No Va Real Estate Investment Group Joint Stock Company (code NVL-HOSE) announces the Resolution of the Board of Directors regarding the issuance of additional shares to existing shareholders.

Accordingly, NVL has submitted to the Board of Directors for approval of the resolution to implement a plan to issue additional shares to existing shareholders with a quantity of 1,170,062,722 shares.

The offering is expected to take place in the second quarter, after the State Securities Commission issues a certificate of registration for public offering of shares as prescribed.

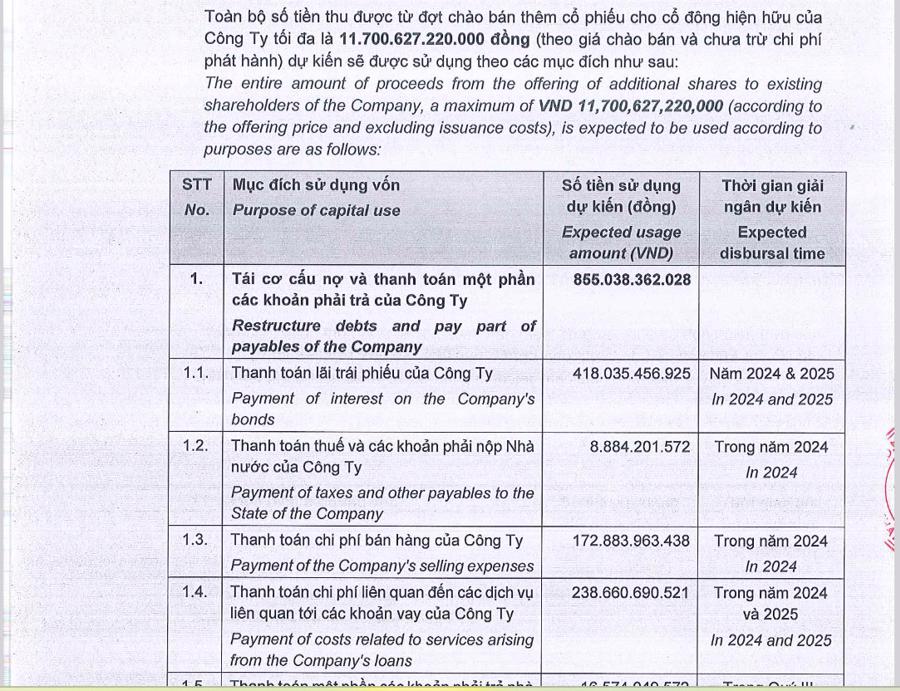

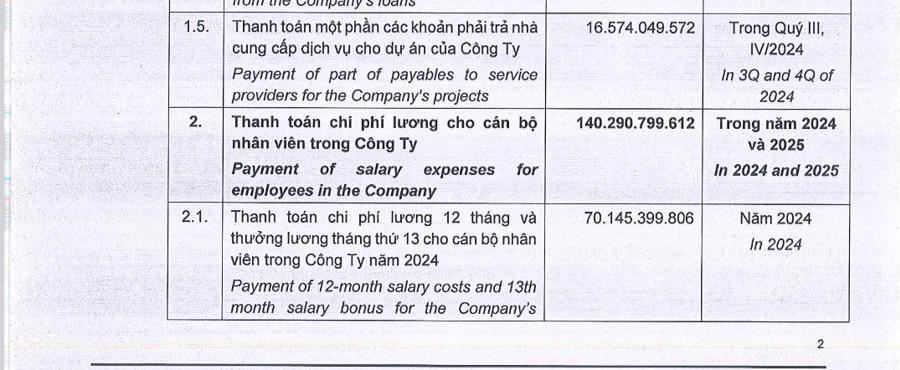

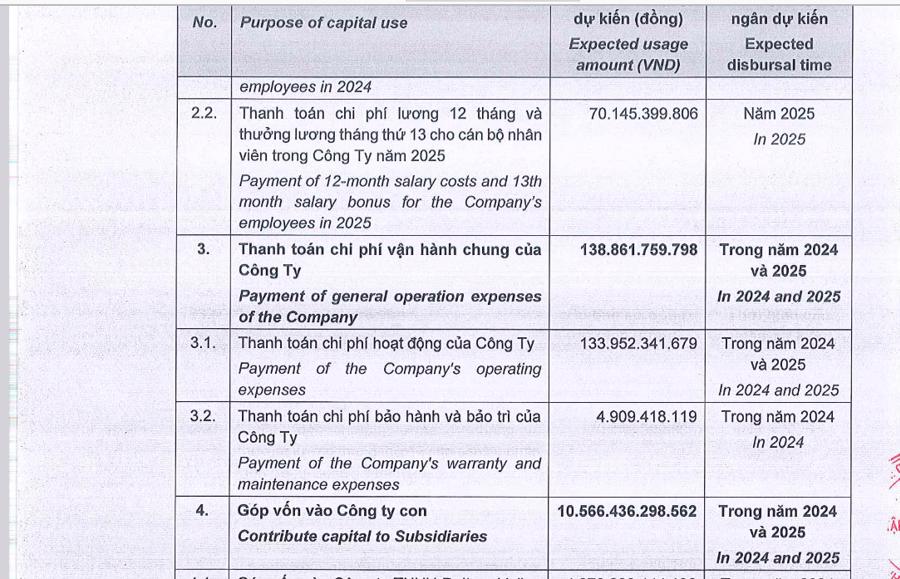

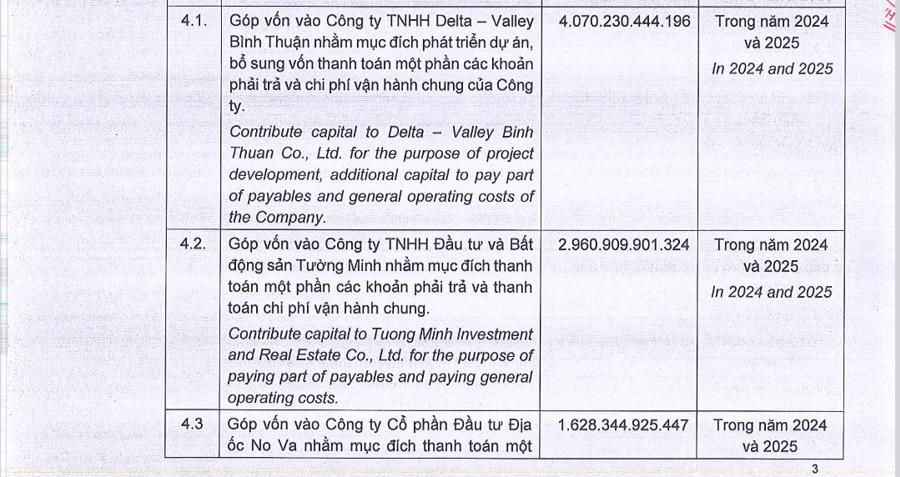

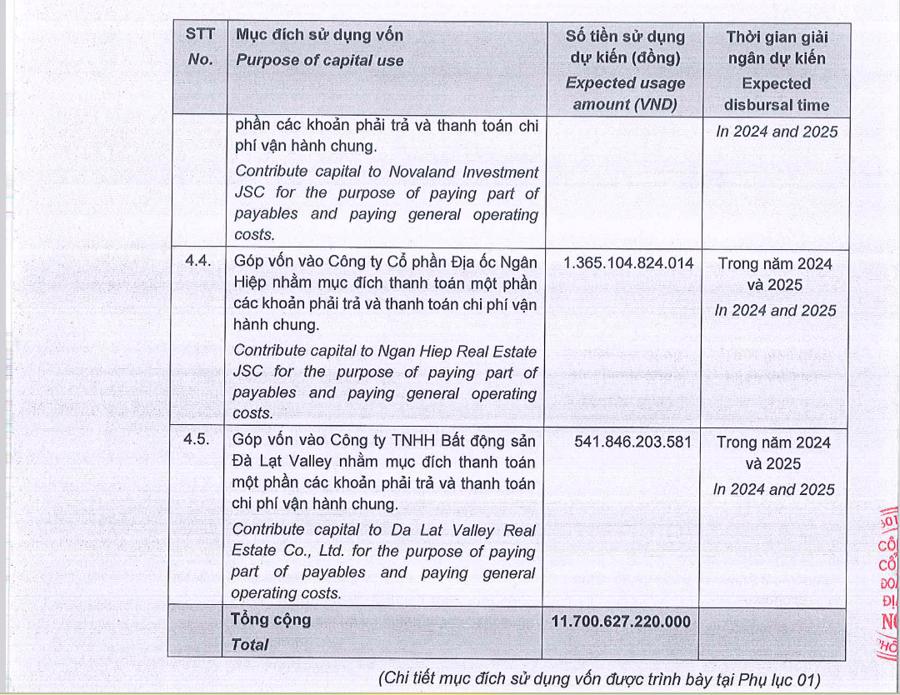

The total value of the mobilization is over VND 11,700 billion. All proceeds will be used to pay salaries for employees in the company. At the same time, NVL also uses money to pay operating expenses, contribute capital to subsidiaries, develop the company’s projects, restructure debts and pay off a portion of its payables.

In addition, the Board of Directors of NVL may adjust the capital use plan depending on the actual situation when implementing the share offering.

According to the annual report of 2023, NVL’s net revenue and after-tax profit were VND 4,757 billion and VND 486 billion, respectively, down 57.3% and 77.7% compared to 2022 – of which, net revenue from real estate transfer continues to be the core business segment recording VND 4,090 billion, accounting for 86% of the total net revenue and down 55.6% compared to the previous year. Net revenue from consulting services, project development, sales consulting and asset leasing in 2023 decreased by 65.4% compared to the same period in 2022, recording VND 667 billion.

Novaland’s total assets reached VND 241,486 billion at the end of 2023, down 6.3% compared to December 31, 2022, mainly due to a decrease in long-term assets. Specifically, Current assets remained at a high level, accounting for 79.2% of total assets, corresponding to VND 191,155 billion, down 3.5% compared to December 31, 2022.

Owner’s equity at the end of 2023 reached VND 45,303 billion, up 1.1% compared to December 31, 2022, and the total undistributed profit after tax was recorded at VND 13,494 billion, up 4.7% compared to December 31, 2022.

Although not giving an unqualified opinion, the auditors also noted in Note 2.2 of the consolidated financial statements that the significant impact of the real estate market and bond liquidity on the business performance of the Group. The going concern assumption of the Group depends on its ability to pay or restructure maturing loans and bonds, as well as implement other solutions to generate cash flow to finance the Group’s business activities as set out in Note 2.2. According to the auditors, these conditions, together with other issues raised in Note 2.2, indicate the existence of a material uncertainty that may cast significant doubt on the Group’s ability to continue as a going concern.

In 2024, Novaland will continue to focus on developing real estate products in Phase 2 with key product segments including urban real estate in Ho Chi Minh City and neighboring provinces, tourism real estate in cities with great tourism potential.

For the 2024 plan, Novaland plans to submit to the General Meeting a target of consolidated net revenue of VND 32,587 billion and after-tax profit of VND 1,079 billion, 6.8 times and 2.2 times higher, respectively, than the business results achieved in 2023.

According to NVL, in order to achieve the above targets, Novaland has prepared plans for business, financial resources and human resources, in which the Group’s top priority is to remove the remaining legal obstacles at the projects and this will be an important premise for the Group to continue implementing construction activities and handing over real estate in stages to customers, while restructuring the financial structure to ensure the interests of customers, lenders, bondholders, suppliers, shareholders, etc.