Smallcap group also fell by 8.53%. In contrast, the VN30 group, which has a high weight in bank stocks, declined less (- 7.06%). Many stock groups fell more than the VN-Index, with some groups losing 12-15%. Several stock groups have lost their gains since the beginning of the year.

Overall market liquidity increased by 40% compared to the previous week to 30,075 billion VND, with liquidity through order matching also surging by 50% to 27,557 billion VND. According to statistics, liquidity in Q1/2023 reached 23,723 billion VND, more than double the same period last year. Since the beginning of April, liquidity has reached 26,540 billion VND, a decrease of 10.8% compared to March.

Foreign investors were net sellers of 1,468 billion VND last week, marking the 7th consecutive week of net selling. Year-to-date, foreign investors have net sold 16,024 billion VND, with selling pressure mainly concentrated on the HOSE exchange at 18,725 billion VND.

During the week, real estate stocks led the decline, with liquidity increasing dramatically. Except for QCG, which unexpectedly increased by 23.45%, many real estate stocks fell by 18-20% during the week, including CEO (-21.33%), DXG (-21.21%), PDR (-18%), NVL (-18.36%), DIG (-18.45%),…

Financial services and securities industry stocks also experienced significant declines, such as: BSI (-20.70%), FTS (-18.70%), VDS (-17.31%), VIX (-16.41%)… Most banking stocks also faced strong selling pressure, including CTG (-11.98%), TPB (-11.23%), NVB (-10.68%), BID (-9.46%)… Several stock groups have erased their gains from the beginning of the year, such as: public investment, real estate, electricity generation and distribution, and industrial real estate.

According to analysts at MB Securities (MBS Research), in the short term, the market is being oversold, and this could lead to a quick rebound. However, the risk of volatility remains high due to factors such as pressure from exchange rates and the average decline in several stock groups by 12-15%, which is putting pressure on investors to adjust their positions.

Technically, the VN-Index has broken through the 200-day MA support level at 1,176.53 points and the 200-week MA at 1,181.67 points. Combined with the RSI indicator entering the oversold zone, MBS Research expects the market to have a technical rebound in the support zone of 1,150 – 1,180 points.

With oil prices continuing to hover around USD 90 per barrel and the US dollar strengthening by 4.88% against a basket of currencies this year, analysts recommend that investors pay attention to oil and gas stocks, securities, and stocks that benefit from exchange rates.

Sharing a similar view, Yuanta Securities Vietnam (YSVN) believes that the market may recover during the first trading session of the week, and the VN-Index could return to the 100-session moving average (i.e., 1,190 points). Meanwhile, technical indicators have fallen deeply into the oversold zone, and the short-term psychological indicator suggests that the market may soon experience a technical rebound in the coming trading sessions. Furthermore, the 1,160 – 1,165 point zone is considered an important support level for the VN-Index, indicating that short-term risks have gradually decreased.

“The short-term trend of the overall market remains bearish. Therefore, we recommend that short-term investors limit selling at this stage and monitor market developments. Simultaneously, if investors have a high risk tolerance and a high cash ratio, they should consider investing with a low weight to explore the short-term trend,” YSVN analysts advise.

Global stocks have corrected for the second consecutive week amid the prospect of higher interest rates persisting for longer, while geopolitical conflicts pressure stock prices. Several stock markets in the Asian region have erased their gains since the beginning of the year, such as: South Korea, Hong Kong (China), Indonesia, Thailand, Singapore, and Japan.

A series of disappointing inflation data has forced policymakers at the US Federal Reserve (Fed) to reconsider the number of rate cuts and reassess the trajectory of price growth. Investors even predict that the Fed may not cut rates until 2025.

Gold prices completed their fifth consecutive week of gains despite downward pressure from the prospect of higher interest rates for longer. At one point, gold prices rose to near USD 2,420/ounce. The driving force behind gold’s upward trend is demand for safe haven assets due to geopolitical risks and central banks continuing to buy the precious metal for their national reserves.

Oil prices fell sharply last week, with Brent crude futures losing the USD 90/barrel mark (a 3.4% decline). Essentially, oil prices have given up all the risk premium after Israel attacked the Iranian consulate in Syria earlier this month – an event that led to an Iranian retaliatory strike on Israel, followed by an Israeli counterstrike on Iran on April 19.