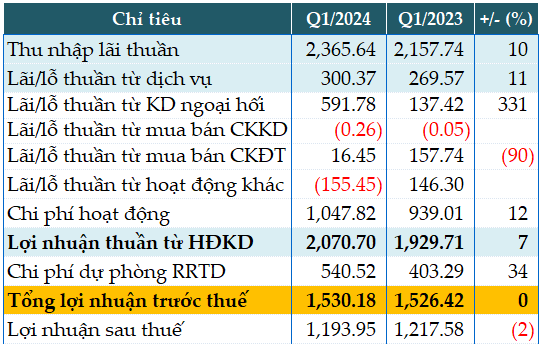

In the first quarter, MSB’s core revenue sources grew by 10% year-on-year, earning VND2,366 billion in net interest income.

Non-interest income accounted for 24% of MSB’s total income in the quarter. Service fees increased by 11% to VND300 billion, driven by higher revenues from payment services, letters of credit, and foreign exchange services.

Notably, MSB recorded a surge in foreign exchange trading income of nearly VND592 billion, 4.3 times higher than the same period last year. MSB stated that to sustain this growth, the Bank will offer incentives to import-export businesses with favorable exchange rates, expand derivative products in the interbank market, enhance risk hedging products, and more.

During the quarter, the Bank increased its credit risk provision expenses by 34% to VND540 billion. Despite this, MSB still reported a pre-tax profit of over VND1,530 billion, a slight increase year-on-year. Thus, MSB has achieved nearly 23% of its full-year pre-tax profit target of VND6,800 billion after the first quarter.

The Bank maintained a net interest margin (NIM) of 3.87%. The cost-to-income ratio (CIR) decreased to 33.6% from 39.26% at the beginning of the year.

Table: MSB’s Q1 2024 Business Results. Unit: VND billion

Source: VietstockFinance

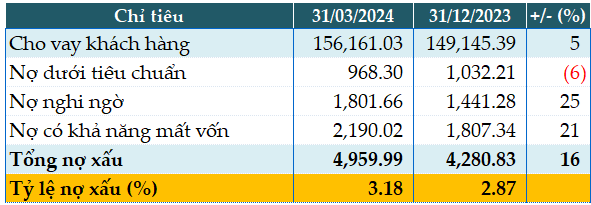

MSB’s total assets expanded by 4% from the beginning of the year to VND278,790 billion as of the end of Q1. Loans to customers increased by 5% to VND156,161 billion.

Customer deposits grew by 4% to VND137,823 billion. The bank’s demand deposits reached nearly VND40,300 billion, an increase of 15%, lifting the CASA ratio to total deposits to 29.21%, up 3 percentage points from the beginning of the year.

The loan-to-deposit ratio (LDR) stood at 71.9%, and the ratio of short-term funds to medium- and long-term loans (MTLT) was 28.78%. The consolidated capital adequacy ratio (CAR) was 12.15%.

As of March 31, 2024, MSB’s total bad debts amounted to VND4,960 billion, a 16% increase from the beginning of the year. The ratio of bad debts to outstanding loans increased from 2.87% at the beginning of the year to 3.18%.

Table: MSB’s Loan Quality as of March 31, 2024. Unit: VND billion

Source: VietstockFinance

Han Dong