Technical Signal of VN-Index

In the morning session of April 25, 2024, VN-Index decreased with a slight decrease in trading volume, indicating cautious investor sentiment.

However, the MACD indicator is gradually narrowing the gap with the Signal line. If the buy signal reappears in the coming sessions, the short-term outlook will be more optimistic.

Technical Signal of HNX-Index

On April 25, 2024, HNX-Index decreased with decreasing liquidity, indicating cautious investor sentiment.

Currently, the index is retesting the Fibonacci Projection 23.6% level (equivalent to the 222-227 point zone) in a context where the Stochastic Oscillator indicator has given a buy signal and is rising above the oversold zone, indicating that a short-term recovery outlook is gradually emerging.

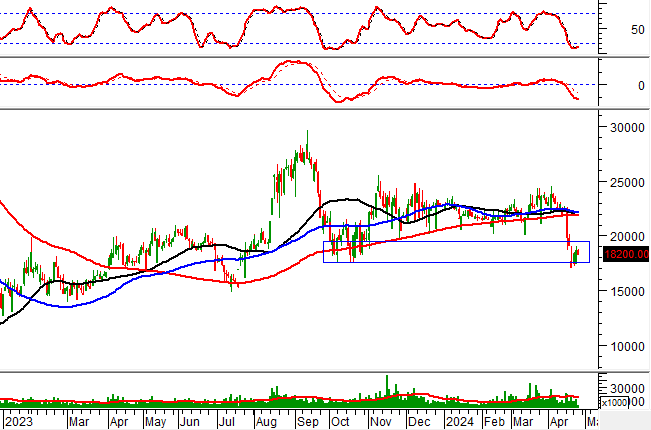

In the morning session of April 25, 2024, CEO decreased encountering a death cross between the 50-day SMA and the 200-day SMA, indicating a rather negative outlook.

However, the stock price is retesting the October 2023 bottom (equivalent to the 17,500-19,000 zone) with the Stochastic Oscillator indicator giving a buy signal in the oversold zone. If the indicator continues to rise and breaks above this zone in the coming sessions, a short-term recovery scenario will soon emerge.

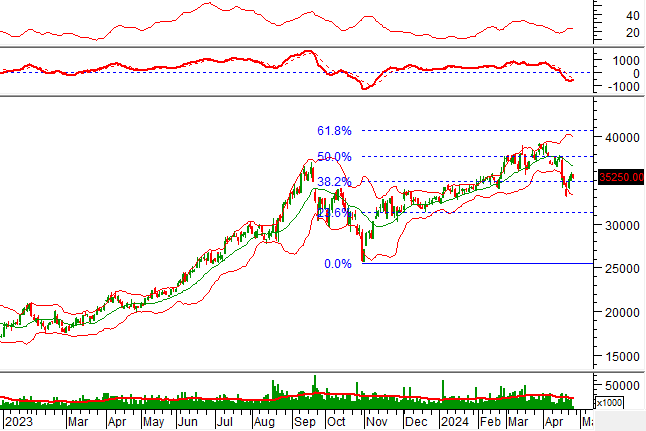

SSI – CTCP Securities SSI

On the morning of April 25, 2024, SSI slightly decreased with a significantly reduced liquidity in the morning session, indicating cautious trading by investors.

In addition, the stock price is still testing the Fibonacci Projection 38.2% level (equivalent to the 34,500-35,500 zone) while the ADX indicator is hovering in the gray area (20

Technical Analysis Department, Vietstock Consulting