Gold bars SJC increased in price after the auction

The domestic gold market has been continuously adjusting down for over a week ago due to the auction. On April 19, the State Bank (NHNN) announced the auction on April 22 and then suddenly canceled and changed to April 23. The deposit price was also changed by the NHNN from VND 81.8 million/tael to VND 80.7 million/tael. Accordingly, the price of SJC gold bars in the market also decreased and reached VND 82 million/tael on the morning of April 23.

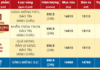

However, after the auction results, the SJC gold price increased sharply to VND 83 million/tael. By the end of the day, the price of SJC gold bars listed by Saigon Jewelry Company was VND 81 – 83.3 million/tael for buying and selling, an increase of VND 1.1 million/tael compared to the end of the morning trading session. The reason is that the auction result was not as expected.

Cannot cool down the price of SJC gold after an auction Photo: Như Ý

According to the NHNN’s announcement, on the morning of April 23, 2 units won the bid with a volume of 3,400 taels, accounting for 20% of the offered quantity. The winning bid price was the highest at VND 81.33 million/tael, and the lowest at VND 81.32 million/tael.

It is known that the 2 winning units are SJC and ACB. In the bidding session, 11 units participated, including 7 banks: VPBank, HDBank, Techcombank, Eximbank, MSB, ACB, Sacombank, and 4 enterprises: SJC, DOJI, PNJ, Phu Quy.

“I think that organizing auctions to reduce the price difference between domestic and international gold bars is not yet a fundamental solution. In the long run, we also need to consider revising Decree No. 24 on management of gold trading activities in line with the current context”.

Assoc. Prof. Dr. Dinh Trong Thinh

The NHNN stipulates that each unit is allowed to bid with a minimum quantity of 1,400 taels and a maximum of 2,000 taels. The floor bidding price is VND 81.3 million/tael, an increase of VND 600,000/tael compared to the deposit notice on April 22.

Failed to cool down!

Talking to PV Tien Phong, Mr. Huynh Trung Khanh, advisor to the World Gold Council in Vietnam, said that the NHNN’s gold auction at this time and requiring a minimum purchase quantity of 1,400 taels also made the participating units hesitate. Because 1,400 taels of SJC gold bars at this time is equivalent to over VND 113 billion. Because the world price has been going down for the past two days, which shows that buying at this time is not really favorable. Spending a huge amount of money if winning the bid but not knowing whether it can be sold out in time, because the market’s purchasing power is very weak at this time.

Mr. Khanh analyzed that the gold auction at this time is different from more than 10 years ago. In 2013, the scale of the gold market was very large. Joint stock commercial banks also had to buy gold to clear debts when terminating gold mobilization and lending in accordance with the regulations of Decree 24.

Therefore, gold companies and banks participate in the auction with the mentality of calculating the price at which they can buy and how much profit they can make at that purchase price. Therefore, in the bidding session, the NHNN only needs to issue a price to be able to decide to buy or not in an instant.

“Currently, the situation is completely different because the scale of the gold market is very small, and banks no longer need to buy gold to clear the status. Therefore, the number of participating banks is less than more than 10 years ago. The two winning units are the units that need gold at this time, and most of the rest are probing the market,” said Mr. Khanh.

With the winning bid price only about VND 1 million/tael lower than the market, Mr. Khanh assessed that it will not be able to cool down the market immediately. “In my opinion, the NHNN will have to bid for 4-5 more sessions. However, the deposit price will have to be lower to attract bidders.

However, bidding is only a situational solution, and in the long run, we still have to import raw gold to increase the supply of gold rings and jewelry,” said Mr. Khanh.

Assoc. Prof. Dr. Dinh Trong Thinh said that the deposit price is too high compared to the world’s average price and it is also high in the context that the price of gold bars is tending to decrease. Mr. Thinh said that if the auction is completed with nearly 17,000 taels of gold, the market will also ease the supply pressure, contributing to reducing the price of gold to some extent.

However, we also need to listen to the demand of the market to supply accordingly. The Gold Association estimates that it is necessary to import about 1.5 tons of gold to meet market demand. So clearly with 16,800 taels bid, it is not enough.

At 5:00 p.m. on April 23, the world gold price fell to $2,303/ounce, down $60/ounce compared to yesterday. Converted by exchange rate, the current world gold price is about VND 70 million/tael excluding taxes and fees. Accordingly, the price of SJC gold bars is still higher than the world’s by more than VND 13 million/tael.