According to Sabeco’s market assessment for 2024, the Vietnamese beer industry, which has already faced challenges due to the severe impact of the COVID-19 pandemic, continues to be affected by certain regulatory measures such as the Law on Prevention and Control of Alcohol-Related Harm and Decree No. 100/2019/ND-CP. This has resulted in companies not achieving their expected results.

Furthermore, the fact that consumers are tightening their spending and becoming increasingly discerning with beer packaging design and quality presents additional pressure on businesses, necessitating significant investments in advertising and promotional campaigns to enhance competitiveness and boost consumption.

Sabeco predicts that Decree 100 will continue to pose a significant barrier to the industry’s recovery this year, in addition to factors such as production costs, including packaging, raw materials, and transportation, which remain high, exhibit unusual fluctuations, and are expected to continue rising, affecting industry players’ profitability.

While the aforementioned regulations and policies continue to have a substantial impact on the beer industry, the proposal by the Ministry of Finance to adjust special consumption tax rates for certain items including beer and alcohol in the latest draft of the Law on Special Consumption Tax is likely to further burden businesses.

The Vietnam Beer-Alcohol-Beverage Association (VBA) also points out that increasing taxes will put a financial strain on businesses, and as such, they need sufficient time to prepare and plan their operations. Therefore, it is advised against rushing, shortening, or eliminating necessary procedures and requirements when revising an important tax law.

At the Congress, Sabeco’s CEO, Tan Teck Chuan Lester, shared, “Beer consumption in Vietnam has declined significantly, particularly in the last few months of the year. The enforcement of Decree 100 has also become increasingly stringent, which has led to customers becoming more hesitant. These two factors are primarily responsible for Sabeco’s performance.”

It is common for businesses to encounter challenges. We can expect to face storms and downpours in the future. We cannot wait for the rain to stop or the wind to die down; we must take action to cope. We must master the art of dancing in the rain.

Despite these challenges, Sabeco believes that 2024 continues to offer ‘golden’ opportunities for the Vietnamese beer industry due to three main factors:

Firstly, a favorable population structure and rapidly increasing income.

Secondly, a substantial potential in the ‘non-alcoholic beer’ segment.

Thirdly, untapped potential in the export market.

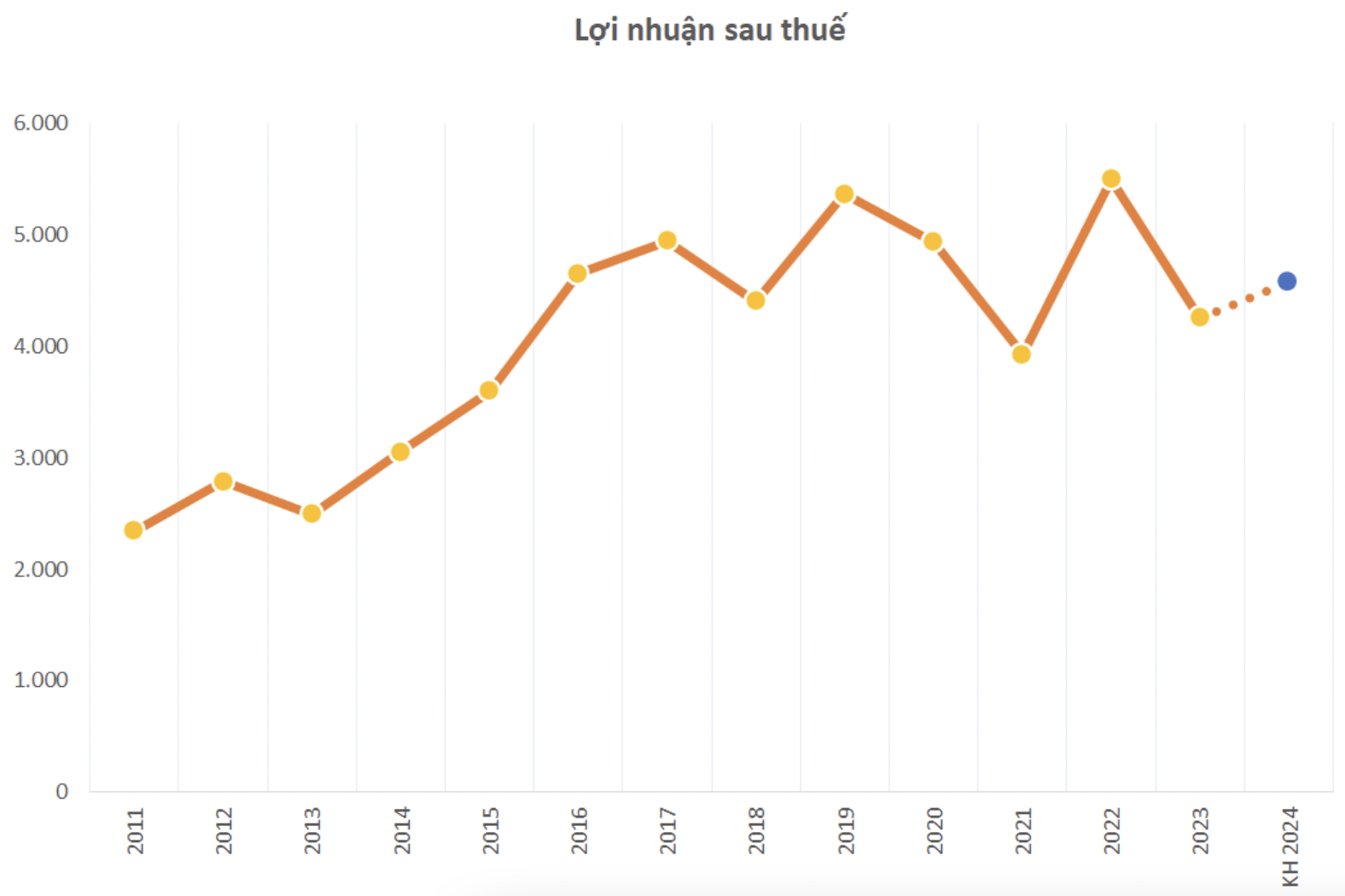

In 2023, Sabeco recorded a net revenue of VND 30,461 billion, a 13% decrease from the previous year. While the company managed to maintain a profit of over VND 4,000 billion, this still represented a 23% reduction compared to 2022.

Given these results, Sabeco presented a profit distribution plan to its shareholders, proposing to allocate VND 4,489 billion for dividends to existing shareholders, equivalent to a dividend rate of 35%. Earlier in February, the company paid an interim dividend for 2023 in cash at a rate of 15%. Consequently, the company plans to pay the second dividend for 2023 at a rate of 20% in cash on July 31, 2024.

Sabeco’s shareholding structure remains unchanged, with Vietnam Beverage, a subsidiary of ThaiBev (Thailand), continuing to hold over 687 million SAB shares, representing 53.59% of the charter capital. It is expected that this Thai giant will continue to receive the remaining approximately VND 1,400 billion in dividends for 2023 and will pocket an additional VND 2,400 billion in dividends for 2024.

SABECO AIMS NOT FOR MARKET SHARE, BUT MARKET DOMINATION

Speaking at the Congress, CEO Tan Teck Chuan Lester stated that Sabeco is currently investing in beverage companies such as Binh Tay and Chuong Duong. In the case of Chuong Duong, Sabeco released a mineral water product and has plans to further enhance its packaging quality and product development this year.

The primary growth driver for the first quarter will come from optimizing commercial operations. Sabeco’s sales team has been performing exceptionally well. However, according to the CEO, competitors will likely adopt similar strategies in this competitive environment; the key is to outperform them.

Another important factor is cost management. Sabeco continually seeks ways to reduce costs and utilize resources efficiently. The company’s goal is to maximize the effectiveness of every dong spent. Consequently, while expenses may increase, so should their impact compared to previous periods. This is one of the factors under Sabeco’s internal control to improve profit margins.

Commenting on losses from associates in the first quarter of 2024, Deputy CEO Koo Liang Kwee Alan explained that these losses stem from investments in affiliated companies. The first loss pertains to an aluminum can production facility in Ho Chi Minh City due to a decline in orders. The second loss relates to the partnership with Binh Tay. Nevertheless, Sabeco is working closely with the parties involved to ensure a more favorable second quarter.

CEO Tan Teck Chuan Lester

Sabeco’s CEO also addressed the issue of market share with FMCG companies, emphasizing that the focus should not be on the exact market share but rather the dominance of the market share. In terms of market share, two factors need to be distinguished: (i) brand market share and (ii) company market share. The Saigon Beer brand is the number one brand in Vietnam. This brand continued to grow in 2023, and the next objective is to elevate Sabeco to the number one position and maintain that position. This is also the company’s mission for 2024.

Regarding company market share, Sabeco has experienced constant fluctuations with its main competitor. However, looking at the past 12 months, Sabeco’s market share has increased. Market share continued to grow in the first quarter of 2023.

With respect to market share development and enhancement, Sabeco does not intend to share market share. Tan Teck Chuan Lester mentioned that the Chairman’s directive is to increase and dominate market share. To achieve this, Sabeco will concentrate on three aspects: sales optimization, supply chain efficiency, and environmental social governance (ESG) initiatives. This focused approach has yielded positive results in the first quarter of 2024.

Chairman Koh Poh Tiong shared, “I am confident in the new target. I also told Tan that there is no need to take small steps; go ahead and rock ‘n’ roll.”

SABECO SUPPORTS DECREE 10