The Vietnam E-commerce Index (EBI 2024) report released by the Vietnam E-commerce Association at the Vietnam E-commerce Outlook Forum 2024 on April 25th noted that this growth rate is significantly higher than the overall economic landscape. E-commerce accounts for approximately 10% of total retail sales and consumer service revenue, surpassing the 8.5% rate in 2022. Notably, the rate of online retail sales compared to total retail sales was around 8.8%, exceeding the 7.2% ratio in 2022.

VIETNAM’S E-COMMERCE SECTOR REACHES USD 25 BILLION

Amidst global and domestic economic challenges, Vietnam’s e-commerce industry has exhibited robust growth with a growth rate exceeding 25%, reaching a scale of over USD 25 billion.

The rapid development of e-commerce is closely intertwined with the growth of related sectors. In recent years, payment services and order fulfillment have witnessed rapid expansion, with cutting-edge technologies contributing to the flourishing of e-commerce in general and the significant growth of online retail. Moreover, cross-border e-commerce exports in the business-to-consumer (B2C) segment have entered a new phase.

According to the report, as of the end of 2023, cashless payments reached approximately 11 billion transactions, representing a nearly 50% increase compared to 2022. The total transaction value exceeded VND 200 trillion (USD 8.6 billion). Notably, online payments accounted for close to 2 billion transactions, with a value of over VND 52 trillion (USD 2.2 billion), indicating a rise of more than 56% in volume and 5.8% in value compared to 2022;

Mobile payments reached over 7 billion transactions with a value of more than VND 49 trillion (USD 2.1 billion), exhibiting an increase of more than 61% in volume and nearly 12% in value;

QR code payments amounted to approximately 183 million transactions, with a value exceeding VND 116 trillion (USD 5 billion), reflecting a surge of nearly 172% in volume and over 74% in value compared to the previous year.

By the end of 2023, nearly 27 million payment accounts had been activated using electronic verification (eKYC), and 12.9 million eKYC-issued cards were in circulation. The number of active e-wallets stood at 36.2 million, accounting for 63.2% of the total 57.3 million e-wallets that had been registered, with the total funds in these wallets reaching almost VND 3 trillion (USD 129 million).

After two years of piloting, Mobile Money has experienced robust growth. By the end of 2023, the number of registered accounts was close to 6 million, with nearly 70% of accounts being opened in remote, rural, and island regions. The total number of transactions was approximately 47 million, with a total transaction value exceeding VND 2.4 trillion (USD 103 million).

According to the E-commerce Association, the growth of e-commerce in 2023 is closely linked to advancements in both the scale and quality of order fulfillment and last-mile delivery services.

In 2023, numerous businesses invested heavily and implemented advanced technologies in their fulfillment centers. A new model emerged, with medium-sized fulfillment centers specializing in serving small and medium-sized customers in major urban centers, such as Swifthub’s Fulfillment Hub or N&H Logistics in Ho Chi Minh City.

The Vietnam E-commerce Association believes that these trends will drive the continued growth of order fulfillment services in the coming years. The two leading e-commerce platforms in Vietnam have inaugurated state-of-the-art goods sorting centers.

Vietnam’s last-mile delivery market has become increasingly competitive, with the entry of numerous players. According to a report by Allied Market Research, the Vietnamese express delivery services market was valued at USD 0.71 billion in 2021 and is projected to reach USD 4.88 billion by 2030, exhibiting a compound annual growth rate of 24.1% during the 2022-2030 period.

Furthermore, there has been a marked increase in direct investment by international express delivery companies. The last-mile delivery market is witnessing intense competition in terms of price and service quality.

The rapid expansion of the e-commerce sector, coupled with the surge in B2C deliveries and the growth in international trade services, is a key factor driving market growth.

VIETNAM’S E-COMMERCE SECTOR FACES SUSTAINABILITY CHALLENGES

According to the report, cross-border e-commerce has become an inevitable trend. As such, cross-border e-commerce, or online import-export activities, have become increasingly prevalent in Vietnam.

Since the COVID-19 pandemic, business-to-business (B2B) cross-border e-commerce exports have faced significant challenges. However, business-to-consumer (B2C) cross-border e-commerce exports have experienced robust growth.

Access Partnership estimates that with the implementation of e-commerce exports by small and micro businesses in recent years, the export turnover will reach USD 5.5 billion by 2027. However, with a scenario involving coordinated and vigorous implementation by businesses and stakeholders, this figure could reach USD 13 billion by 2027.

Contrasting the rapid growth in scale is the unsustainable nature of Vietnam’s e-commerce industry. The primary factors contributing to this unsustainability are the digital divide, digital human resources, and the environment.

Meanwhile, Amazon reports that during the 12-month period ending August 31, 2023, Vietnamese sellers on Amazon achieved strong results, with 17 million products sold to Amazon customers worldwide, strengthening the global presence of Vietnamese goods. The export value of Vietnamese businesses selling on Amazon increased by 50%. Thousands of Vietnamese businesses seized global business opportunities with Amazon, with the number of Vietnamese sellers on Amazon growing by 40%.

Evidently, Vietnam’s e-commerce industry has experienced rapid growth in scale. However, the E-commerce Association also highlights the unsustainability of Vietnam’s e-commerce industry, including factors such as the digital divide, digital human resources, and the environment.

In reality, there is a significant gap in e-commerce development between the two major cities of Hanoi and Ho Chi Minh City and the remaining 61 provinces and cities. Additionally, the supply of high-quality human resources with formal training from universities does not meet the demand, and e-commerce is having an increasingly negative impact on the environment.

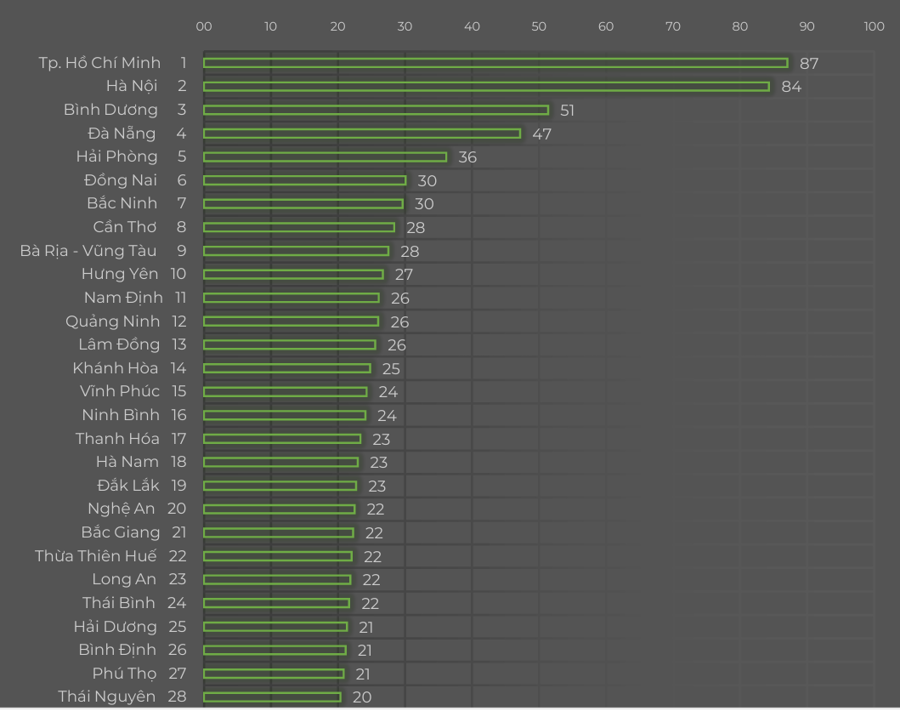

The report also indicates that Ho Chi Minh City continues to lead the ranking in the 2024 Vietnam E-commerce Index with a score of 87 points. Hanoi ranks second with 84.3 points. Binh Duong ranks third with a score of 51.3 points, still a significant gap of 33 points behind Hanoi.

The average score of the Index this year is 23.1 points. The gap in e-commerce between the two economic centers of Hanoi and Ho Chi Minh City and the other provinces and cities is substantial. The gap between Ho Chi Minh City, the highest-ranked province/city, and the lowest-ranked province/city out of the 58 provinces/cities in the Index is 76.4 points.

The report continues to highlight the necessity of implementing policies and solutions to address these issues. It also recommends that government agencies evaluate the current situation, enact policies, and create legislation to promote cross-border e-commerce, educational technology (EdTech), and health technology (HealthTech).

The Vietnam E-commerce Association believes that in the next decade, from 2026 to 2030, while maintaining a high growth rate, Vietnam needs to establish a vision for sustainable e-commerce development. Factors crucial to the success of this