Dragon Capital Real Estate Sector Outlook

Dragon Capital has recently published an updated report on the real estate industry’s outlook. It highlights positive developments in the business performance and financial positions of companies within the sector. Real estate companies have reported stronger business results in 2H23, with revenue (indicating project handover capabilities) continuing to show positive results from projects launched in 2021-2022.

Despite a period of decline due to a lack of new project launches, the balance of customer prepayments recorded a significant increase in Q4/23, driven by cash flow from effective/newly launched projects.

Developers have continued to reduce their loan debt, indicating challenges in raising capital through borrowing channels, and have prioritized repaying maturing loans. With legal issues surrounding projects expected to be gradually resolved in 2024, banks are likely to become more willing to finance real estate projects.

Market supply and absorption are projected to improve in 2024 compared to 2023 as developers and investors gain confidence in the market’s recovery; interest rates remain low; and infrastructure projects are in the construction and completion phases.

The condominium segment is expected to continue its sales recovery in 2024, but there will be differentiation between segments. In the mid-end segment, projects will primarily come from reputable domestic developers and be located in suburban areas. In the high-end segment, projects will mostly originate from foreign developers and be situated in central business districts (CBDs).

For low-rise/urban projects, the connection of ring roads/highways to the CBD is a key factor for investors. It is anticipated that the second half of 2024 will present a suitable time for companies to ramp up sales activities, as infrastructure systems (particularly the ring road network) enter the peak construction phase and secondary prices show clearer signs of recovery.

The primary market and sales potential in Tier II cities will recover at a slower pace than Tier I cities, as the secondary market has not yet shown clear signs of recovery.

In the long-term outlook since 2021-2022, the mid-end segment (selling prices below USD 2,000/m2, corresponding to an average price per apartment below VND 2 billion) has become virtually non-existent in Ho Chi Minh City. Neighboring areas, which are home to major industrial clusters and developing infrastructure, still have some supply but are also showing signs of a shortage.

Therefore, social housing projects will be crucial in meeting the stable housing needs of workers in major cities. However, social housing projects require support from policymakers to establish policies that are appropriate for developers and homebuyers.

VDSC anticipates that from 2025, when the amended Real Estate Business Law and Housing Law come into effect, along with the issuance of the Decree on the Development and Management of Social Housing, bottlenecks related to social housing projects will be resolved. Consequently, Tier II cities, where major industrial clusters are concentrated, are expected to witness significant activity in this segment.

The market is starting to price in the potential recovery of companies, but there are still opportunities for investment.

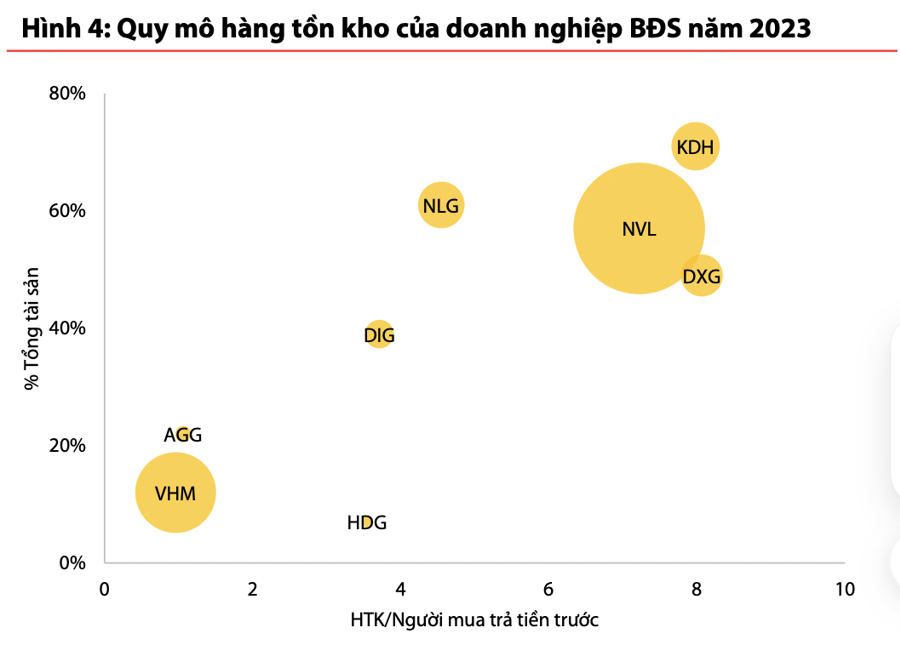

Developers’ lack of new products for sale in 2022-2023 will make it difficult for them to achieve strong profit growth in 2024.

Real estate stocks currently trade at P/B ratios of 1.5-2, which is relatively reasonable in terms of their existing assets. However, some mid-sized real estate companies with significant land banks in Tier II cities are trading at P/B ratios of 0.9-1.2x, below the industry average (1.5x), representing potential long-term investment opportunities.