Update

2024 Annual General Meeting of Shareholders of DGW on the afternoon of April 25, 2024

|

Striving to Become a Billion-Dollar Enterprise

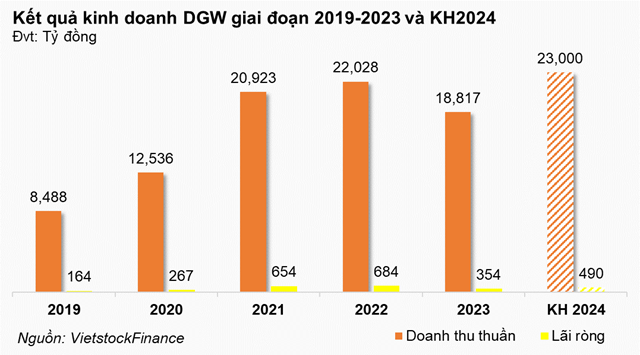

At its 2024 Annual General Meeting of Shareholders, the management team of DGW outlined ambitious business objectives for 2024, including revenue and net income of VND 23 trillion and VND 490 billion, respectively, representing a 22% and 38% growth compared to the actual figures achieved in 2023.

In terms of revenue structure, mobile phones will continue to be the primary focus, generating VND 8.7 trillion (an 8% increase), while laptops and tablets are projected to yield VND 6.55 trillion (an 11% increase). Other segments, including office equipment, home appliances, and consumer goods, are expected to grow by 60%, 44%, and 78%, respectively.

To achieve these goals, DGW will maintain its relationships with existing partners while seeking out new collaborations; expand its multi-industry distribution channels; upgrade its facilities and workforce to develop new product lines; and increase its market share, revenue, and profitability.

A significant aspect of this plan is DGW‘s pursuit of a billion-dollar valuation: “Digiworld has developed a business plan for 2024 that represents growth compared to the 2023 plan, ensuring that the Company continues on track and becomes a ‘billion-dollar company.’”

Chairman Đoàn Hồng Việt elaborated: “The vision of DGW is to become a billion-dollar company, not just in terms of revenue and profit. This is the driving force that will propel DGW to continue growing. Economies of scale will play an increasingly vital role, enabling DGW to operate more efficiently and attract talent to shape the future.”

First Quarter Net Income Increases by 16%

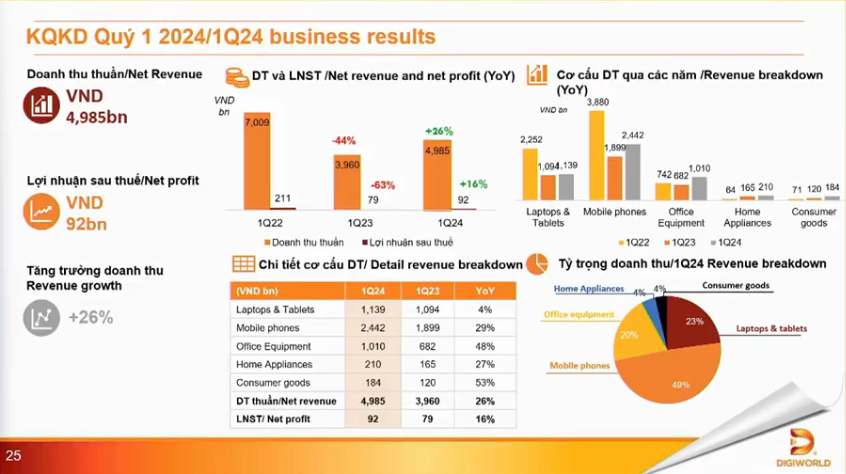

At the meeting, the management team of DGW reported that the company recorded revenue of VND 4.985 trillion and net income of VND 92 billion in the first quarter of 2024, representing growth of 26% and 16%, respectively, compared to the same period last year.

All of DGW‘s business segments experienced revenue growth during the first quarter, with the smartphone and office equipment segments posting the most significant gains of 29% and 48%, respectively. The consumer goods segment also saw strong growth, albeit with a lower absolute value. Meanwhile, laptops and tablets recorded a modest increase of 4% to VND 1.139 trillion.

Discussion

DGW‘s strategy involves diversifying its product lines to reduce revenue dependency on any one major segment, but ICT still accounts for a significant proportion of DGW‘s revenue mix. What are the plans for the future?

Chairman Đoàn Hồng Việt: The contributions of the mobile and computer segments remain dominant, but their share is gradually declining over time, mainly due to stronger growth in other segments. Looking at the 2024 plan, new segments are growing significantly compared to mobile phones and laptops.

The ICT industry has been operating for many years and has well-established channels. We will primarily focus on adding new products to these channels to maximize their effectiveness. For the FMCG segment, DGW will concentrate on F&B, home care, and personal care products.

Does the Company have any plans for M&A in the near future? What are the business plans for the acquired companies?

Chairman Việt: M&A is a key development strategy. The formula for success is providing the target companies with a solid back-end platform and helping them optimize their operations. Achison is a prime example. After its acquisition, DGW helped reduce costs, and the company now targets revenue of VND 1,000 billion for 2024, representing a 50% increase.

DGW aims to complete 2-3 M&A transactions each year. These acquisitions will enable DGW to move forward more quickly, leveraging its market knowledge and solid back-end platform.

What is the impact of the exchange rate?

General Director Đặng Kiện Phương: The exchange rate is currently a hot topic for all companies involved in foreign currency. However, with nearly 30 years of experience in the industry, DGW has developed a sound currency hedging strategy. As a result, the exchange rate situation has not impacted DGW‘s operations.

Could you share your outlook for the pawnbroking segment?

Chairman Việt: Pawnbroking is just one of Vietmoney’s operations. Vietmoney also offers micro-credit to small businesses, which aligns with DGW‘s FMCG distribution strategy.

Vietmoney has the infrastructure in place to start selling used computers and mobile phones. According to DGW‘s data, this market is substantial. For example, the life cycle of an iPhone can be as long as six years, passing through multiple owners, resulting in a high volume of transactions.

Chairman Việt emphasized that while DGW is currently selling new products and it may be challenging to enter the used product market, this is where Vietmoney’s strength lies. Additionally, Vietmoney can leverage DGW‘s Dcare service network.

Are there any existing collaborations with Viettel Construction?

Chairman Việt: Viettel Construction has various activities that can be integrated with DGW‘s operations. In fact, DGW has already implemented several business initiatives with Viettel Construction.

What is the market size and expected growth for the personal protective equipment and FMCG segments in 2024?

Chairman Việt: Achison specializes in providing accessories and personal protective equipment to factories. The company currently holds a 10% market share, which is not particularly high. However, Vietnam’s emergence as a regional and global manufacturing hub will create long-term growth opportunities for this segment.

Used products encounter issues related to VAT invoices. How does the Company assess this problem?

Chairman Việt: This is the most significant challenge in the used product market. Currently, around 99% of the market consists of small, unregulated businesses, while DGW must comply with regulations, creating a competitive disadvantage. However, DGW‘s leadership team is confident that the company’s Dcare service and specific customer segments willing to pay a premium for quality will mitigate these issues.

Why has DGW set a growth target of 70% for the FMCG segment in 2024?

General Director Phương: The FMCG segment grew by 100% year-over-year in 2023, and DGW is confident in achieving an additional 70% growth.

For FMCG, DGW has defined a clear strategy in the segments of home care, personal care, and F&B. DGW only entered the F&B market in 202