FTX Digital Markets Limited (“FTX Digital Markets”) is the licensed and principal entity for the international FTX platform. FTX Digital Markets has successfully negotiated a landmark settlement agreement with FTX Trading Ltd. and its affiliated debtors (collectively, “FTX Debtors”) pursuant to Chapter 11 proceedings.

This will see assets pooled from FTX Debtors’ assets and FTX Digital Markets, while allowing for a coordinated approach to distribution to the creditors, ensuring that customers of FTX.com in both proceedings receive fundamentally identical distributions at substantially similar times. Thus, the project encourages creditors and customers to submit claims for their assets’ compensation.

FTX Digital, primarily based in The Bahamas, is registered to provide exchanges between digital assets and traditional fiat currencies, along with exchanges between one or more different forms of digital assets.

On November 10, 2022, the Securities Commission of The Bahamas filed a lawsuit against FTX Digital Markets Ltd. and suspended the company’s license to operate as a digital asset business. FTX Digital is a subsidiary of FTX Trading Ltd, a company incorporated in Antigua and Barbuda.

Furthermore, there is a specific website dedicated to the interests of FTX Digital’s stakeholders, such as customers and employees, and occasionally provides relevant information and updates from the Joint Official Liquidators relating to FTX Digital and the Bahamian liquidation proceedings. No party should access this website for information regarding the Chapter 11 Bankruptcy Proceedings.

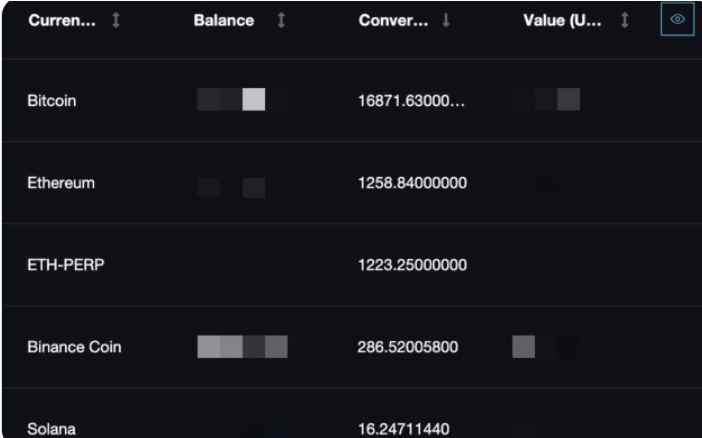

However, according to multiple leaked sources, the compensation amounts for major assets such as Bitcoin, ETH, etc. are significantly lower than the current market value (only about 20-30% of the current price). This has sparked much controversy as the payout is deemed too low and appears to be coercive.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)