VN-Index Surges Past 1,200 as Holiday Season Nears

The VN-Index has once again surpassed 1,200 points as the prolonged holiday season approaches, driven primarily by the easing of exchange rate pressures following recent measures by the State Bank of Vietnam. Notably, the implementation of the KRX system has provided significant psychological support to the market, even though trading volumes remain largely unchanged.

The index rose strongly by 28.21 points to reach 1,205 points. Market breadth was positive, with 435 stocks gaining and only 69 declining. However, the number of stocks hitting the ceiling was relatively low, indicating a broad-based buying trend across sectors.

The brokerage sector led the gains, rising 4.13 points with several stocks such as SSI, VCI, and SHS performing well. The real estate sector also gained 2.36%, while banking stocks increased by 1.63%. Energy stocks rose 2.94%, seafood stocks 4.35%, construction materials 3.87%, and retail stocks 4.27%. Information technology stocks soared by 6.67%, with FPT hitting the ceiling on strong profit growth and Nvidia announcing plans to establish an AI manufacturing facility. FPT contributed the most to market growth at 2.41%, followed by CTG (1.90%), GVR (1.85%), and HPG (1.70%). Other notable contributors included MWG, BID, MSN, and MBB.

Foreign capital flows tested the market depth, leading to improved liquidity across the three exchanges. Total trading value reached VND 21.8 trillion, with foreign investors selling a net VND 212.2 billion. However, focusing solely on matched orders, foreign investors were net buyers to the tune of VND 662.7 billion.

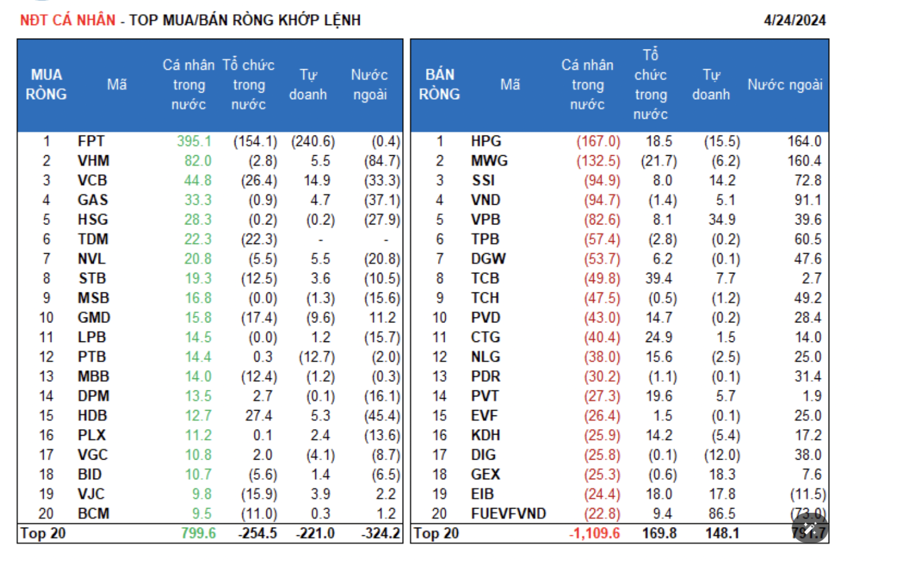

Foreign investors’ primary net purchases via matched orders were in the retail and basic material sectors. Leading net purchases included HPG, MWG, VND, SSI, TPB, TCH, DGW, VPB, DIG, and PDR.

Foreign investors’ top sales via matched orders were in the power, water, and gas supply sectors. Major net sellers included VHM, FUEVFVND, HDB, GAS, VCB, NVL, DPM, LPB, and MSB.

Domestic individual investors sold a net VND 781.6 billion, of which VND 686.4 billion was via matched orders. Excluding matched orders, they were net buyers in five out of 18 sectors, primarily information technology. Top purchases by domestic individual investors included FPT, VHM, VCB, GAS, HSG, TDM, NVL, STB, MSB, and GMD.

Their largest sales via matched orders were in 13 out of 18 sectors, mainly financial services and retail. Top sales included HPG, MWG, SSI, VND, VPB, TPB, TCB, TCH, and PVD.

Proprietary traders bought a net VND 993.4 billion, while their matched order sales came to VND 21.1 billion. Excluding matched orders, proprietary traders were net buyers in 11 out of 18 sectors. The most significant net purchases were in financial services and banking. Top matched order net purchases by proprietary traders included FUEVFVND, VPB, GEX, PC1, EIB, VCB, SSI, VIC, TCB, and SHB. They were net sellers primarily in information technology, with the most significant sales in FPT, HPG, PTB, DIG, PNJ, GMD, MWG, KDH, REE, and VGC.

Domestic institutional investors bought a net VND 30.9 billion, primarily via matched orders where they were net buyers of VND 44.8 billion. Excluding matched orders, domestic institutions were net sellers in eight out of 18 sectors, with the largest value in information technology. Notable sales included FPT, VCB, TDM, MWG, GMD, VJC, STB, MBB, BCM, and VRE. The most significant net purchases were in the banking sector, including TCB, HDB, REE, PNJ, CTG, PVT, HPG, EIB, DGC, and NLG.

Block transactions reached VND 3,133.0 billion, an increase of 53.8% compared to the previous session, and contributed 14.4% to the total trading value.

A noteworthy block transaction occurred between domestic proprietary traders (buyers) and foreign institutions (sellers) in FUEVFVND, the ETF certificate of the DCVFMVN DIAMOND ETF. The ETF also recorded a significant net withdrawal of over VND 355 billion.

Individuals also engaged in substantial block transactions in several banking stocks, including SSB, VIB, and VPB.

The distribution of capital flows increased in real estate, brokerage, software, steel, construction, aquaculture, chemicals, plastics, rubber and fibers, and investment funds. Meanwhile, it decreased in banking, retail, food, oil and gas services, and aviation.

Focusing solely on matched orders, the value of trading increased in the mid-cap (VNMID) and small-cap (VNSML) segments, while it declined in the large-cap (VN30) segment.