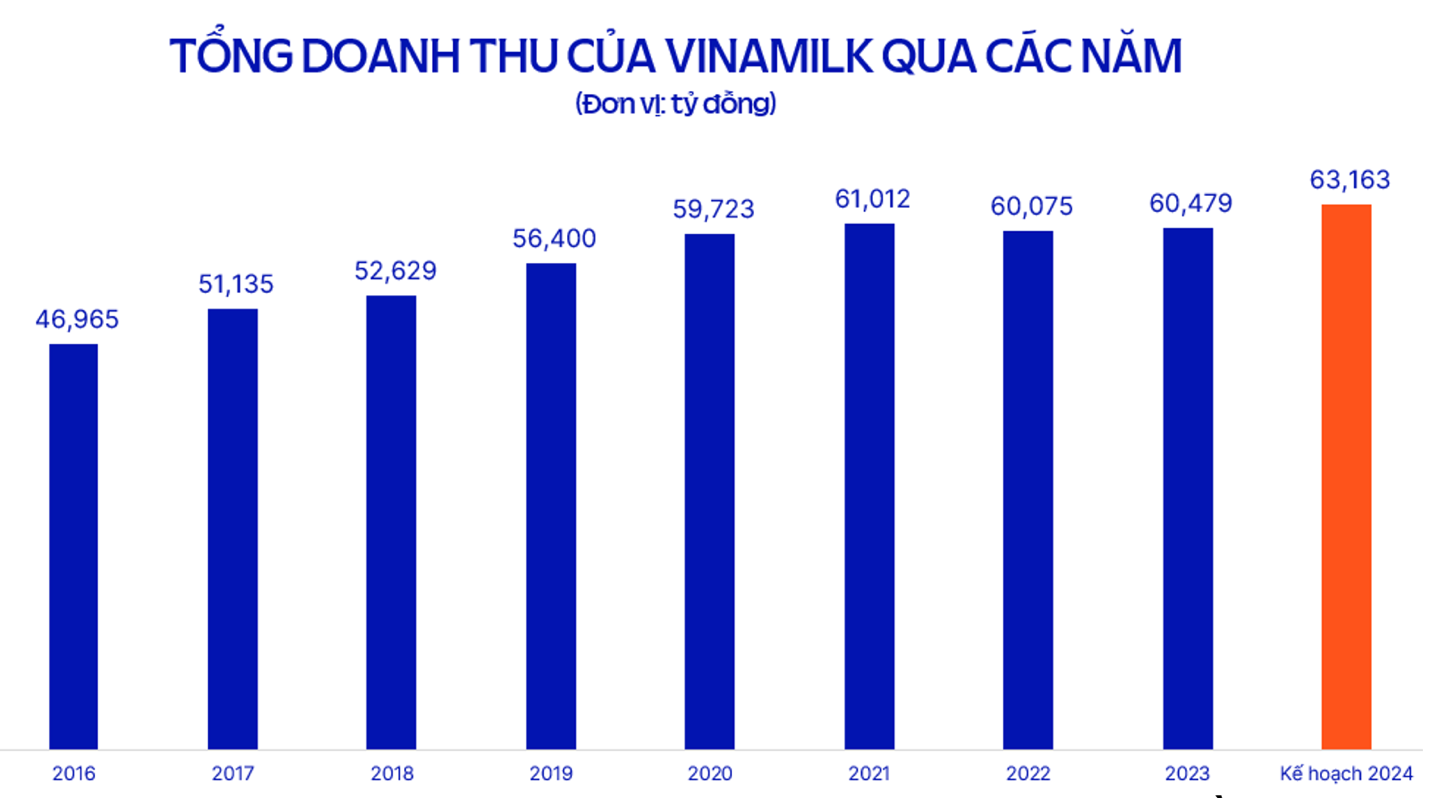

Vinamilk Plans to Break Revenue Record and Maintain High Dividend Payout

At its 2024 Annual General Meeting held on April 25, 2024, Vietnam Dairy Products Joint Stock Company (Vinamilk, stock code: VNM) approved a business plan targeting revenues of 63,163 billion VND and after-tax profits of 9,376 billion VND, representing increases of 4.4% and 4%, respectively, compared to 2023. If the plan is achieved, Vinamilk will surpass its previous revenue record set in 2021 and achieve positive profit growth for the second consecutive year.

In 2023, Vinamilk recorded a slight increase in revenue to 60,479 billion VND, exceeding 95% of its annual plan. After-tax profits reached 9,019 billion VND, a 5% increase over 2022, exceeding the target by 5%.

Given the positive results, Vinamilk’s Board of Directors plans to propose to shareholders a cash dividend payout of 38.5% for 2023. The company has already distributed 6,061 billion VND in three interim dividends, totaling 29%.

Thus, Vinamilk will have one more dividend payment of 9.5% (01 share receiving 950 VND). With 2.09 billion shares currently outstanding, the company expects to pay an additional 1,985 billion VND for the final dividend in 2023. The record date and payment date will be decided by the Board of Directors, but no later than 6 months from April 25.

Regarding the dividend plan for 2024, Vinamilk expects to maintain the same payout ratio of 38.5% (01 share receiving 3,850 VND) as in 2023. The total amount the company expects to distribute to shareholders is over 8,000 billion VND, accounting for approximately 95% of its 2024 profit target.

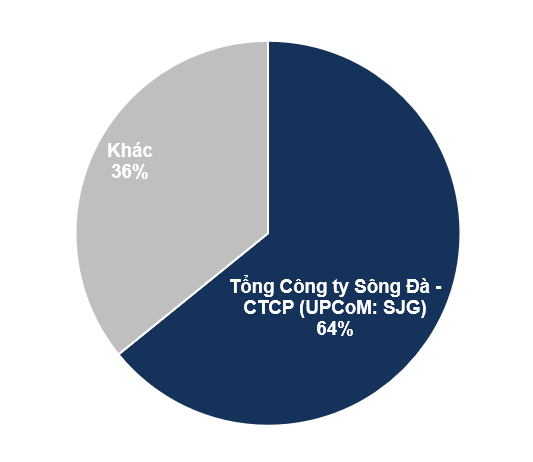

Among the major shareholders, State Capital Investment Corporation (SCIC), the largest with a 36% stake, may receive nearly 2,900 billion VND. Thai billionaire Charoen Sirivadhanabhakdi’s F&N Group is expected to collect over 1,600 billion VND based on its 20.4% ownership. Platinum Victory Pte. Ptd, another significant foreign shareholder with a 10.62% stake, will also receive close to 855 billion VND.

Discussions at the General Meeting

1. Vinamilk has been providing cash dividends to its shareholders for many years. Will this continue in the future?

Ms. Mai Kieu Lien: We are committed to balancing investment in development and dividend payouts to ensure shareholder benefits. Therefore, we will continue to maintain cash dividends for shareholders in the coming years.

2. Vinamilk’s recent revenue has been around 60,000 billion VND, and profit has been 9,000 billion VND. Has the absorption rate of milk products by Vietnamese consumers reached saturation?

The dairy industry has experienced growth, but it has been slow. We have lost two years due to COVID-19 and its aftermath. In addition to domestic and international factors, consumer spending on dairy products has declined over the past two years and is likely to continue decreasing this year.

However, each company has its own strategy to recover market share. We continue to innovate to increase revenue and market share sustainably.

3. What is the business situation in the first quarter of 2024?

Total consolidated revenue increased by 1.2%, pre-tax profit increased by 17%, and profit after tax increased by 15.8% compared to the same period last year (unaudited).

Total revenue of the parent company increased by 2.3%, pre-tax profit increased by 16.5%, and profit after tax increased by 15.4%.

4. In 2023, IDP and Moc Chau both experienced positive growth in domestic revenue, while Vinamilk’s growth was almost flat. Why?

Vinamilk offers a full range of dairy products, while our competitors typically have only one to three products. The reason for Vinamilk’s flat growth last year, while our competitors experienced growth, is due to powdered milk.

Currently, the healthcare system encourages mothers to breastfeed their children more, especially during the first 0-6 months. As a result, powdered milk consumption has declined. The overall powdered milk market declined by 20% last year. Vinamilk has also minimized advertising of infant powdered milk.

In 2023, Vinamilk also repositioned its liquid milk brand. Despite the brand repositioning, existing packaging is still in use, resulting in a delay in results until the third or fourth quarter of 2024.

After five months of brand repositioning, liquid milk market share has increased by 2.8% compared to the first seven months of the year, which demonstrates the effectiveness and accuracy of the brand repositioning.

5. Does Vinamilk have expectations for each product in 2024? What is the gross profit margin target for the next five years?

If we focus on products that perform well, we can improve our gross profit margin.

The brand repositioning began in 2023, and we expect the packaging, name, and branding of our products to be fully updated by 2024, not only in the liquid milk segment but also in yogurt and other products.

In the third quarter of 2024, Vinamilk will also reposition its infant milk products.

6. Will the company buy back its own shares?

Vinamilk has no plans to buy back its own shares.

7. According to the press, Vinamilk’s advertising expenses are equal to its profits. Can management provide specific details about current advertising costs?

We do not disclose advertising expenses separately. They include both sales costs and marketing costs. Currently, these costs account for 20-21% of revenue and have been maintained for many years.

8. When is the restructuring complete, and by how much is growth expected to increase?

Restructuring is a five-year strategy that encompasses everything from sales to livestock, marketing, human resources, and administration. The impact will be most evident in the first two years through brand repositioning.

9. Can you share your thoughts on the current price of VNM shares?

I don’t have time to look at the stock price. In Vietnam, the stock market is influenced by the market… The management team at Vinamilk is solely focused on performing our duties effectively.

10. What are the management’s thoughts on the fact that organic products are priced too high for the majority of consumers?

Organic products are premium, meeting global standards from livestock to production, which is why they are more expensive. Currently, a segment of the Vietnamese population can afford to pay for these products, and I expect purchasing power to increase in the future.

11. What strategies does the company have for developing the Chinese and Middle Eastern markets?

These two markets have been part of Vinamilk’s strategy for many years. We are hopeful about our growth in China, even though it is a new market for us, as our products are relatively unique.

We have developed a wide range of powdered milk products for the Middle East market.

We are pursuing a dual-pronged approach, focusing on both export and domestic markets. In the first four months of 2024, Vinamilk’s exports increased by 14% year-over-year.

12. What is Vinamilk’s forecast for consumer spending in the second half of the year?

According to Nielsen, in the first quarter of 2024, consumer spending on dairy products