Tan Viet Securities Reports First Quarter 2024 Business Results

Tan Viet Securities (TVSI) has recently announced its business results for the first quarter of 2024.

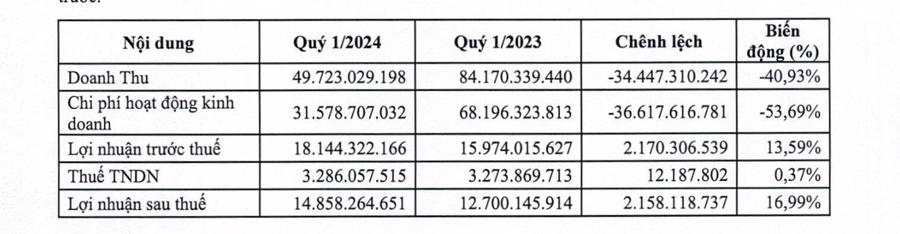

In Q1 2024, TVSI’s revenue declined by 40.93% from VND 84.17 billion to VND 49.72 billion. Operating expenses fell by 53.69% from VND 68.19 billion to VND 31.6 billion. Pre-tax profit increased by 13.59% from VND 15.97 billion to VND 18.144 billion, while post-tax profit rose by 16.99% from VND 12.7 billion to VND 14.858 billion.

According to TVSI’s explanation, the 16.99% increase in Q1 2024 post-tax profit (VND 2.158 billion) compared to Q1 2023 is attributed to the 53.69% decrease in expenses (VND 36.62 billion) and a 40.93% decline in revenue and other income (VND 34.45 billion).

The significant reduction in total expenses is primarily due to a 151.76% decrease in losses from financial assets measured at fair value through profit or loss (FVTPL), a 98.58% reduction in proprietary trading expenses, a 38.13% decline in brokerage expenses, an 82.94% decrease in sales expenses, and a 29.34% fall in administrative expenses.

Furthermore, variations in revenue and other income are mainly caused by a 3.45% increase in interest income from financial assets measured at FVTPL, a 23.21% decline in brokerage revenue, a 95.21% decrease in depository revenue, and a 40.9% reduction in interest income from loans and receivables.

As of March 31, 2024, TVSI’s total assets amounted to VND 4,061 billion, with close to VND 1,951 billion deposited in banks for securities company operations, slightly higher than the end of 2023 (VND 1,939.86 billion).

It is noteworthy that TVSI’s audited 2023 financial report showed a loss of nearly VND 380 billion (with a profit of over VND 148 billion in the same period of the previous year), and the auditor had highlighted areas of concern.

Specifically, during its business operations, the company purchased private corporate bonds from issuing organizations and then resold them multiple times to investors. Concurrently, the company entered into contracts to repurchase certain bonds sold to investors at a specified price on a specific future date.

As of December 31, 2023, the total face value of the bonds for which the company had entered into repurchase agreements was approximately VND 16,491 billion (approximately VND 20,700 billion as of January 1, 2023), of which approximately VND 16,062 billion had matured but remained unpaid, while approximately VND 4,870 billion had matured and remained unpaid as of January 1, 2023.

At the time of this report, the total face value of the company’s repurchased bonds remained at approximately VND 16,491 billion, of which approximately VND 16,477 billion had matured but remained unpaid. However, the company is currently unable to make payments to the transferor and has notified investors that it will not fulfill this obligation. Additionally, the company is negotiating with investors to cancel or extend the repurchase of bonds corresponding to the maturity dates of the issuing organization’s bonds, but these negotiations have yet to yield specific results.

According to the auditor, the company did not recognize the aforementioned bonds on the accompanying financial statements. As such, investors retain ownership and control of these bonds.

Also, as of November 2, 2022, the company’s cash balance at Saigon Commercial Joint Stock Bank (SCB) was approximately VND 1,609 billion, comprising approximately VND 879 billion in investor deposits for securities trading and approximately VND 730 billion in company deposits for meeting other payment obligations to customers. Additionally, the company held VND 29 billion in non-transactional certificates of deposit at SCB.

As of December 31, 2023, the company’s cash balance at SCB stood at approximately VND 1,625 billion, including approximately VND 889 billion in investor deposits for securities trading and approximately VND 736 billion in company deposits for meeting payment obligations to customers. The company’s balance of certificates of deposit at SCB remained at approximately VND 29 billion.

It is known that the company had sent official letters (no. 1258/2022/CV-TVSI dated October 27, 2022; no. 1259/2022/CV-TVS1 dated October 27, 2022; and no. 1316/2022/CV-TỴSI dated November 2, 2022) to the relevant authorities to request approval for the transfer of funds from the company’s accounts at SCB to other accounts for securities trading. However, the company has not yet received any feedback from the authorities.