Lacking experience in borrowing from banks, some individuals perceive it as a risky decision and worry about enduring high-interest rates with stringent loan conditions. However, many individuals and families opt for bank loans after thoroughly researching and understanding key techniques.

Mortgaging an apartment to purchase it

Instead of purchasing an apartment in installments and making payments as the project progresses, many families currently choose to buy an apartment building with a sổ hồng (property ownership certificate) and get a mortgage using the apartment as collateral. Although the price of apartments in the secondary market is higher than in the primary market, this mode of purchase is preferred by many homebuyers due to the legal security of the apartment and the immediate satisfaction of their family’s housing needs.

Speaking at a recent stock market seminar, Mr. Pham Anh Khoi, Chief Economist at Dat Xanh Real Estate Services Joint Stock Company, reported that the segment with the highest number of transactions is apartments, with transactions of 3 billion or less being common in Ho Chi Minh City. Hanoi is experiencing a small surge, with prices fluctuating daily. This is a noteworthy signal, considering the market’s continuous supply shortage in recent years.

Recognizing the market trend, VIB (Vietnam International Bank) has launched a credit package that provides homeownership opportunities for clients who choose to mortgage apartments with sổ hồng, covering thousands of apartment projects in Hanoi, Ho Chi Minh City, and nearby regions.

Selecting a loan package with a low, long-term fixed interest rate

If, a few months ago, many people seeking bank loans to buy apartments for personal use were concerned about preferential interest rates available only during the initial months, today’s home loan market presents a different picture. Many were surprised to learn about exclusive preferential programs being implemented to stimulate consumer credit, particularly for home loans.

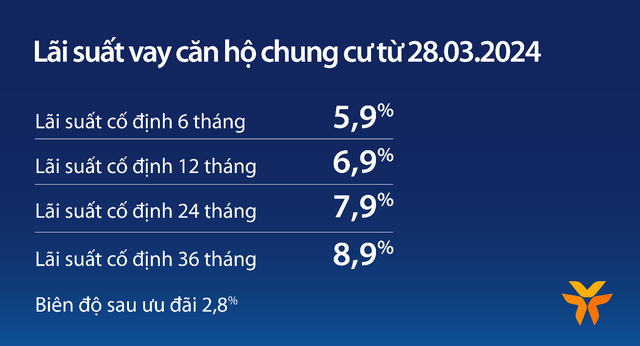

For instance, VIB is offering apartment loans secured by apartments with sổ hồng, with a range of interest rate options tailored to individual customer needs. Clients have four fixed interest rate options: 5.9%, 6.9%, 7.9%, and 8.9% per annum, corresponding to terms of 6 months, 12 months, 24 months, and 36 months, respectively. After the preferential period, the fluctuation range is only 2.8%, making it easier for customers to plan their finances and cash flow as they are less affected by interest rate changes.

In numerous discussions with reporters, economic expert Dr. Dinh The Hien also stated that the apartment segment consistently experiences market demand, regardless of market downturns in the real estate industry. Apartment prices are unlikely to decline significantly due to the market’s supply shortage. Individuals seeking to buy for personal use or rental purposes are currently at an advantage due to loan interest rates reaching their lowest point in 20 years.

Choosing a repayment method that aligns with financial capacity

According to reporters’ observations, the home loan segment offered by commercial banks has never been as competitive or favorable as it is now. Not only have interest rates been significantly reduced, but many banks are also introducing an array of home loan incentives.

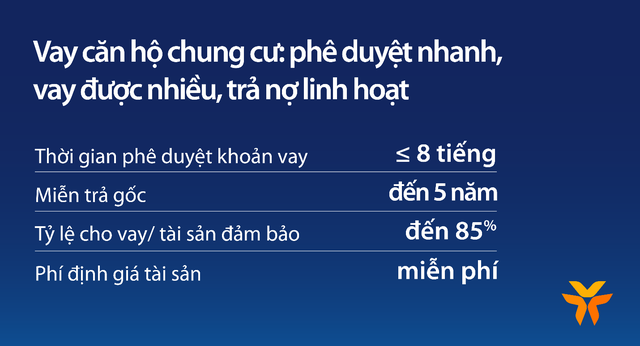

At VIB, customers can borrow up to 85% of the apartment’s value. Consequently, with limited financial resources and an initial capital investment of only 15-20%, many families can still acquire their dream homes. For clients with greater financial means, many experts suggest an optimal loan-to-value ratio of 50-60%. This ensures both debt repayment capability and avoidance of overdue debt risks.

Notably, VIB offers principal payment exemptions for up to 5 years, with the option to make regular principal payments every six months after the preferential period. Customers with higher incomes can proactively make early debt repayments of up to 25 million VND per month (equivalent to 300 million VND per year) without incurring any prepayment fees.

“Previously, several preferential credit packages offered by banks typically provided principal payment grace periods of only 1-2 years. However, a grace period of up to 5 years is quite unique. Combined with loan terms of up to 30 years, this creates a competitive advantage and provides peace of mind for individuals who may not yet have sufficient funds to purchase a home. The preferential fixed interest rate for up to 3 years also alleviates customers’ interest rate concerns. Once they have settled into their new homes and their finances improve, customers can opt to make early debt repayments as stipulated in the preferential terms to optimize their financial strategy,” a VIB representative stated.