The challenges and opportunities facing the Vietnamese beer industry: A thriving industry despite challenges

In 2024, Sabeco’s management believes that the Vietnamese beer sector, already facing adversity due to the COVID-19 outbreak and the effects of certain policy mechanisms like the Alcohol Prevention and Control Law and Decree 100, will continue to experience difficulties.

Scene before Sabeco’s general meeting. Photo: Chau An |

Furthermore, the need for businesses to spend heavily on marketing and promotions is being fueled by a drop in consumer spending, increasingly high expectations from consumers, and stringent quality and packaging standards.

According to the Company, Decree 100 is anticipated to remain a significant obstacle to the beer industry’s recovery this year, not to mention the persistently high, volatile, and anticipated increase in production and operating cost components including packaging, raw materials, and transportation.

Additionally, the Ministry of Finance has put up proposals to change special consumption tax rates for certain items bad for health, such as alcohol and beer, in the most recent draught of the Special Consumption Tax Law.

Despite these difficulties, 2024 will continue to offer the Vietnamese beer sector “golden possibilities,” including a favorable demographic, rapidly rising incomes, a sizable potential for the “non-alcoholic beer” category, and potential export markets.

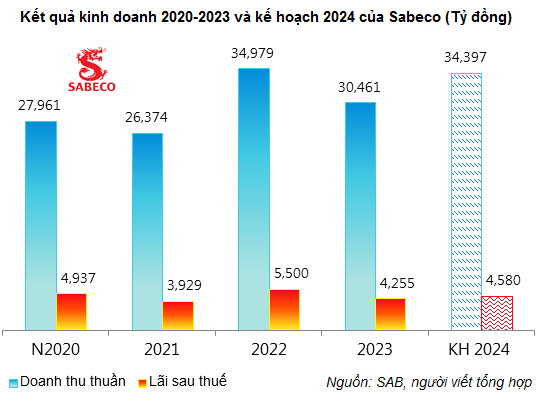

Sabeco has established revenue growth targets of 13% and post-tax profit growth of 8% for 2024, reaching VND 34,397 billion and VND 4,580 billion, respectively, in light of the difficulties and opportunities that lie ahead. The business also anticipates continuing to pay a 35% cash dividend, amounting to VND 4,489 billion in expenditures.

Chart: The Manh |

In a retrospective of 2023, SAB recorded VND 30,461 billion in net revenue and VND 4,255 billion in post-tax profit, which represented decreases of 13% and 23%, respectively, from the record high set in 2022. The Company was only able to achieve about 76% of its revenue target and nearly 74% of its profit target for the year as a result of this.

Tan Teck Chuan Lester, the CEO, attributed this performance to several variables at the general meeting. The overall beer consumption in Vietnam has decreased, particularly in the final months of the year. Another significant factor significantly impacting Sabeco’s performance is the very rigorous enforcement of Decree 100, which has made consumers more hesitant.

“It’s typical for business to have ups and downs. There are always challenges ahead, such as rainstorms and thunderstorms. We can’t wait for the rain to stop or the wind to die down; we need to react. We must learn to dance even when it’s pouring,” Mr. Tan stated.

Sabeco CEO Tan Teck Chuan Lester |

According to Mr. Tan, the results received for the first quarter of 2024 suggest that performance has been stronger than anticipated and over Sabeco’s expectations. “I anticipate that we will still achieve the plans for 2024 even though they are more ambitious,” he said. Sabeco will concentrate on three main areas: optimizing commercial operations, supply chain effectiveness, and ESG.

Based on the 2023 results, Sabeco resolved to pay shareholders a 35% cash dividend, following the plan authorized at the 2023 Annual General Meeting of Shareholders. SAB already paid an interim dividend of 15% in cash, or over VND 1.9 trillion, in February 2024. The business plans to pay out the remaining 20% of the 2023 dividend in cash (VND 2,000 per share) from its retained post-tax profits. The ex-dividend date is July 5th, and the planned payment date is July 31st, 2024.

Sabeco AGM 2024. Photo: Chau An |

Discussion:

Are there any plans to develop a line of pure mineral water products to compete with PepsiCo?

CEO Tan: As a beer producer, beer is our main product. However, Sabeco also makes investments in other beverage businesses, such as Binh Tay and Truong Duong. Regarding Truong Duong, we already provide spring water. We have enhanced the quality of the product’s packaging and intend to expand it further this year. We are optimistic that these enhancements will produce positive results.

The main driver of growth in the first quarter was the optimization of commercial operations.

What are the key factors behind the strong growth in Q1 and what are the expectations for gross margin in 2024?

CEO Tan: Regarding the main growth driver in Q1, as mentioned, it was the optimization of commercial operations. Our sales force has performed exceptionally well. There are specific details in sales that are very important to the market. Our team has demonstrated a high level of discipline and has been following a structured approach. This has been effectively implemented and consistently maintained throughout the system, beginning with Tier 1 distributors, moving on to convenience stores, and finally to the sales force below.

In this highly competitive environment, our competitors will do the same. The question is who will do it better and faster.

Cost is another factor. We are continuously looking for ways to cut costs and utilize them effectively. Therefore, enhancing our gross margin is always a key objective for us this year. Our Chairman wants everything to proceed more quickly and for cost reductions to be even better.

Why did sales and marketing costs increase in Q1 of this year compared to Q4 of last year?

CEO Tan: During the first quarter, there were higher sales and marketing costs due to commercial activities in preparation for Tet. Within the company, we have stringent cost controls as well as promotional programs. We not only have internal cost controls, but also an international team to assist us in exercising better control.

Sabeco’s goal is to maximize the return on every dollar spent. Even with increased costs, the effectiveness must surpass previous levels. This is one internal control measure we implement to increase our profit margin.

Can you provide some insights into the losses incurred by associates in Q1?

Mr. Koo Liang Kwee Alan, Deputy CEO: These losses are the result of investments in associated companies. The first loss is from a Saigon-based aluminum can manufacturing facility. This is because they have received fewer orders.

The second loss is from our partnership with Binh Tay. They incurred a loss, which was incorporated into our overall loss.

Nonetheless, Sabeco is actively working with the parties involved to ensure a more favorable second quarter.

KPMG is an independent auditor for Sabeco. Is it necessary to follow the governance rule of changing auditors after 5 years?

Chairman of Audit Committee: Governance is very important for Sabeco. I can assure you that we have had extensive discussions about this matter. This instance is no different. There is a procedure and a set of requirements that must be considered when selecting an auditor. The first is to ensure independence, which means that even when selecting a previous firm, there will be a change in the personnel assigned to the audit. Essentially, a new team.

The auditor must be qualified, have a strong reputation in Vietnam, and will typically come from one of the Big 4 audit firms.

The third requirement is that the firm has a history of good performance and is familiar with the market as well as Sabeco.

In summary, these are the criteria we evaluate very strictly.

The goal is to maintain the Saigon Beer brand’s position as number one.

What is the company’s market share expectation for 2024?

CEO Tan: I am hesitant to speak on this topic, but I can reveal that the Chairman has higher expectations than I do. Generally speaking, for FMCG companies, the focus is not on precise market share, but rather on market share position. Saigon Beer is the number one beer brand in Vietnam. The next goal is to position Sabeco as number one and maintain