Mr. Long, on the morning of April 25, the SBV will continue to organize the second bidding round in 2024 with a total gold volume of 16,800 taels. To reduce the price gap between domestic gold and international gold, in your opinion, how should the SBV adjust the bidding conditions to ensure upcoming gold bidding rounds are more successful?

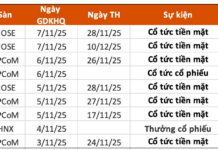

After the first gold bidding round conducted by the SBV in 2024 ended, there were only two winning organizations with a winning volume of 34 lots (3,400 taels of gold). These were credit institutions (TCBD) and businesses that had established gold trading relationships with the SBV.

PhD. Ngo Tri Long, economic expert. Photo: NB

From the disappointing results of the gold bidding round on April 23, I reckon that the bidding condition with a minimum bidding volume of 14 lots, or 1,400 taels, is too high.

According to current market prices, SJC gold is 81 million dong per tael, equivalent to an investment of about 100 billion VND. There are currently 38 gold trading entities in Vietnam. In my opinion, very few businesses have the financial capacity to participate in the bidding with such an amount. This condition only favors large commercial banks (NHTM) with sufficient financial resources. As a result, the bidding conditions are unfair and unequal to small and medium-sized enterprises.

A new aspect of the second gold bidding round in 2024 is that the SBV does not specify a reference price to calculate the deposit value as they did in the round on April 23. However, in my opinion, the SBV has not complied with the correct bidding principles. The deposit and reference price were initially set at VND 80.6 million/tael, but before the bidding started, the floor price (minimum) was increased to VND 81.3 million/tael.

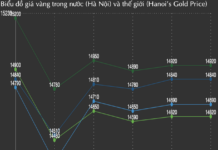

On April 23, the world gold price had dropped by 30 USD/ounce, so the domestic gold price at the opening time of the bidding round was VND 80.6 million/tael. From this, there are some issues that need to be considered: the SBV has inadvertently “recognized” the market price of SJC gold at VND 81.3 million/tael, which is not in line with the goal of narrowing the gap between domestic and international gold prices. Therefore, if the winning bid is higher than the floor price, there is a significant risk and the bidder will incur a loss.

In addition, after winning the bid, the gold will only be delivered after two days, and it is uncertain what the gold price will be at that time. The winning enterprise must hold the gold for two days and still pay over 100 billion VND on the same day. According to the principles of gold trading, businesses do not speculate but buy and sell as much as possible to ensure capital safety, since gold price fluctuations are complex and unpredictable. In such a situation, gold speculation is very risky. Moreover, the large volume as required by the SBV’s bidding request (minimum 14 lots, or 1,400 taels) is a significant challenge.

The SBV should consider reducing the minimum purchase requirement to around 500 taels of gold, which would attract more bidders.

According to the SBV’s regulations, “In the event that the SBV cannot purchase gold from the international market due to insufficient supply from suppliers, the SBV may decide to cancel the bidding results”. However, if a winning enterprise has sold some of the gold purchased from the SBV and is unable to deliver the gold from the bidding round, it will incur a significant loss.

Therefore, all the bidding principles and technical factors (so-called bidding conditions) make it difficult for small and medium-sized enterprises to participate in the bidding process. Only capital-rich enterprises or TCTDs that are willing to accept the risks will participate. In Vietnam, small and medium-sized enterprises account for nearly 90% of businesses. The nature of bidding is a competitive process, so the more participants, the higher the competition, and the more effective the bidding process will be.

The goal of gold bidding is to increase the supply of gold in the market, reduce the price difference between SJC gold and international gold. However, since the first bidding round in 2024, the SJC gold price has increased by almost 2 million VND/tael, widening the gap before and after the bidding from VND 10 million to VND 12 million/tael. Overall, the SBV’s first gold auction of 2024 only achieved 20% of the volume of gold put up for auction.

Mr. Long, what are your thoughts on the unusual movements of the gold price recently?

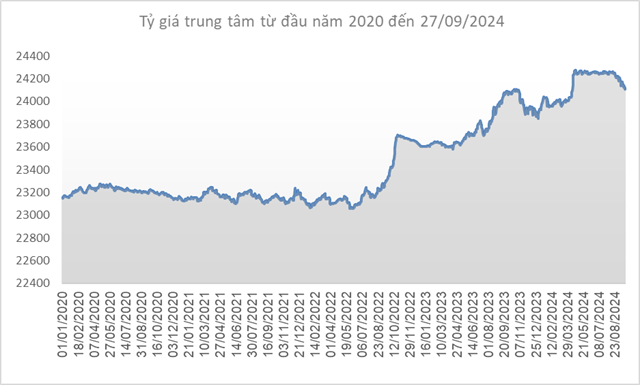

Gold prices have been fluctuating dramatically since the end of 2023 due to market concerns about a potential recession in 2024. Gold also reacts inversely to the value of the US dollar, and the market is expecting the US Federal Reserve (Fed) to cut interest rates in 2024.

Any geopolitical risks that arise now will cause a surge in gold prices; the conflict in the Gaza Strip and the ongoing conflict between Ukraine and Russia show no sign of abating. Another important factor supporting the rise in gold prices is the fact that central banks around the world are actively increasing their gold purchases. Following the rise in international gold prices, the domestic SJC gold price has also increased unusually. The difference between the domestic and international gold prices is significant, at times reaching almost 20 million VND/tael.

The reasons for this difference are as follows: Due to supply and demand, when demand increases and supply is limited, the gold price rises; investors believe that the sharp increase in gold prices is creating attractive investment opportunities, especially given that bank savings rates, stock market investments, and real estate investments are no longer as appealing. As a result, money is flowing into defensive investment channels such as gold, and people are buying gold to preserve the value of their assets.

The exclusive right granted to SJC as the national gold brand leads to a lack of equality among enterprises in the gold trading business, causing a shortage in supply, overheating the market, and adversely affecting consumers and the economy.

In light of the complicated and unpredictable fluctuations in the domestic and international gold markets, the Prime Minister has issued a directive and several documents requesting that the SBV implement immediate solutions to stabilize the gold market.

Specifically, the SBV is asked to promptly find effective solutions to manage and control gold prices according to market principles, eliminate the significant difference between domestic and international gold prices, and prevent it from negatively impacting macroeconomic management, increasing gold smuggling, causing foreign exchange bleeding, and resulting in tax losses. The SBV is also expected to intensify its inspection, control, and comprehensive supervision of the gold market, with a focus on key areas.

In addition, to stabilize the gold market, the SBV has resumed gold bidding to enhance transparency and increase the supply of gold in the economy, thereby reducing the price gap between domestic and international gold and the difference between SJC gold prices and the prices of other gold brands.

Thank you Mr. Long.