Dam Ha Bac Fertilizer Joint Stock Company (stock code: DHB) has just announced its Q1/2024 financial statement with net revenue of VND 1,009 billion, down 14.8% compared to the same period last year. After deducting the cost of goods sold, the gross profit of this enterprise reached VND 25.3 billion, down 69%.

Financial revenue was only “a mere” over VND 5 billion, down VND 1.4 billion compared to last year. The company’s expenses all decreased, in which financial expenses decreased by 44% to VND 85 billion. Dam Ha Bac recorded a net loss from operating activities of VND 103.6 billion.

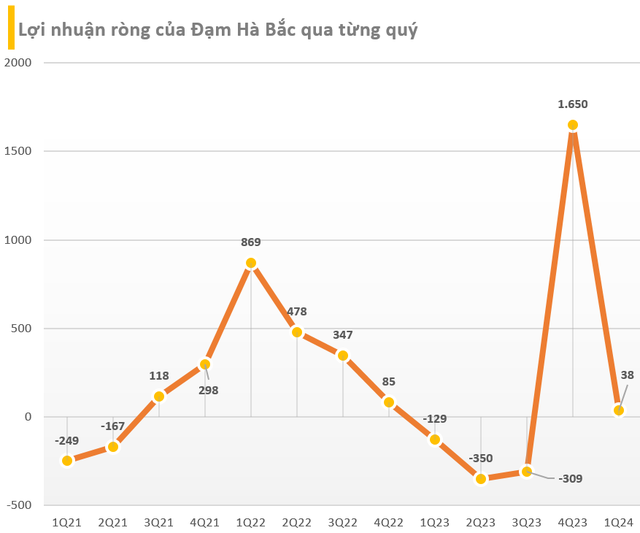

However, thanks to other income of nearly VND 142 billion, Dam Ha Bac still reported a net profit of VND 38 billion, while in the same period, it lost VND 129 billion. According to the explanation, this other income comes from the fact that the company has its interest debt cleared on interest overdue in 2023 from the Vietnam Development Bank – Northeast Region.

This is the second consecutive quarter that Dam Ha Bac has made a profit thanks to the clearance of bank interest debt. In Q4/2023, this enterprise was also cleared of VND 1,800 billion in debt from the restructuring plan of loans from the Development Bank.

As of March 31, Dam Ha Bac still has an outstanding debt at the Development Bank of over VND 1,220 billion. The total financial debt of this enterprise is at VND 2,921 billion.

Despite reporting profit in the last 2 quarters, by the end of Q1/2024, Dam Ha Bac still has an accumulated loss of VND 2,072 billion. Contributed capital at VND 2,722 billion, resulting in equity of only VND 649.8 billion. Total assets reach VND 6,519 billion.

Dam Ha Bac is a subsidiary of the Vietnam Chemical Group (Vinachem) with an ownership rate of 97.66%. It used to be the “steel fist” of Vietnam’s fertilizer manufacturing industry, however, Dam Ha Bac is also on the list of 12 major projects weakness that must be restructured.