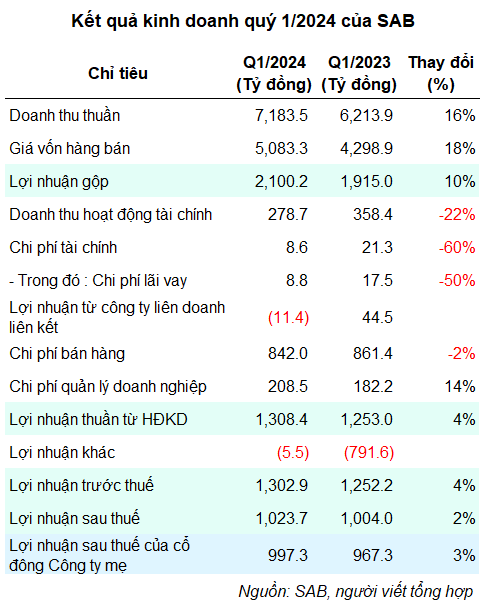

During the first quarter of 2024, Sabeco recorded net revenue of nearly VND 7,184 billion, an increase of 16% compared to the same period last year. Gross profit reached VND 2,100 billion after deducting the cost of sales, an increase of 10%; gross profit margin decreased to 29% from 31% in the same period last year.

After deducting expenses, the Company’s after-tax profit was nearly VND 1,024 billion, a slight increase of 2% compared to the same period last year, while net profit was more than VND 997 billion, an increase of 3%.

SAB said that revenue in the first quarter improved thanks to increased output and the favorable impact of last year’s price increases. This led to higher net profit, although it was partially offset by a fall in income from interest on deposits (-22%) and a loss from associates of more than VND 11 billion (gain of VND 44.5 billion in the same period last year).

In 2024, the Company aims for net revenue of VND 34,397 billion and after-tax profit of VND 4,580 billion, up 13% and 8%, respectively, compared to 2023. At the end of the first quarter, Sabeco achieved 21% of its revenue target and 22% of its profit target for the year.

As of March 31, 2024, on the balance sheet, total assets of SAB were over VND 32.1 trillion, a decrease of more than VND 1.9 trillion (equivalent to a decrease of 6%) compared to the beginning of the year. Inventories were close to VND 2.2 trillion, a decrease of VND 125 billion. Cash and cash equivalents were over VND 21.4 trillion, a decrease of more than VND 1.3 trillion and accounting for 67% of total assets. In the first quarter, interest on deposits brought about VND 234 billion to the Company, a decrease of 19%.

On the other side of the balance sheet, liabilities were nearly VND 5.7 trillion, a decrease of about VND 2.9 trillion (equivalent to a decrease of 34%) compared to the beginning of the year, mainly due to a decrease in accounts payable to suppliers and other short-term liabilities. Total short-term and long-term borrowings were VND 731 billion, a slight increase of VND 30 billion.

Strengths