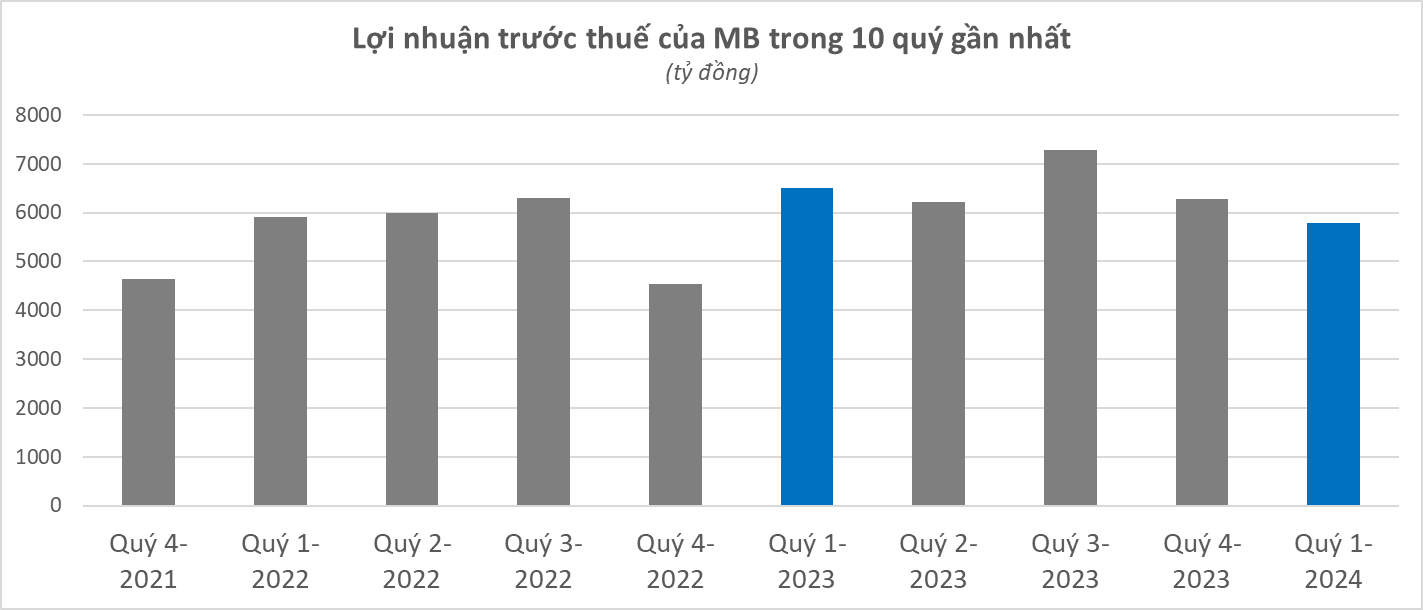

The bank’s consolidated pre-tax profit in Q1/2024 reached VND 5,795 billion, down 11% compared to the same period in 2023. In which, pre-tax profit of the parent bank was VND 5,258 billion, down 10%.

The main reason for the profit decline was due to poor performance of core business activities and the bank’s increased provision for bad debts.

The bank’s net interest income in Q1 was only VND 9,062 billion, down 11.4% year-on-year. Meanwhile, non-credit business segments performed well.

Specifically, net interest income from service activities in Q1/2024 of the bank reached VND 945 billion, up 37% compared to the same period. Interest income from foreign exchange trading reached VND 461 billion, up 24.5%. Interest income from trading in securities for trading reached VND 965 billion, 26 times higher. Interest income from trading in investment securities reached VND 217 billion, up 61%.

MB’s total operating income in Q1/2024 was VND 12,017 billion, slightly up from the same period last year at VND 11,930 billion. Operating expenses decreased by 1.5% to VND 3,514 billion. Accordingly, net income from operating activities increased by 1.7% to VND 8,502 billion.

However, MB’s risk provision expenses increased significantly by 46.4% to VND 2,707 billion. The increase in provision charges led to a decrease in pre-tax profit compared to the same period.

As of March 31, 2024, MB’s total assets were VND 900,647 billion, down 4.7% compared to the beginning of the year, mainly due to a sharp decrease of 83% in deposits at the State Bank to more than VND 10,800 billion. MB’s loans to customers increased slowly by only 0.7% in the first 3 months of 2024. Although previously, in 2023, MB was one of the banks with the highest credit growth rate (increased by nearly 29%).

Regarding loan quality, bad debts at MB increased by 56% in 3 months to VND 15,294 billion. Accordingly, the ratio of bad debt to outstanding loans increased from 1.6% to 2.49%.

Customer deposits at MB decreased by 1.5% in Q1 to VND 558,826 billion. The CASA ratio decreased from 40.2% (end of 2023) to 36.6% (end of March 2024).

Recently, at the Annual General Meeting of Shareholders on April 20, MB approved the business plan for 2024 with the target of pre-tax profit growth of 6-8%. In terms of total assets, the bank set a target of 13% growth, equivalent to nearly 1,068 trillion VND by the end of 2024, becoming the next bank to surpass the 1,000 trillion VND mark after the Big4 group. Credit is forecasted to grow by 15-16% in 2024, depending on the limit set by the State Bank of Vietnam (SBV). Mobilization in 2024 will depend on the demand for capital use.

In terms of indicators such as ROE, ROA or CIR, the bank is expected to be among the top in the industry. By the end of 2024, MB will reach 30 million customers and will achieve the milestone of 40 million customers by 2029.